Karyopharm Therapeutics Inc. (KPTI): Price and Financial Metrics

KPTI Price/Volume Stats

| Current price | $0.97 | 52-week high | $1.95 |

| Prev. close | $0.96 | 52-week low | $0.62 |

| Day low | $0.93 | Volume | 1,671,600 |

| Day high | $1.00 | Avg. volume | 1,531,427 |

| 50-day MA | $0.97 | Dividend yield | N/A |

| 200-day MA | $1.03 | Market Cap | 120.94M |

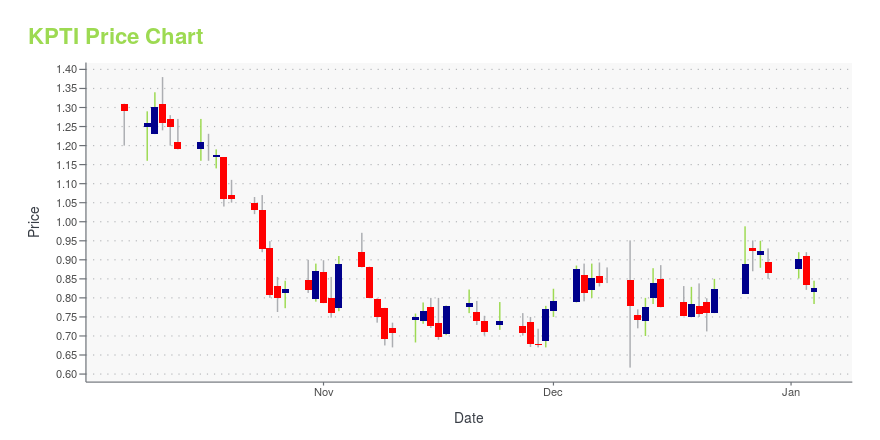

KPTI Stock Price Chart Interactive Chart >

Karyopharm Therapeutics Inc. (KPTI) Company Bio

Karyopharm Therapeutics is a clinical-stage pharmaceutical company focused on the discovery and development of drugs directed against nuclear transport targets for the treatment of cancer and other major diseases. The company was founded in 2008 and is based in in Newton, Massachusetts.

Latest KPTI News From Around the Web

Below are the latest news stories about KARYOPHARM THERAPEUTICS INC that investors may wish to consider to help them evaluate KPTI as an investment opportunity.

Karyopharm Shares Data at ASH 2023 Showing Strong SVR and TSS Durability Observed from Phase 1 Study of Selinexor 60mg and Ruxolitinib in JAK Inhibitor (JAKi)-Naïve Myelofibrosis Patients, with no SVR or TSS Progressions Observed As of the Data Cutoff(1)Karyopharm Therapeutics Inc. (Nasdaq: KPTI), a commercial-stage pharmaceutical company pioneering novel cancer therapies, today announced long-term follow up of treatment-naïve patients with myelofibrosis (MF) who participated in the Phase 1 portion of its study evaluating once-weekly selinexor in combination with ruxolitinib (NCT04562389). The data, featured in an oral presentation at the 65th American Society of Hematology Annual Meeting and Exposition (ASH 2023), show patients treated with 60 |

Great week for Karyopharm Therapeutics Inc. (NASDAQ:KPTI) institutional investors after losing 84% over the previous yearKey Insights Given the large stake in the stock by institutions, Karyopharm Therapeutics' stock price might be... |

Karyopharm Therapeutics Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)Karyopharm Therapeutics Inc. (Nasdaq: KPTI), a commercial-stage pharmaceutical company pioneering novel cancer therapies, today announced that the Company granted an aggregate of 15,700 restricted stock units (RSUs) to three newly-hired employees. These RSU awards were granted as of November 30, 2023 (the "Grant Date") pursuant to the Company's 2022 Inducement Stock Incentive Plan, as amended, as inducements material to the new employees entering into employment with Karyopharm in accordance wit |

Karyopharm to Participate at Upcoming Investor ConferencesKaryopharm Therapeutics Inc. (Nasdaq: KPTI), a commercial-stage pharmaceutical company pioneering novel cancer therapies, today announced that the Company's senior management team will participate in the following investor conferences in November: |

Karyopharm Announces New Preliminary Data in Overall Survival (OS) in Selinexor-Treated Patients with Advanced or Recurrent TP53 Wild-Type Endometrial Cancer as Part of Pre-Specified Exploratory Subgroup Analysis of the SIENDO StudyKaryopharm Therapeutics Inc. (Nasdaq: KPTI), a commercial-stage pharmaceutical company pioneering novel cancer therapies, today announced the presentation of updated long-term safety and efficacy data from a pre-specified exploratory subgroup analysis of the SIENDO study (NCT03555422) in patients with advanced or recurrent TP53 wild-type endometrial cancer at the International Gynecological Cancer Society (IGCS) Annual Global Meeting in Seoul, South Korea. |

KPTI Price Returns

| 1-mo | -2.52% |

| 3-mo | -8.49% |

| 6-mo | 7.05% |

| 1-year | -42.60% |

| 3-year | -88.56% |

| 5-year | -88.82% |

| YTD | 12.14% |

| 2023 | -74.56% |

| 2022 | -47.12% |

| 2021 | -58.46% |

| 2020 | -19.25% |

| 2019 | 104.59% |

Continue Researching KPTI

Want to see what other sources are saying about Karyopharm Therapeutics Inc's financials and stock price? Try the links below:Karyopharm Therapeutics Inc (KPTI) Stock Price | Nasdaq

Karyopharm Therapeutics Inc (KPTI) Stock Quote, History and News - Yahoo Finance

Karyopharm Therapeutics Inc (KPTI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...