Kaixin Auto Holdings (KXIN): Price and Financial Metrics

KXIN Price/Volume Stats

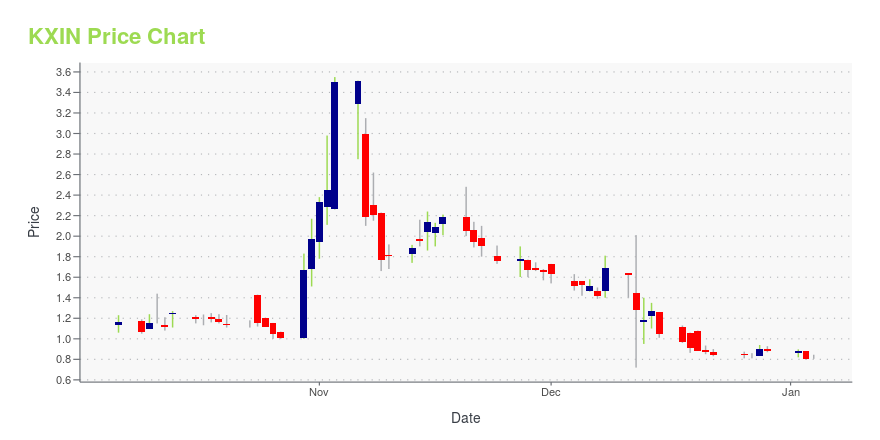

| Current price | $0.11 | 52-week high | $5.52 |

| Prev. close | $0.11 | 52-week low | $0.10 |

| Day low | $0.11 | Volume | 850,900 |

| Day high | $0.12 | Avg. volume | 2,645,652 |

| 50-day MA | $0.15 | Dividend yield | N/A |

| 200-day MA | $0.61 | Market Cap | 5.48M |

KXIN Stock Price Chart Interactive Chart >

Kaixin Auto Holdings (KXIN) Company Bio

Kaixin Auto Holdings operates as a used car dealership in the People's Republic of China. As of December 31, 2019, the company had 14 dealerships. It also provides financing channels to its customers through its partnership with financial institutions; and value-added services to its customers, including insurance, extended warranties, and after-sales services. The company was founded in 2015 and is headquartered in Beijing, the People's Republic of China. Kaixin Auto Holdings is a subsidiary of Renren Inc.

Latest KXIN News From Around the Web

Below are the latest news stories about KAIXIN AUTO HOLDINGS that investors may wish to consider to help them evaluate KXIN as an investment opportunity.

Kaixin Auto Holdings Announces Establishing AI Automobile Research Institute to Formulate AI Development StrategyBEIJING, Dec. 11, 2023 (GLOBE NEWSWIRE) -- Kaixin Auto Holdings (“Kaixin” or the “Company”) (NASDAQ: KXIN), a leading new energy vehicle manufacturer and one of the premium imported cars and used cars platform in China, today announced that it has established its AI Automotive Research Institute, with senior VP Mr. Lei Gu appointed as the dean, to facilitate the formation and integration of the company’s development strategy for artificial intelligence applications. Kaixin is also actively seeki |

Kaixin Auto Holdings Announces Supplements to Unaudited First Half 2023 Financial ResultsBEIJING, Nov. 16, 2023 (GLOBE NEWSWIRE) -- Kaixin Auto Holdings (“Kaixin” or the “Company”) (NASDAQ: KXIN), a leading new energy vehicle manufacturer and one of the premium imported cars and used cars platform in China, today announces certain supplements to the unaudited financial results for the six months ended June 30, 2023 originally announced on November 3, 2023 (the “November 3 Announcement”). The November 3 Announcement is hereby replaced in its entirety with this announcement (the “Amen |

While insiders are yet to place a huge wager on Kaixin Auto Holdings (NASDAQ:KXIN), retail investors saw 11% gain on holdings value last weekKey Insights Significant control over Kaixin Auto Holdings by retail investors implies that the general public has more... |

Kaixin Auto Holdings Announces Resignation of DirectorBEIJING, Nov. 06, 2023 (GLOBE NEWSWIRE) -- Kaixin Auto Holdings (“Kaixin” or the “Company”) (NASDAQ: KXIN), a leading new energy vehicle manufacturer and one of the premium imported cars and used cars platform in China, today announced that Mr. Lin Cong resigned from the Company's Board of Directors, effective on October 30, 2023. Mr. Cong resigned for personal reasons and not due to any disagreement with the Company on any matter relating to the Company's operations, policies, or practices. “On |

Kaixin Auto Holdings Announces Unaudited First Half 2023 Financial ResultsBEIJING, Nov. 03, 2023 (GLOBE NEWSWIRE) -- Kaixin Auto Holdings (“Kaixin” or the “Company”) (NASDAQ: KXIN), a leading new energy vehicle manufacturer and one of the premium imported cars and used cars platform in China, today announced its unaudited financial results for the six months ended June 30, 2023. First Half of 2023 Highlights Total net revenues were US$18.9 million, representing a decrease of 43% from US$33.3 million in the first half of 2022.Gross profit was US$0.2 million, keeping st |

KXIN Price Returns

| 1-mo | -20.35% |

| 3-mo | -14.66% |

| 6-mo | -80.61% |

| 1-year | -97.18% |

| 3-year | -99.60% |

| 5-year | -99.52% |

| YTD | -87.50% |

| 2023 | -79.99% |

| 2022 | -74.28% |

| 2021 | -69.44% |

| 2020 | 99.47% |

| 2019 | -81.49% |

Loading social stream, please wait...