Key Tronic Corporation (KTCC): Price and Financial Metrics

KTCC Price/Volume Stats

| Current price | $3.90 | 52-week high | $6.24 |

| Prev. close | $3.93 | 52-week low | $3.60 |

| Day low | $3.87 | Volume | 13,578 |

| Day high | $3.95 | Avg. volume | 17,994 |

| 50-day MA | $3.99 | Dividend yield | N/A |

| 200-day MA | $4.27 | Market Cap | 41.97M |

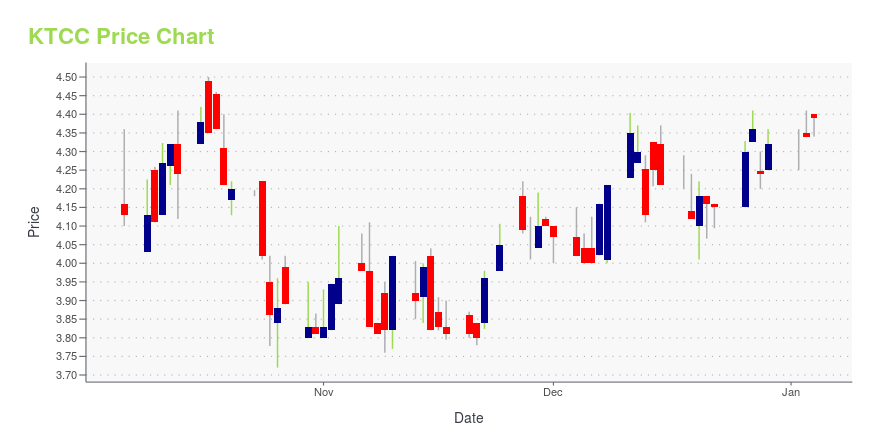

KTCC Stock Price Chart Interactive Chart >

Key Tronic Corporation (KTCC) Company Bio

Key Tronic Corporation, doing business as KeyTronicEMS Co., provides electronic manufacturing services (EMS) to original equipment manufacturers in the United States and internationally. The company was founded in 1969 and is based in Spokane Valley, Washington.

Latest KTCC News From Around the Web

Below are the latest news stories about KEY TRONIC CORP that investors may wish to consider to help them evaluate KTCC as an investment opportunity.

Q1 2024 Key Tronic Corp Earnings CallQ1 2024 Key Tronic Corp Earnings Call |

Key Tronic Corporation (NASDAQ:KTCC) Q1 2024 Earnings Call TranscriptKey Tronic Corporation (NASDAQ:KTCC) Q1 2024 Earnings Call Transcript October 31, 2023 Operator: Good day, and welcome to the Key Tronic First Quarter Fiscal 2024 Conference Call. Today’s conference is being recorded. At this time, I’d like to turn the conference over to Mr. Brett Larsen. Please go ahead. Brett Larsen: Thank you. Good afternoon, […] |

Key Tronic Corp (KTCC) Reports 8% Year-over-Year Revenue Increase in Q1 2024Net Income Drops Amid Workforce Reduction and High Interest Expenses |

Key Tronic Corporation Announces Results for the First Quarter of Fiscal Year 2024Year-over-Year Revenue Up 8%; New Program WinsSPOKANE VALLEY, Wash., Oct. 31, 2023 (GLOBE NEWSWIRE) -- Key Tronic Corporation (Nasdaq: KTCC), a provider of electronic manufacturing services (EMS), today announced its results for the quarter ended September 30, 2023. These results are in line with the preliminary results announced on October 24, 2023. For the first quarter of fiscal year 2024, Keytronic reported total revenue of $147.8 million, up 8% from $137.3 million in the same period of fisc |

Keytronic Corporation Announces Preliminary Results For the First Quarter of Fiscal Year 2024SPOKANE VALLEY, Wash., Oct. 24, 2023 (GLOBE NEWSWIRE) -- Key Tronic Corporation (Nasdaq: KTCC), a provider of electronic manufacturing services (EMS), today announced its preliminary results for the three months ended September 30, 2023. For the first quarter of fiscal 2024, Keytronic expects to report revenue of approximately $147.7 million, in line with revenue expectations, and earnings of approximately $0.02 per share, which are below expectations. The lower than expected earnings are primar |

KTCC Price Returns

| 1-mo | -0.76% |

| 3-mo | -9.09% |

| 6-mo | -11.76% |

| 1-year | -31.94% |

| 3-year | -41.70% |

| 5-year | -20.89% |

| YTD | -9.72% |

| 2023 | -0.23% |

| 2022 | -30.78% |

| 2021 | -9.35% |

| 2020 | 26.84% |

| 2019 | -3.72% |

Continue Researching KTCC

Want to see what other sources are saying about Key Tronic Corp's financials and stock price? Try the links below:Key Tronic Corp (KTCC) Stock Price | Nasdaq

Key Tronic Corp (KTCC) Stock Quote, History and News - Yahoo Finance

Key Tronic Corp (KTCC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...