LAIX Inc. American Depositary Shares, each representing one Class A Ordinary Share (LAIX): Price and Financial Metrics

LAIX Price/Volume Stats

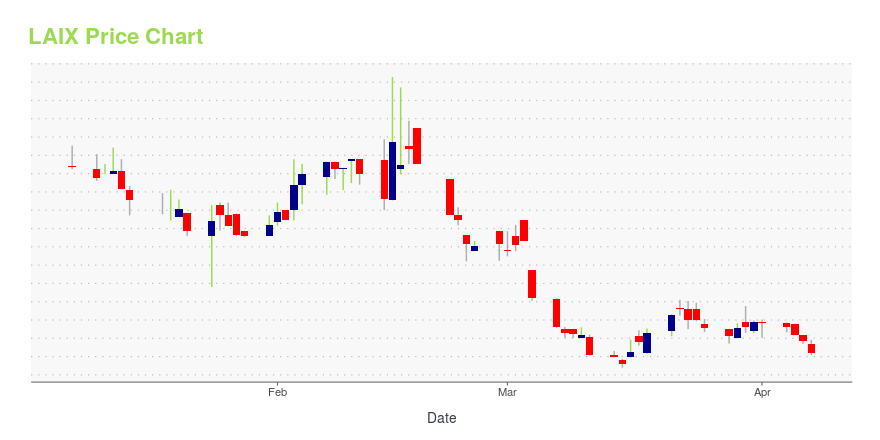

| Current price | $3.10 | 52-week high | $35.56 |

| Prev. close | $3.43 | 52-week low | $2.70 |

| Day low | $3.04 | Volume | 29,100 |

| Day high | $3.46 | Avg. volume | 19,509 |

| 50-day MA | $5.45 | Dividend yield | N/A |

| 200-day MA | $11.22 | Market Cap | 10.98M |

LAIX Stock Price Chart Interactive Chart >

LAIX Inc. American Depositary Shares, each representing one Class A Ordinary Share (LAIX) Company Bio

LAIX Inc is the creator and operator of AI-powered English language learning app Liulishuo. The company’s proprietary AI teacher utilizes deep learning and adaptive learning technologies, big data, well-established education pedagogies and the mobile internet. The company is based in Shanghai, China.

Latest LAIX News From Around the Web

Below are the latest news stories about LAIX Inc that investors may wish to consider to help them evaluate LAIX as an investment opportunity.

LAIX Inc. Announces Plan to Implement ADS Ratio ChangeLAIX Inc. ("LAIX" or the "Company") (NYSE: LAIX), an artificial intelligence (AI) company in China that creates and delivers products and services to popularize English learning, today announced that it plans to change the ratio of its American Depositary Shares ("ADSs") to its Class A ordinary shares (the "ADS Ratio"), par value US$0.001 per share, from the current ADS Ratio of one (1) ADS to one (1) Class A ordinary share to a new ADS Ratio of one (1) ADS to fourteen (14) Class A ordinary shar |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayGood morning, trader! |

Reviewing LAIX (NYSE:LAIX) and BioHiTech Global (NASDAQ:BHTG)BioHiTech Global (NASDAQ:BHTG) and LAIX (NYSE:LAIX) are both small-cap business services companies, but which is the superior investment? We will compare the two businesses based on the strength of their risk, valuation, analyst recommendations, profitability, earnings, dividends and institutional ownership. Profitability This table compares BioHiTech Global and LAIXs net margins, return on equity and return [] |

Squarepoint Ops LLC Purchases New Shares in LAIX Inc. (NYSE:LAIX)Squarepoint Ops LLC purchased a new stake in LAIX Inc. (NYSE:LAIX) during the second quarter, according to the company in its most recent Form 13F filing with the SEC. The firm purchased 71,986 shares of the companys stock, valued at approximately $134,000. Squarepoint Ops LLC owned 0.15% of LAIX as of its most recent filing [] |

LAIX receives non-compliance letter regarding ADS trading price from NYSENo summary available. |

LAIX Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -75.92% |

| 5-year | -97.67% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | -63.07% |

| 2020 | -68.72% |

| 2019 | -35.88% |

Continue Researching LAIX

Here are a few links from around the web to help you further your research on LAIX Inc's stock as an investment opportunity:LAIX Inc (LAIX) Stock Price | Nasdaq

LAIX Inc (LAIX) Stock Quote, History and News - Yahoo Finance

LAIX Inc (LAIX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...