Linde PLC (LIN): Price and Financial Metrics

LIN Price/Volume Stats

| Current price | $451.39 | 52-week high | $477.71 |

| Prev. close | $443.03 | 52-week low | $361.02 |

| Day low | $443.46 | Volume | 1,307,399 |

| Day high | $452.75 | Avg. volume | 1,990,271 |

| 50-day MA | $437.20 | Dividend yield | 1.24% |

| 200-day MA | $425.49 | Market Cap | 216.97B |

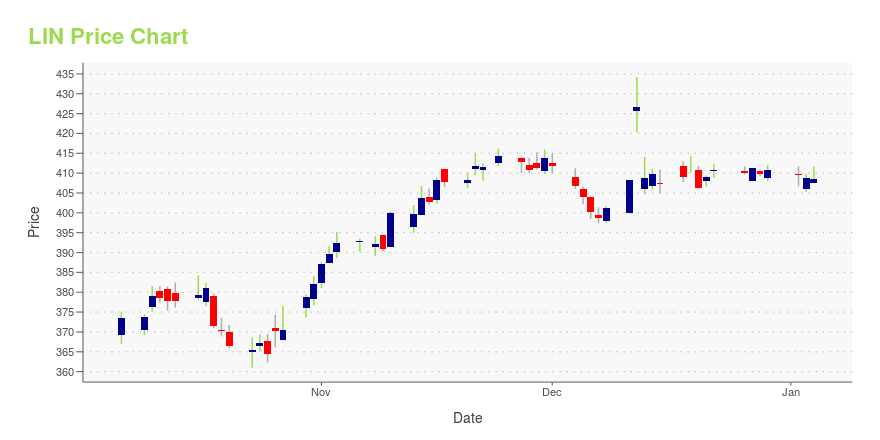

LIN Stock Price Chart Interactive Chart >

Linde PLC (LIN) Company Bio

Linde plc is a multinational chemical company with German-American roots. It is the largest industrial gas company by market share and revenue. It serves customers in the healthcare, petroleum refining, manufacturing, food, beverage carbonation, fiber-optics, steel making, aerospace, chemicals, electronics and water treatment industries.[1] The company's primary business is the manufacturing and distribution of atmospheric gases, including oxygen, nitrogen, argon, rare gases, and process gases, including carbon dioxide, helium, hydrogen, electronic gases, specialty gases, and acetylene . (Source:Wikipedia)

Latest LIN News From Around the Web

Below are the latest news stories about LINDE PLC that investors may wish to consider to help them evaluate LIN as an investment opportunity.

Energetic Investments: 3 Prime Hydrogen Stocks Poised for GrowthAs the global energy transition accelerates, these hydrogen stocks offer investments in the growing clean energy market. |

3 Highly Underrated Renewable Energy Stocks to Buy for 2024The renewable energy sector is poised for a massive rebound and investors should consider these underrated renewable energy stocks to buy. |

Best Hydrogen Stocks 2024: 3 Names To Add to Your Must-Buy ListThe best hydrogen stocks have great value for investors, but not all hydrogen companies are created equal. |

The 3 Most Undervalued Hydrogen Stocks to Buy in DecemberThese are the undervalued hydrogen stocks and represent companies that are making big investments in hydrogen production. |

Linde Included in Dow Jones Sustainability World Index for the Twenty-First Consecutive YearWOKING, UK / ACCESSWIRE / December 14, 2023 / Linde (Nasdaq: LIN) announced today it has been included in the Dow Jones Sustainability World Index (DJSI World) for the twenty-first consecutive year. Linde has also been included in the DJSI North America.The ... |

LIN Price Returns

| 1-mo | 2.96% |

| 3-mo | 2.18% |

| 6-mo | 12.41% |

| 1-year | 18.84% |

| 3-year | 57.51% |

| 5-year | 138.96% |

| YTD | 10.58% |

| 2023 | 27.66% |

| 2022 | -4.39% |

| 2021 | 33.39% |

| 2020 | 25.29% |

| 2019 | 36.44% |

LIN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...