Kennedy-Wilson Holdings Inc. (KW): Price and Financial Metrics

KW Price/Volume Stats

| Current price | $9.50 | 52-week high | $11.88 |

| Prev. close | $9.20 | 52-week low | $7.85 |

| Day low | $9.50 | Volume | 254 |

| Day high | $9.50 | Avg. volume | 528,221 |

| 50-day MA | $10.53 | Dividend yield | 5.22% |

| 200-day MA | $10.26 | Market Cap | 1.31B |

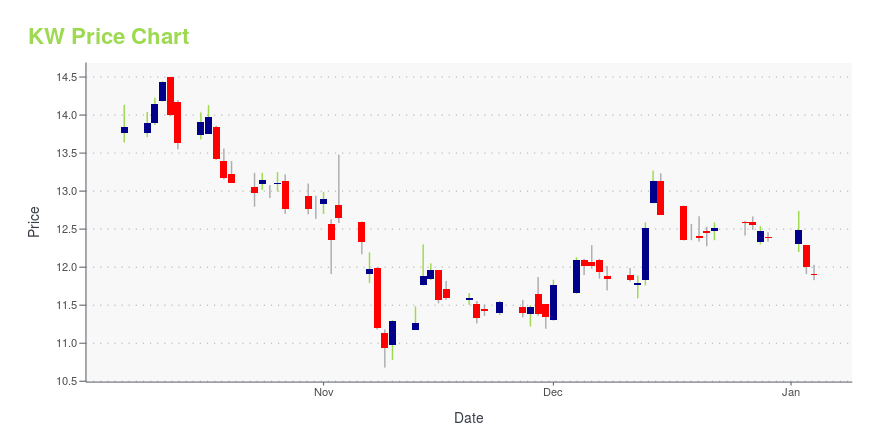

KW Stock Price Chart Interactive Chart >

Kennedy-Wilson Holdings Inc. (KW) Company Bio

Kennedy-Wilson Holdings invests in real estate related investments, including commercial, multifamily, loan purchases and originations, residential, and hotels. The company offers a comprehensive array of real estate services including investment management, property services, auction, conventional sales, brokerage and research. The company was founded in 1977 and is based in Beverly Hills, California.

KW Price Returns

| 1-mo | -4.32% |

| 3-mo | -12.59% |

| 6-mo | -7.95% |

| 1-year | -11.64% |

| 3-year | -48.62% |

| 5-year | -43.74% |

| YTD | -4.90% |

| 2024 | -13.83% |

| 2023 | -15.99% |

| 2022 | -30.56% |

| 2021 | 39.25% |

| 2020 | -14.91% |

KW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KW

Here are a few links from around the web to help you further your research on Kennedy-Wilson Holdings Inc's stock as an investment opportunity:Kennedy-Wilson Holdings Inc (KW) Stock Price | Nasdaq

Kennedy-Wilson Holdings Inc (KW) Stock Quote, History and News - Yahoo Finance

Kennedy-Wilson Holdings Inc (KW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...