The Lion Electric Company (LEV): Price and Financial Metrics

LEV Price/Volume Stats

| Current price | $0.87 | 52-week high | $2.68 |

| Prev. close | $0.88 | 52-week low | $0.84 |

| Day low | $0.86 | Volume | 103,506 |

| Day high | $0.90 | Avg. volume | 476,698 |

| 50-day MA | $0.98 | Dividend yield | N/A |

| 200-day MA | $1.41 | Market Cap | 196.58M |

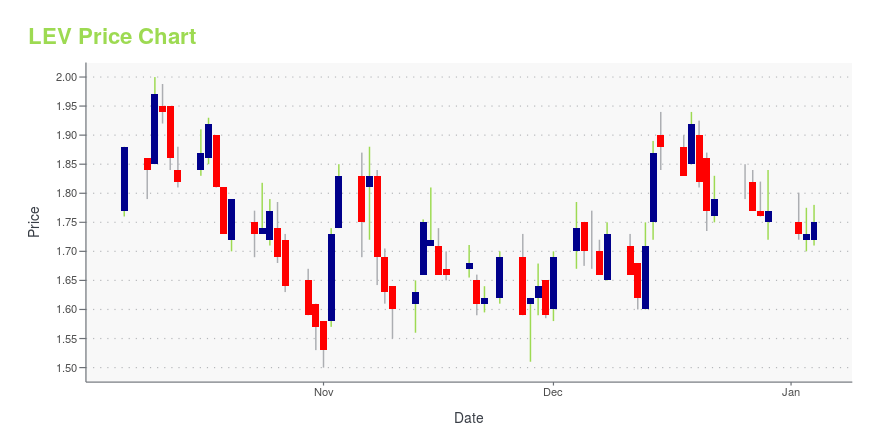

LEV Stock Price Chart Interactive Chart >

The Lion Electric Company (LEV) Company Bio

The Lion Electric Company manufactures all-electric medium and heavy-duty urban vehicles in North America. It creates, designs, and manufactures all-electric class 5 to class 8 commercial urban trucks, and all-electric buses and minibuses for the school, paratransit, and mass transit segments. The company is based in Saint-Jérôme, Canada.

Latest LEV News From Around the Web

Below are the latest news stories about LION ELECTRIC CO that investors may wish to consider to help them evaluate LEV as an investment opportunity.

Canada’s First Bidirectional EV Charging Hub Launches in British ColumbiaCTCE Group Picture First of its kind V2G demonstration project kick off. Photo of Rob Safrata Rob Safrata, CEO of CTCE. Coast to Coast Experiences Leads Collaboration to Bring Vehicle-to-Grid Technology to their Fleet of Electric Buses and to BC Hydro Pilot Project with BC Hydro, Lion Electric, BorgWarner, Powertech Labs and Fermata Energy demonstrates Technical Feasibility as a Proof of Concept to Make Vehicle-to-Grid a Reality in British Columbia and Globally VANCOUVER, British Columbia, Dec. |

Lion Electric Announces Successful Final Certification of its LionBattery MD Battery PackThe Lion Electric Company (NYSE: LEV) (TSX: LEV) ("Lion" or the "Company"), a leading manufacturer of all-electric medium- and heavy-duty vehicles, announced today the successful final certification for its medium duty ("MD") battery pack, the LionBattery MD, a lithium-ion battery pack specifically designed for the Company's medium duty trucks and school buses. |

FCEL Stock Alert: FuelCell Energy Announces AI Deal With IBMFuelCell Energy stock is climbing higher on Tuesday as investors in FCEL celebrate the company signing a deal with IBM! |

Lion Electric Layoffs 2023: What to Know About the Latest LEV Job CutsLion Electric layoffs are coming for 150 of the electric bus company's employees as it seeks to reduce its headcount by 10%. |

Novocure Layoffs 2023: What to Know About the Latest NVCR Job CutsNovocure layoffs are coming for 13% of the company's workers as it seeks to reduce its headcount by 200 people to reduce costs. |

LEV Price Returns

| 1-mo | -3.33% |

| 3-mo | -8.80% |

| 6-mo | -51.12% |

| 1-year | -62.50% |

| 3-year | -94.13% |

| 5-year | N/A |

| YTD | -50.85% |

| 2023 | -20.98% |

| 2022 | -77.46% |

| 2021 | -44.09% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...