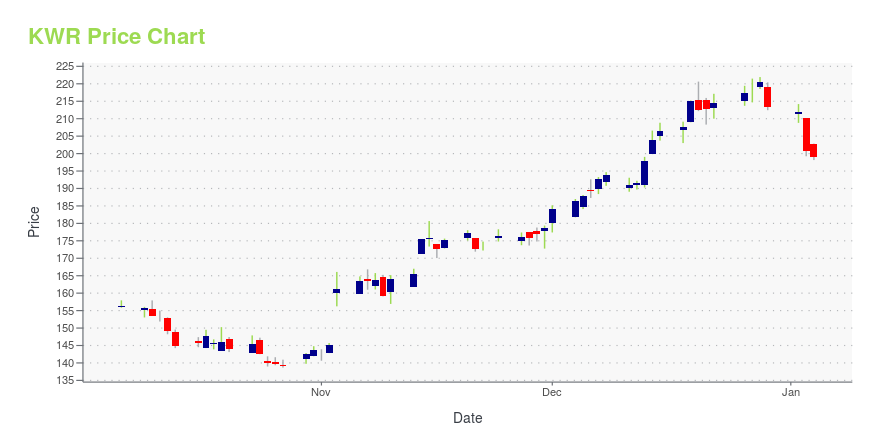

Quaker Chemical Corporation (KWR): Price and Financial Metrics

KWR Price/Volume Stats

| Current price | $182.37 | 52-week high | $221.94 |

| Prev. close | $180.15 | 52-week low | $138.67 |

| Day low | $181.24 | Volume | 58,400 |

| Day high | $183.54 | Avg. volume | 93,080 |

| 50-day MA | $177.46 | Dividend yield | 1% |

| 200-day MA | $185.04 | Market Cap | 3.28B |

KWR Stock Price Chart Interactive Chart >

Quaker Chemical Corporation (KWR) Company Bio

Quaker Chemical Corporation is a leading global provider of process fluids, chemical specialties, and technical expertise to a wide range of industries, including steel, aluminum, automotive, mining, aerospace, tube and pipe, cans, and others. The company was founded in 1918 and is based in Conshohocken, Pennsylvania.

Latest KWR News From Around the Web

Below are the latest news stories about QUAKER CHEMICAL CORP that investors may wish to consider to help them evaluate KWR as an investment opportunity.

Should You Investigate Quaker Chemical Corporation (NYSE:KWR) At US$173?Quaker Chemical Corporation ( NYSE:KWR ), is not the largest company out there, but it saw a significant share price... |

Quaker Houghton Announces Quarterly DividendThe Board of Directors of Quaker Houghton (NYSE: KWR) today declared a quarterly cash dividend of $0.455 per share, payable on January 31, 2024, to shareholders of record at the close of business on January 17, 2024. |

Quaker Chemical's (KWR) Earnings and Sales Top Estimates in Q3Quaker Chemical (KWR) benefits from higher selling price, product mix and favorable currency swings in Q3. |

Quaker Chemical Corporation (NYSE:KWR) Q3 2023 Earnings Call TranscriptQuaker Chemical Corporation (NYSE:KWR) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Greetings and welcome to the Quaker Houghton Third Quarter 2023 Earnings Conference Call. A brief question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded. I would now like to turn the call over to […] |

Q3 2023 Quaker Chemical Corp Earnings CallQ3 2023 Quaker Chemical Corp Earnings Call |

KWR Price Returns

| 1-mo | 8.39% |

| 3-mo | -3.90% |

| 6-mo | -5.60% |

| 1-year | -6.69% |

| 3-year | -22.07% |

| 5-year | 0.82% |

| YTD | -13.95% |

| 2023 | 29.14% |

| 2022 | -26.90% |

| 2021 | -8.32% |

| 2020 | 55.41% |

| 2019 | -6.66% |

KWR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KWR

Want to see what other sources are saying about Quaker Chemical Corp's financials and stock price? Try the links below:Quaker Chemical Corp (KWR) Stock Price | Nasdaq

Quaker Chemical Corp (KWR) Stock Quote, History and News - Yahoo Finance

Quaker Chemical Corp (KWR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...