LGI Homes, Inc. (LGIH): Price and Financial Metrics

LGIH Price/Volume Stats

| Current price | $106.95 | 52-week high | $140.27 |

| Prev. close | $104.34 | 52-week low | $84.00 |

| Day low | $105.47 | Volume | 273,200 |

| Day high | $109.43 | Avg. volume | 217,642 |

| 50-day MA | $96.09 | Dividend yield | N/A |

| 200-day MA | $107.74 | Market Cap | 2.52B |

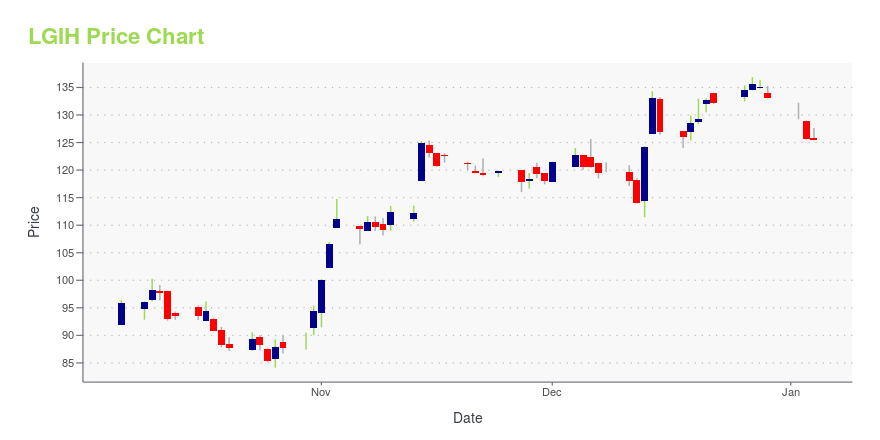

LGIH Stock Price Chart Interactive Chart >

LGI Homes, Inc. (LGIH) Company Bio

LGI Homes designs, constructs, markets, and sells homes in Texas, Arizona, Florida, Georgia, New Mexico, Colorado, North Carolina, and South Carolina, the United States. The company was founded in 2003 and is based in The Woodlands, Texas.

Latest LGIH News From Around the Web

Below are the latest news stories about LGI HOMES INC that investors may wish to consider to help them evaluate LGIH as an investment opportunity.

50 Cheapest Places to Buy a House in Every StateIn this article, we will be covering the 50 cheapest places to buy a house in every state. If you wish to skip our detailed analysis, you can move directly to the 10 Cheapest Places to Buy a House in Every State. Housing Dynamics in the US The US housing market has long been subject […] |

When Should You Buy LGI Homes, Inc. (NASDAQ:LGIH)?While LGI Homes, Inc. ( NASDAQ:LGIH ) might not be the most widely known stock at the moment, it saw a significant... |

25 Cities Where Home Prices Are Rising Despite the High Mortgage RatesIn this article, we will be navigating through the housing market in the United States while covering the 25 cities where home prices are rising despite the high mortgage rates. If you wish to skip our detailed analysis, you can move directly to the 5 Cities Where Home Prices Are Rising Despite the High Mortgage […] |

LGI Homes Opens Two Brand-New Communities in the Houston MarketThe Osage Plan by LGI Homes at Wayside Village in Houston features three bedrooms, two-and-a-half bathrooms, and a spacious family room. LGI Homes announces the grand opening of Wayside Village and Emberly, two communities of new, move-in ready homes with designer upgrades included. HOUSTON, Dec. 14, 2023 (GLOBE NEWSWIRE) -- LGI Homes, Inc. (NASDAQ: LGIH) today announced the opening of two new communities in the Houston market: Emberly in Beasley and Wayside Village in northeast Houston. Both co |

LGI Homes, Inc. Reports November 2023 Home ClosingsTHE WOODLANDS, Texas, Dec. 05, 2023 (GLOBE NEWSWIRE) -- LGI Homes, Inc. (NASDAQ: LGIH) today announced it closed 522 homes in November 2023, up from 412 homes closed in November 2022, representing year-over-year growth of 26.7%. As of November 30, 2023, the Company had 112 active selling communities. About LGI Homes, Inc. Headquartered in The Woodlands, Texas, LGI Homes, Inc. is a pioneer in the homebuilding industry, successfully applying an innovative and systematic approach to the design, con |

LGIH Price Returns

| 1-mo | 20.70% |

| 3-mo | 11.58% |

| 6-mo | -8.70% |

| 1-year | -18.98% |

| 3-year | -33.72% |

| 5-year | 47.56% |

| YTD | -19.68% |

| 2023 | 43.80% |

| 2022 | -40.06% |

| 2021 | 45.94% |

| 2020 | 49.82% |

| 2019 | 56.24% |

Continue Researching LGIH

Here are a few links from around the web to help you further your research on LGI Homes Inc's stock as an investment opportunity:LGI Homes Inc (LGIH) Stock Price | Nasdaq

LGI Homes Inc (LGIH) Stock Quote, History and News - Yahoo Finance

LGI Homes Inc (LGIH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...