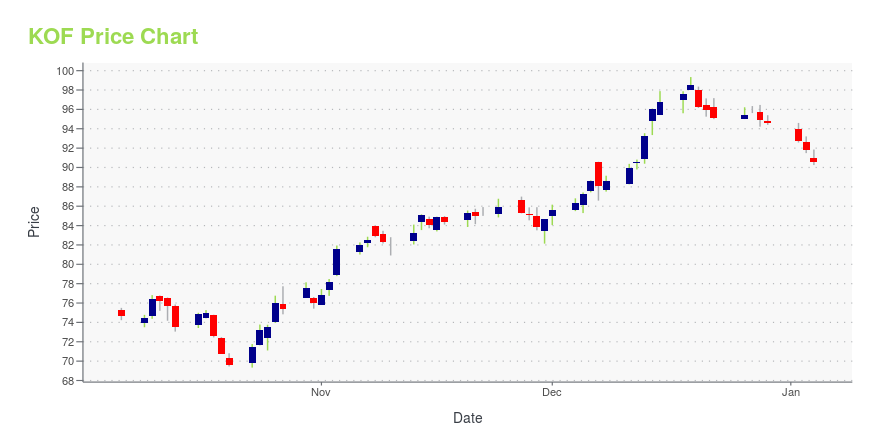

Coca-Cola Femsa S.A.B. de C.V. ADR (KOF): Price and Financial Metrics

KOF Price/Volume Stats

| Current price | $87.75 | 52-week high | $104.38 |

| Prev. close | $84.92 | 52-week low | $69.33 |

| Day low | $84.63 | Volume | 211,486 |

| Day high | $88.15 | Avg. volume | 166,083 |

| 50-day MA | $88.71 | Dividend yield | 0.86% |

| 200-day MA | $90.81 | Market Cap | 147.48B |

KOF Stock Price Chart Interactive Chart >

Coca-Cola Femsa S.A.B. de C.V. ADR (KOF) Company Bio

Coca-Cola FEMSA a franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages. The company was founded in 1979 and is based in Mexico, Mexico.

Latest KOF News From Around the Web

Below are the latest news stories about COCA COLA FEMSA SAB DE CV that investors may wish to consider to help them evaluate KOF as an investment opportunity.

Centi-Billionaire Bill Gates’ Top 15 Dividend StocksIn this article, we discuss centi-billionaire Bill Gates’ top 15 dividend stocks. You can skip our detailed analysis of Bill Gates’ investment philosophy and his major investments, and go directly to read Bill Gates’ Top 5 Dividend Stocks. Every investor dreams of accumulating higher returns and making massive profits while investing in the equity markets. […] |

Bill Gates’ 10 Stock Picks with Huge Upside PotentialIn this article we present the list of Bill Gates’ 10 Stock Picks with Huge Upside Potential. Click to skip our discussion of the billionaire’s global initiatives and portfolio activity and jump straight to Bill Gates’ 5 Stock Picks with Huge Upside Potential. Coupang, Inc. (NYSE:CPNG), Schlumberger Limited (NYSE:SLB), and Chevron Corporation (NYSE:CVX) are three […] |

21 Countries with Most Spanish Speakers Heading into 2024In this article, we will discuss the 21 countries with most Spanish speakers heading into 2024. If you want to skip our discussion on global language trends, you can go directly to the 5 Countries with Most Spanish Speakers Heading into 2024. Spanish is one of the most popular languages in the world. It is […] |

Are Investors Undervaluing Coca-Cola FEMSA, S.A.B. de C.V. (NYSE:KOF) By 25%?Key Insights Coca-Cola FEMSA. de's estimated fair value is US$110 based on 2 Stage Free Cash Flow to Equity Current... |

Is Coca Cola Femsa (KOF) Stock Outpacing Its Consumer Staples Peers This Year?Here is how Coca-Cola FEMSA (KOF) and Molson Coors Brewing (TAP) have performed compared to their sector so far this year. |

KOF Price Returns

| 1-mo | 5.76% |

| 3-mo | -11.15% |

| 6-mo | -2.92% |

| 1-year | 8.85% |

| 3-year | 80.97% |

| 5-year | 80.67% |

| YTD | -5.71% |

| 2023 | 44.64% |

| 2022 | 29.54% |

| 2021 | 24.65% |

| 2020 | -19.71% |

| 2019 | 2.75% |

KOF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KOF

Want to do more research on Coca Cola Femsa Sab De Cv's stock and its price? Try the links below:Coca Cola Femsa Sab De Cv (KOF) Stock Price | Nasdaq

Coca Cola Femsa Sab De Cv (KOF) Stock Quote, History and News - Yahoo Finance

Coca Cola Femsa Sab De Cv (KOF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...