Knowles Corporation (KN): Price and Financial Metrics

KN Price/Volume Stats

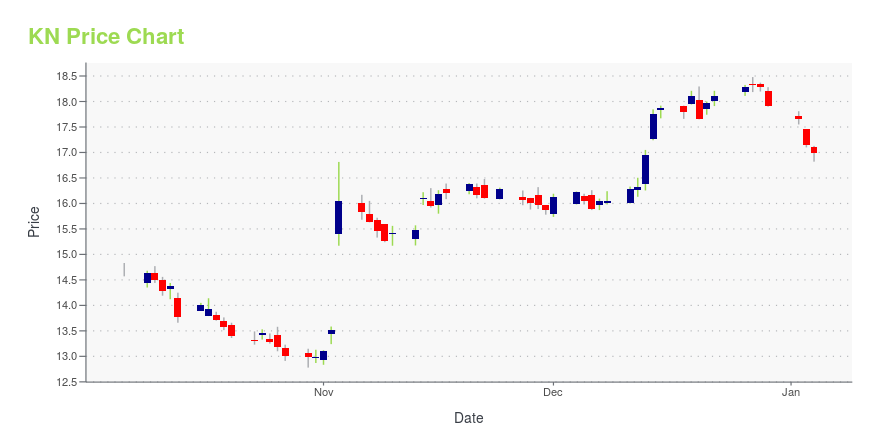

| Current price | $18.56 | 52-week high | $19.73 |

| Prev. close | $18.31 | 52-week low | $12.78 |

| Day low | $18.27 | Volume | 501,088 |

| Day high | $18.72 | Avg. volume | 540,151 |

| 50-day MA | $17.69 | Dividend yield | N/A |

| 200-day MA | $16.46 | Market Cap | 1.67B |

KN Stock Price Chart Interactive Chart >

Knowles Corporation (KN) Company Bio

Knowles Corporation is a supplier of advanced micro-acoustic solutions and specialty components serving the mobile communications, consumer electronics, medical technology, military, aerospace and industrial markets. The company was founded in 2013 and is based in Itasca, Illinois.

Latest KN News From Around the Web

Below are the latest news stories about KNOWLES CORP that investors may wish to consider to help them evaluate KN as an investment opportunity.

Knowles Corporation Teams Up With JLab to Bring Premium Sound to the Epic Lab Edition True Wireless EarbudsITASCA, Ill., November 07, 2023--Knowles Corporation (NYSE: KN), a leading global supplier of high-performance components and solutions, including capacitors and radio frequency ("RF") filters, advanced medtech microphones and balanced armature speakers and audio solutions, announces consumer audio brand JLab has selected Knowles’ RAN balanced armature (BA) drivers to help produce premium sound for the new Epic Lab Edition true wireless earbuds. |

Knowles Corporation (NYSE:KN) Q3 2023 Earnings Call TranscriptKnowles Corporation (NYSE:KN) Q3 2023 Earnings Call Transcript November 4, 2023 Operator: Thank you for standing by. My name is Kayla Baker, and I will be your conference operator today. At this time, I’d like to welcome everyone to the Knowles Third Quarter 2023 Earnings Conference Call. All lines have been placed on mute to […] |

Broker Revenue Forecasts For Knowles Corporation (NYSE:KN) Are Surging HigherKnowles Corporation ( NYSE:KN ) shareholders will have a reason to smile today, with the analysts making substantial... |

Q3 2023 Knowles Corp Earnings CallQ3 2023 Knowles Corp Earnings Call |

Knowles Corp (KN) Q3 2023 Earnings: Revenue at $175.1M, Diluted EPS at $0.18Company completes acquisition of Cornell Dubilier, provides Q4 2023 outlook |

KN Price Returns

| 1-mo | 9.37% |

| 3-mo | 15.78% |

| 6-mo | 9.31% |

| 1-year | 4.62% |

| 3-year | -2.01% |

| 5-year | -7.25% |

| YTD | 3.63% |

| 2023 | 9.07% |

| 2022 | -29.68% |

| 2021 | 26.70% |

| 2020 | -12.86% |

| 2019 | 58.90% |

Continue Researching KN

Want to see what other sources are saying about Knowles Corp's financials and stock price? Try the links below:Knowles Corp (KN) Stock Price | Nasdaq

Knowles Corp (KN) Stock Quote, History and News - Yahoo Finance

Knowles Corp (KN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...