Lamar Advertising Co. (LAMR): Price and Financial Metrics

LAMR Price/Volume Stats

| Current price | $125.17 | 52-week high | $139.88 |

| Prev. close | $124.04 | 52-week low | $99.84 |

| Day low | $123.90 | Volume | 425,182 |

| Day high | $125.67 | Avg. volume | 616,781 |

| 50-day MA | $120.89 | Dividend yield | 4.96% |

| 200-day MA | $0.00 | Market Cap | 12.82B |

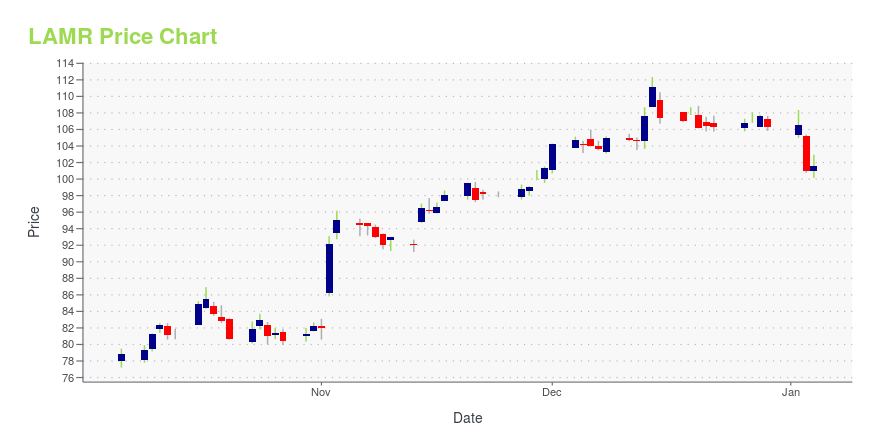

LAMR Stock Price Chart Interactive Chart >

Lamar Advertising Co. (LAMR) Company Bio

Lamar Advertising operates three types of outdoor advertising displays: billboards, logo signs and transit advertising displays. The company was founded in 1902 and is based in Baton Rouge, Louisiana.

LAMR Price Returns

| 1-mo | 4.23% |

| 3-mo | 14.51% |

| 6-mo | 1.76% |

| 1-year | 8.59% |

| 3-year | 51.80% |

| 5-year | 133.96% |

| YTD | 5.65% |

| 2024 | 19.98% |

| 2023 | 18.56% |

| 2022 | -18.04% |

| 2021 | 51.29% |

| 2020 | -3.19% |

LAMR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LAMR

Want to do more research on Lamar Advertising Co's stock and its price? Try the links below:Lamar Advertising Co (LAMR) Stock Price | Nasdaq

Lamar Advertising Co (LAMR) Stock Quote, History and News - Yahoo Finance

Lamar Advertising Co (LAMR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...