Katapult Group, Inc., (KPLT): Price and Financial Metrics

KPLT Price/Volume Stats

| Current price | $19.79 | 52-week high | $23.54 |

| Prev. close | $18.84 | 52-week low | $8.26 |

| Day low | $18.54 | Volume | 84,800 |

| Day high | $19.98 | Avg. volume | 19,157 |

| 50-day MA | $17.65 | Dividend yield | N/A |

| 200-day MA | $13.04 | Market Cap | 81.26M |

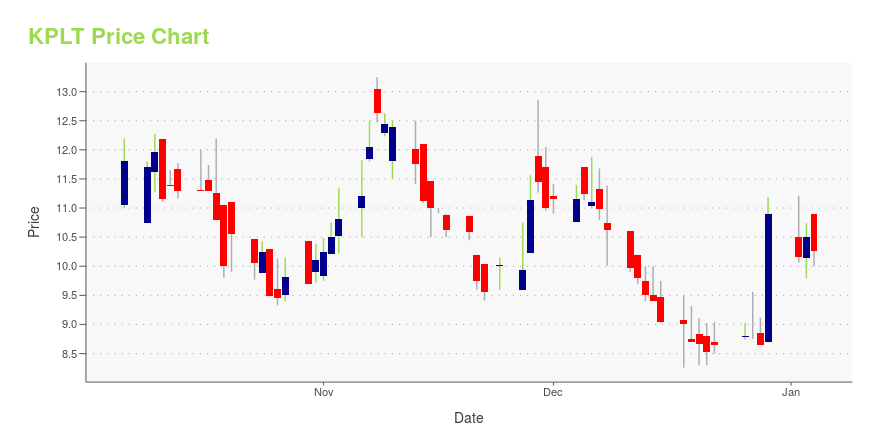

KPLT Stock Price Chart Interactive Chart >

Katapult Group, Inc., (KPLT) Company Bio

Katapult Group, Inc., doing business as Zibby, develops and operates a lease-to-own monthly payment platform to help consumers acquire durable goods from retailers in the United States. It offers its customers a lease purchase transaction processing system with no long-term obligation and options for ownership. The company offers its services to acquire the online or in-store purchases of electronics, appliances, furniture, musical instruments, and more. Katapult Group, Inc. was formerly known as Cognical Inc and changed its name to Katapult Group, Inc. in February 2020. The company was incorporated in 2012 and is based in New York, New York.

Latest KPLT News From Around the Web

Below are the latest news stories about KATAPULT HOLDINGS INC that investors may wish to consider to help them evaluate KPLT as an investment opportunity.

Grown Brilliance Integrates Katapult to Help Qualified Consumers Acquire High-Quality Diamond JewelryPLANO, Texas, Nov. 29, 2023 (GLOBE NEWSWIRE) -- Katapult Holdings, Inc. (NASDAQ: KPLT), an e-commerce-focused financial technology company, has launched an exciting new partnership with Grown Brilliance, a pioneer in ethically engineered lab-grown diamonds. Under the terms of the partnership, Grown Brilliance has integrated Katapult's innovative lease-to-own (LTO) solution into its payment checkout flow, which expands the variety of durable goods that can be obtained using Katapult’s lease offer |

Katapult to Participate in Stephens Annual Investment ConferencePLANO, Texas, Nov. 09, 2023 (GLOBE NEWSWIRE) -- Katapult Holdings, Inc. (“Katapult” or the “Company”) (NASDAQ: KPLT), an e-commerce focused financial technology company, announced that Orlando Zayas, CEO, and Nancy Walsh, CFO, will participate in the Stephens Annual Investment Conference on Wednesday, November 15, 2023. Orlando Zayas and Nancy Walsh will participate in a fireside chat and Q&A session at 9:00 AM ET. A live audio webcast and replay will be available on the Company’s Investor Relat |

Katapult Delivers 10% Year-Over-Year Revenue Growth In Third Quarter 2023Fourth Consecutive Quarter of Year-Over-Year Gross Originations Growth Fourth Quarter Outlook Includes Continued Year-Over-Year Growth for Gross Originations, Revenue and Adjusted EBITDA PLANO, Texas, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Katapult Holdings, Inc. (“Katapult” or the “Company”) (NASDAQ: KPLT), an e-commerce-focused financial technology company, today reported its financial results for the third quarter ended September 30, 2023. “We delivered another quarter of strong operating and fina |

Katapult to Announce Third Quarter 2023 Financial Results on November 8, 2023PLANO, Texas, Oct. 25, 2023 (GLOBE NEWSWIRE) -- Katapult Holdings, Inc. (NASDAQ: KPLT), an e-commerce-focused financial technology company, today announced it will release its third quarter 2023 financial results before market open on Wednesday, November 8, 2023. The company will host a conference call and webcast to discuss these results at 8:00 AM ET that same day. A live audio webcast of the conference call will be available on the Katapult Investor Relations website at http://ir.katapulthold |

3 Undervalued Stocks That Could 10X by 2033These undervalued stocks seem poised to outperform the market this decade and deliver 1,000%-plus returns. |

KPLT Price Returns

| 1-mo | 17.10% |

| 3-mo | 55.09% |

| 6-mo | 79.91% |

| 1-year | 4.16% |

| 3-year | -90.97% |

| 5-year | N/A |

| YTD | 81.71% |

| 2023 | -54.46% |

| 2022 | -71.61% |

| 2021 | -73.04% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...