nLIGHT, Inc. (LASR): Price and Financial Metrics

LASR Price/Volume Stats

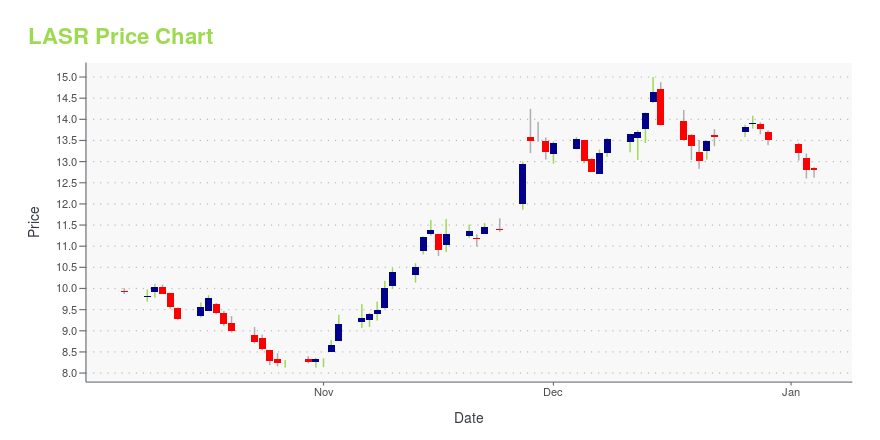

| Current price | $12.28 | 52-week high | $15.00 |

| Prev. close | $12.08 | 52-week low | $8.13 |

| Day low | $12.17 | Volume | 196,000 |

| Day high | $12.39 | Avg. volume | 192,881 |

| 50-day MA | $12.15 | Dividend yield | N/A |

| 200-day MA | $12.17 | Market Cap | 584.10M |

LASR Stock Price Chart Interactive Chart >

nLIGHT, Inc. (LASR) Company Bio

nLIGHT, Inc. designs, develops, and manufactures semiconductor and fiber lasers It serves industrial, microfabrication, and aerospace and defense markets. The company was founded in 2000 and is headquartered in Vancouver, Washington.

Latest LASR News From Around the Web

Below are the latest news stories about NLIGHT INC that investors may wish to consider to help them evaluate LASR as an investment opportunity.

nLIGHT Announces $34.5 Million Contract for DE M-SHORAD Laser Weapon SystemCAMAS, Wash., November 27, 2023--nLIGHT, Inc. (Nasdaq: LASR), a leading provider of high-power semiconductor and fiber lasers, today announced a $34.5 million contract award that will be executed over approximately 18 months to provide a High Energy Laser (HEL) in support of the U.S. Army’s Rapid Capabilities Critical Technologies Office (RCCTO) Directed Energy Maneuver-Short Range Air Defense (DE M-SHORAD) prototyping effort. nLIGHT is serving as a subcontractor to KORD Technologies, LLC as pri |

nLIGHT, Inc. (NASDAQ:LASR) Q3 2023 Earnings Call TranscriptnLIGHT, Inc. (NASDAQ:LASR) Q3 2023 Earnings Call Transcript November 4, 2023 Operator: Good day, and welcome to the nLIGHT Third Quarter 2023 Earnings Conference Call. All participants will be in a listen-only mode. [Operator Instructions]. After today’s presentation, there will be an opportunity to ask questions. [Operator Instructions]. Please note this event is being recorded. […] |

nLight Inc (LASR) Reports Q3 2023 Earnings: Revenue Down 15.7% YoY, Net Loss NarrowsCompany's revenue falls to $50.6 million, while net loss decreases to $11.9 million |

nLIGHT, Inc. Announces Third Quarter 2023 ResultsCAMAS, Wash., November 02, 2023--nLIGHT, Inc. (Nasdaq: LASR), a leading provider of high-power semiconductor and fiber lasers used in the industrial, microfabrication, and aerospace and defense markets, today reported financial results for the third quarter of 2023. |

nLIGHT Announces Expansion of HELSI Contract Award to $171 Million for Development of 1 Megawatt Directed Energy LaserCAMAS, Wash., November 02, 2023--nLIGHT, Inc. (Nasdaq: LASR), a leading provider of high-power semiconductor and fiber lasers, today announced the award of additional options that more than double the previously-announced contract to produce a High Energy Laser (HEL) prototype as part of the second phase of the DoD’s Office of the Under Secretary of Defense, Research & Engineering (OUSD (R&E)) High Energy Laser Scaling Initiative (HELSI). The original phase two award announced in May 2023 was fo |

LASR Price Returns

| 1-mo | 9.55% |

| 3-mo | 6.27% |

| 6-mo | -4.58% |

| 1-year | -13.76% |

| 3-year | -61.56% |

| 5-year | -28.52% |

| YTD | -9.04% |

| 2023 | 33.14% |

| 2022 | -57.66% |

| 2021 | -26.65% |

| 2020 | 61.00% |

| 2019 | 14.06% |

Continue Researching LASR

Want to do more research on Nlight Inc's stock and its price? Try the links below:Nlight Inc (LASR) Stock Price | Nasdaq

Nlight Inc (LASR) Stock Quote, History and News - Yahoo Finance

Nlight Inc (LASR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...