Li Auto Inc. ADR (LI): Price and Financial Metrics

LI Price/Volume Stats

| Current price | $19.14 | 52-week high | $47.33 |

| Prev. close | $19.20 | 52-week low | $17.75 |

| Day low | $18.87 | Volume | 3,003,412 |

| Day high | $19.27 | Avg. volume | 8,017,313 |

| 50-day MA | $20.09 | Dividend yield | N/A |

| 200-day MA | $29.93 | Market Cap | 20.31B |

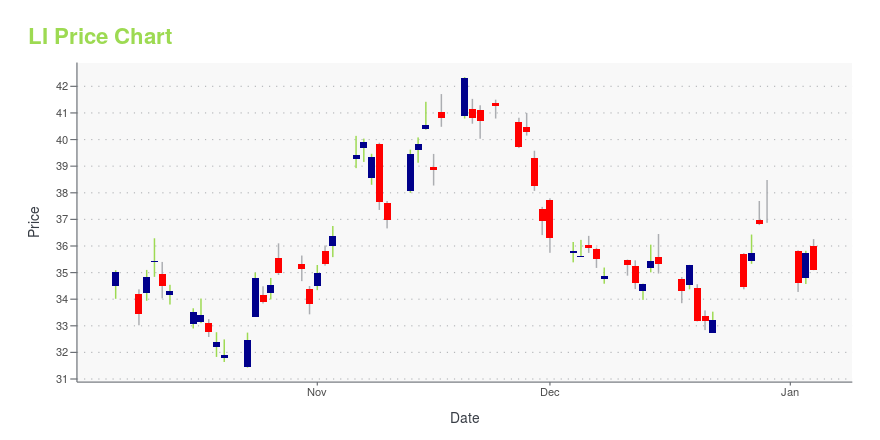

LI Stock Price Chart Interactive Chart >

Li Auto Inc. ADR (LI) Company Bio

Li Auto Inc., also known as Li Xiang, is a Chinese electric vehicle manufacturer headquartered in Beijing, with manufacturing facilities in Changzhou. (Source:Wikipedia)

Latest LI News From Around the Web

Below are the latest news stories about LI AUTO INC that investors may wish to consider to help them evaluate LI as an investment opportunity.

The 3 Hottest EV Stocks to Watch in 2024If you want to make the most of the transition towards EV, here are the hot EV stocks to keep an eye on as they soar higher. |

EV Game Changers: 7 Stocks Fueling the Green Energy MovementUnlock value in the EV sector by wagering on these top EV stocks blending financial resilience with innovation in a rapidly evolving market. |

7 Emerging Markets Stocks With Strong Growth PotentialEmerging market stocks are a great way to diversify a portfolio that may be too focused on U.S.-based stocks. |

Good News! Why Top China EV Play Li Auto Is Just Getting Started.For long-term investors bullish on the rise of EVs in China, LI stock remains a standout choice among U.S.-listed names in the space. |

2024’s Rising Stars: 3 Top Emerging Market Stocks Poised for GrowthPowered by increased spending from a rising middle class, these emerging market stocks are shattering revenue records. |

LI Price Returns

| 1-mo | 1.16% |

| 3-mo | -23.56% |

| 6-mo | -30.70% |

| 1-year | -50.91% |

| 3-year | -27.72% |

| 5-year | N/A |

| YTD | -48.86% |

| 2023 | 83.48% |

| 2022 | -36.45% |

| 2021 | 11.34% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...