Knightscope Inc. (KSCP): Price and Financial Metrics

KSCP Price/Volume Stats

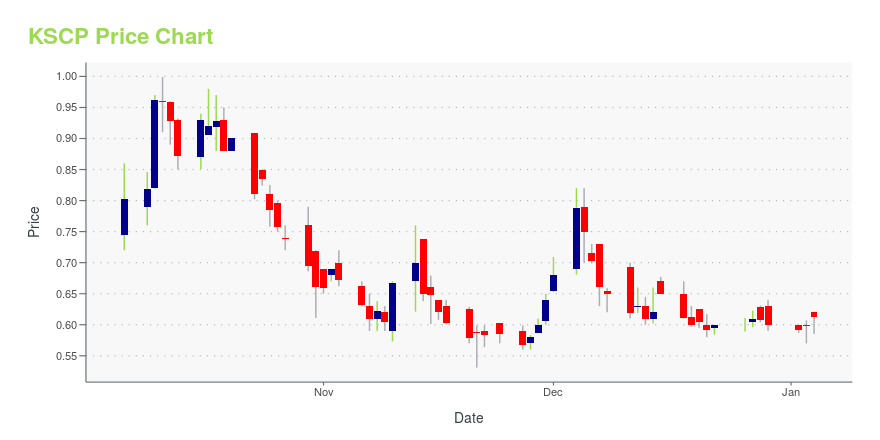

| Current price | $0.23 | 52-week high | $1.80 |

| Prev. close | $0.23 | 52-week low | $0.21 |

| Day low | $0.22 | Volume | 2,675,000 |

| Day high | $0.24 | Avg. volume | 1,780,387 |

| 50-day MA | $0.29 | Dividend yield | N/A |

| 200-day MA | $0.51 | Market Cap | 26.60M |

KSCP Stock Price Chart Interactive Chart >

Knightscope Inc. (KSCP) Company Bio

Knightscope, Inc. is an American security camera and robotics company headquartered in Mountain View, California. Knightscope designs, builds and deploys robots called Autonomous Data Robots for use in monitoring people in malls, parking lots, neighborhoods and other public areas.

Latest KSCP News From Around the Web

Below are the latest news stories about KNIGHTSCOPE INC that investors may wish to consider to help them evaluate KSCP as an investment opportunity.

Commercial Real Estate Investment Firm Signs Contract for Knightscope K5 ASRMOUNTAIN VIEW, Calif., December 28, 2023--Commercial Real Estate Investment Firm Signs Contract for Knightscope K5 ASR |

Texas Transportation Provider Expands Use of Knightscope TechnologiesMOUNTAIN VIEW, Calif., December 27, 2023--Texas Transportation Provider Expands Use of Knightscope Technologies |

Real Estate Developer Deploys 2 New Knightscope K1 Towers in Los AngelesMOUNTAIN VIEW, Calif., December 26, 2023--Real Estate Developer Deploys 2 New K1 Towers in Los Angeles |

Knightscope Files Lawsuit on Capybara Research for Short and Distort PracticesMOUNTAIN VIEW, Calif., December 21, 2023--Knightscope Files Lawsuit on Capybara Research for Short and Distort Practices |

Leading Semiconductor Test Equipment Supplier Signs 3-Machine ContractMOUNTAIN VIEW, Calif., December 20, 2023--Leading Semiconductor Test Equipment Supplier Signs 3-Machine Contract |

KSCP Price Returns

| 1-mo | -28.35% |

| 3-mo | -48.31% |

| 6-mo | -61.98% |

| 1-year | -84.25% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -61.67% |

| 2023 | -68.25% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...