Kronos Worldwide Inc (KRO): Price and Financial Metrics

KRO Price/Volume Stats

| Current price | $12.05 | 52-week high | $14.50 |

| Prev. close | $11.75 | 52-week low | $6.16 |

| Day low | $11.56 | Volume | 403,000 |

| Day high | $12.20 | Avg. volume | 245,366 |

| 50-day MA | $12.96 | Dividend yield | 6.46% |

| 200-day MA | $10.44 | Market Cap | 1.39B |

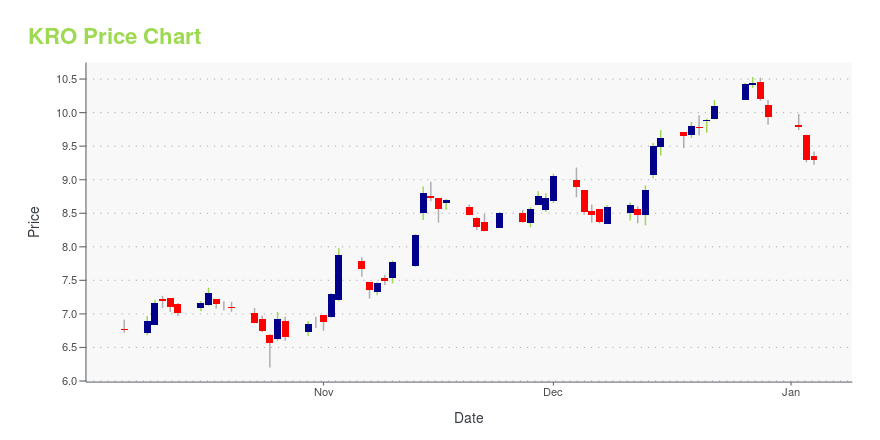

KRO Stock Price Chart Interactive Chart >

Kronos Worldwide Inc (KRO) Company Bio

Kronos Worldwide, Inc. produces and markets titanium dioxide pigments (TiO2) worldwide. It produces TiO2 in two crystalline forms, rutile and anatase to impart whiteness, brightness, opacity, and durability for products, paints, coatings, plastics, paper, fibers, and ceramics, as well as for various specialty products, such as inks, food, and cosmetics. The company is based in Dallas.

Latest KRO News From Around the Web

Below are the latest news stories about KRONOS WORLDWIDE INC that investors may wish to consider to help them evaluate KRO as an investment opportunity.

7 Dividend Stocks I Wouldn’t Touch With a 10-Foot PoleAvoid these seven dividend stocks to sell at all costs, as their payouts may not be a sustainable as they seem. |

Should You Think About Buying Kronos Worldwide, Inc. (NYSE:KRO) Now?While Kronos Worldwide, Inc. ( NYSE:KRO ) might not be the most widely known stock at the moment, it received a lot of... |

Kronos Worldwide (NYSE:KRO) Has Affirmed Its Dividend Of $0.19Kronos Worldwide, Inc. ( NYSE:KRO ) has announced that it will pay a dividend of $0.19 per share on the 14th of... |

3 Dividend Stocks That Are at Risk of Cutting Their DividendsThese dividend stocks to sell are poised to cut their dividends in the future. |

Kronos Worldwide (NYSE:KRO) Will Pay A Dividend Of $0.19Kronos Worldwide, Inc.'s ( NYSE:KRO ) investors are due to receive a payment of $0.19 per share on 14th of December... |

KRO Price Returns

| 1-mo | -3.83% |

| 3-mo | 5.38% |

| 6-mo | 29.48% |

| 1-year | 39.10% |

| 3-year | 4.50% |

| 5-year | 21.57% |

| YTD | 25.57% |

| 2023 | 14.94% |

| 2022 | -33.72% |

| 2021 | 5.76% |

| 2020 | 18.29% |

| 2019 | 23.04% |

KRO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KRO

Want to do more research on Kronos Worldwide Inc's stock and its price? Try the links below:Kronos Worldwide Inc (KRO) Stock Price | Nasdaq

Kronos Worldwide Inc (KRO) Stock Quote, History and News - Yahoo Finance

Kronos Worldwide Inc (KRO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...