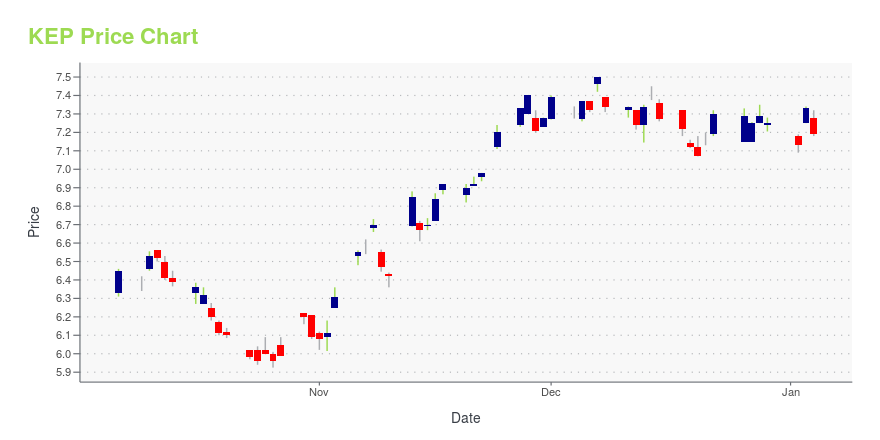

Korea Electric Power Corp. ADR (KEP): Price and Financial Metrics

KEP Price/Volume Stats

| Current price | $8.18 | 52-week high | $9.55 |

| Prev. close | $8.29 | 52-week low | $5.93 |

| Day low | $8.17 | Volume | 97,900 |

| Day high | $8.32 | Avg. volume | 107,640 |

| 50-day MA | $7.88 | Dividend yield | N/A |

| 200-day MA | $7.74 | Market Cap | 10.50B |

KEP Stock Price Chart Interactive Chart >

Korea Electric Power Corp. ADR (KEP) Company Bio

Korea Electric Power Corporation (NYSE: KEP, KRX: 015760), better known as KEPCO (Hangul: 켑코) or Hanjeon (Hangul: 한전), is the largest electric utility in South Korea, responsible for the generation, transmission and distribution of electricity and the development of electric power projects including those in nuclear power, wind power and coal. KEPCO, through its subsidiaries, is responsible for 93% of Korea's electricity generation as of 2011. The South Korean government (directly and indirectly) owns a 51.11% share of KEPCO. Together with its affiliates and subsidiaries, KEPCO has an installed capacity of 65,383 MW. On the 2011 Fortune Global 500 ranking of the world's largest companies, KEPCO was ranked 271. KEPCO is a member of the World Energy Council, the World Nuclear Association and the World Association of Nuclear Operators. As of August 2011, KEPCO possesses an A+ credit rating with Fitch Ratings, while Moody's has assigned KEPCO an A1 stable rating.(Source:Wikipedia)

KEP Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Continue Researching KEP

Want to see what other sources are saying about Korea Electric Power Corp's financials and stock price? Try the links below:Korea Electric Power Corp (KEP) Stock Price | Nasdaq

Korea Electric Power Corp (KEP) Stock Quote, History and News - Yahoo Finance

Korea Electric Power Corp (KEP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...