Kemper Corporation (KMPR): Price and Financial Metrics

KMPR Price/Volume Stats

| Current price | $65.04 | 52-week high | $65.07 |

| Prev. close | $63.29 | 52-week low | $38.32 |

| Day low | $63.33 | Volume | 385,637 |

| Day high | $65.07 | Avg. volume | 395,713 |

| 50-day MA | $59.89 | Dividend yield | 1.94% |

| 200-day MA | $54.37 | Market Cap | 4.19B |

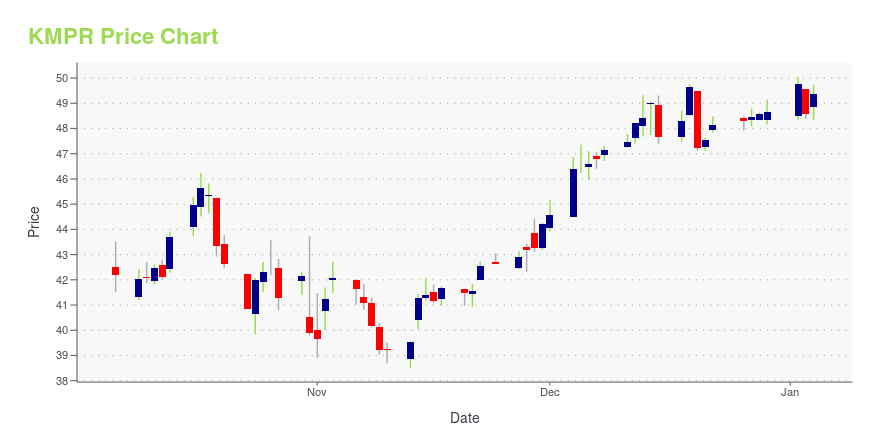

KMPR Stock Price Chart Interactive Chart >

Kemper Corporation (KMPR) Company Bio

Kemper Corporation provides automobile, homeowners, life, health, and other insurance products to individuals and businesses in the United States. It operates through two segments, Property and Casualty Insurance, and Life and Health Insurance. The company was founded in 1990 and is based in Chicago, Illinois.

Latest KMPR News From Around the Web

Below are the latest news stories about KEMPER CORP that investors may wish to consider to help them evaluate KMPR as an investment opportunity.

Investors in Kemper (NYSE:KMPR) from three years ago are still down 34%, even after 3.9% gain this past weekKemper Corporation ( NYSE:KMPR ) shareholders should be happy to see the share price up 22% in the last month. But that... |

Stuart Parker Bought 28% More Shares In KemperPotential Kemper Corporation ( NYSE:KMPR ) shareholders may wish to note that the Lead Independent Director, Stuart... |

Insider Buying: Director Stuart Parker Acquires 10,000 Shares of Kemper Corp (KMPR)In a notable insider transaction, Director Stuart Parker of Kemper Corp (NYSE:KMPR) has recently increased his stake in the company. |

Analysts Just Made A Major Revision To Their Kemper Corporation (NYSE:KMPR) Revenue ForecastsThe analysts covering Kemper Corporation ( NYSE:KMPR ) delivered a dose of negativity to shareholders today, by making... |

Kemper (NYSE:KMPR) Has Announced A Dividend Of $0.31The board of Kemper Corporation ( NYSE:KMPR ) has announced that it will pay a dividend on the 30th of November, with... |

KMPR Price Returns

| 1-mo | 13.05% |

| 3-mo | 13.83% |

| 6-mo | 6.51% |

| 1-year | 35.56% |

| 3-year | 2.58% |

| 5-year | -17.80% |

| YTD | 35.02% |

| 2023 | 1.54% |

| 2022 | -14.20% |

| 2021 | -22.11% |

| 2020 | 0.84% |

| 2019 | 18.29% |

KMPR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...