Kennedy-Wilson Holdings Inc. (KW): Price and Financial Metrics

KW Price/Volume Stats

| Current price | $10.71 | 52-week high | $17.34 |

| Prev. close | $10.56 | 52-week low | $7.85 |

| Day low | $10.56 | Volume | 489,992 |

| Day high | $10.81 | Avg. volume | 1,131,515 |

| 50-day MA | $10.06 | Dividend yield | 4.42% |

| 200-day MA | $10.45 | Market Cap | 1.47B |

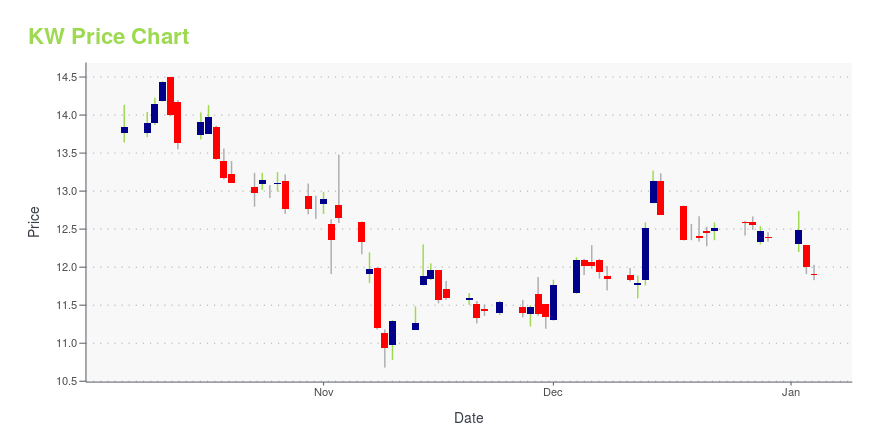

KW Stock Price Chart Interactive Chart >

Kennedy-Wilson Holdings Inc. (KW) Company Bio

Kennedy-Wilson Holdings invests in real estate related investments, including commercial, multifamily, loan purchases and originations, residential, and hotels. The company offers a comprehensive array of real estate services including investment management, property services, auction, conventional sales, brokerage and research. The company was founded in 1977 and is based in Beverly Hills, California.

Latest KW News From Around the Web

Below are the latest news stories about KENNEDY-WILSON HOLDINGS INC that investors may wish to consider to help them evaluate KW as an investment opportunity.

Kennedy-Wilson Holdings (NYSE:KW) Has Announced A Dividend Of $0.24Kennedy-Wilson Holdings, Inc. ( NYSE:KW ) has announced that it will pay a dividend of $0.24 per share on the 4th of... |

Kennedy-Wilson Holdings (NYSE:KW) Is Paying Out A Dividend Of $0.24Kennedy-Wilson Holdings, Inc. ( NYSE:KW ) will pay a dividend of $0.24 on the 4th of January. This means the annual... |

Insider Buying: Kennedy-Wilson Holdings Chairman & CEO Bought US$1.2m Of SharesKennedy-Wilson Holdings, Inc. ( NYSE:KW ) shareholders (or potential shareholders) will be happy to see that the... |

Kennedy-Wilson Holdings, Inc. (NYSE:KW) Q3 2023 Earnings Call TranscriptKennedy-Wilson Holdings, Inc. (NYSE:KW) Q3 2023 Earnings Call Transcript November 4, 2023 Operator: Good day and welcome to the Kennedy-Wilson Third Quarter 2023 Earnings Call and Webcast. [Operator Instructions] Please note this event is being recorded. I would now like to turn the conference over to Daven Bhavsar, Head of Investor Relations. Please go ahead. […] |

Kennedy-Wilson Holdings (NYSE:KW) Is Due To Pay A Dividend Of $0.24Kennedy-Wilson Holdings, Inc. ( NYSE:KW ) will pay a dividend of $0.24 on the 4th of January. The dividend yield will... |

KW Price Returns

| 1-mo | 12.72% |

| 3-mo | 27.57% |

| 6-mo | 2.35% |

| 1-year | -31.27% |

| 3-year | -35.39% |

| 5-year | -33.26% |

| YTD | -9.72% |

| 2023 | -15.99% |

| 2022 | -30.55% |

| 2021 | 39.25% |

| 2020 | -14.91% |

| 2019 | 27.71% |

KW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KW

Here are a few links from around the web to help you further your research on Kennedy-Wilson Holdings Inc's stock as an investment opportunity:Kennedy-Wilson Holdings Inc (KW) Stock Price | Nasdaq

Kennedy-Wilson Holdings Inc (KW) Stock Quote, History and News - Yahoo Finance

Kennedy-Wilson Holdings Inc (KW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...