LiqTech International, Inc. (LIQT): Price and Financial Metrics

LIQT Price/Volume Stats

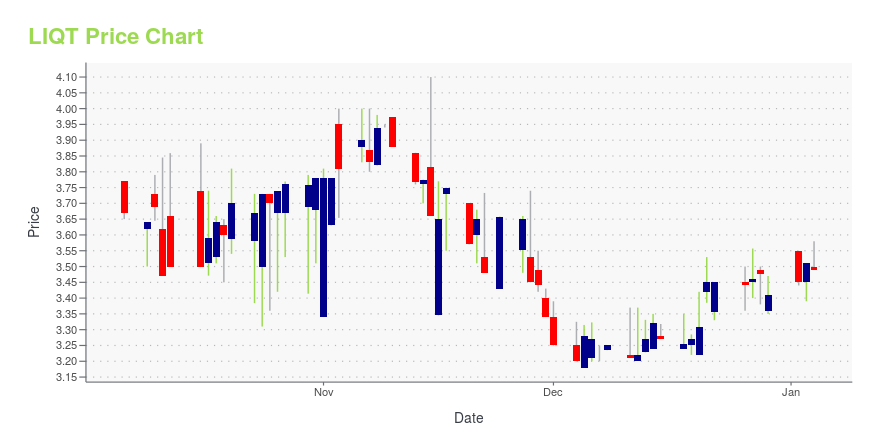

| Current price | $2.17 | 52-week high | $4.20 |

| Prev. close | $2.18 | 52-week low | $1.90 |

| Day low | $2.06 | Volume | 8,986 |

| Day high | $2.33 | Avg. volume | 9,350 |

| 50-day MA | $2.35 | Dividend yield | N/A |

| 200-day MA | $3.04 | Market Cap | 12.60M |

LIQT Stock Price Chart Interactive Chart >

LiqTech International, Inc. (LIQT) Company Bio

LiqTech International, Inc. is a clean technology company. The Company manufactures ceramic silicon carbide filters for the control of soot exhaust particles from diesel engines and for water filtration. LiqTech also produces kiln furniture.

Latest LIQT News From Around the Web

Below are the latest news stories about LIQTECH INTERNATIONAL INC that investors may wish to consider to help them evaluate LIQT as an investment opportunity.

LiqTech International, Inc. (NASDAQ:LIQT) Q3 2023 Earnings Call TranscriptLiqTech International, Inc. (NASDAQ:LIQT) Q3 2023 Earnings Call Transcript November 9, 2023 Operator: Good morning, and welcome to the LiqTech Third Quarter Fiscal Year 2023 Results Conference Call. All participants will be in listen-only mode. [Operator Instructions] After today’s presentation, there will be an opportunity to ask questions. [Operator Instructions] Please note this event is […] |

LiqTech International Announces Third Quarter 2023 Financial ResultsLiqTech International, Inc. (NASDAQ: LIQT) ("LiqTech"), a clean technology company that manufactures and markets highly specialized filtration technologies, today announced its financial results for the third quarter of 2023 for the period ended September 30, 2023. |

LiqTech International to Discuss Third Quarter 2023 Results on Thursday, November 9, 2023LiqTech International, Inc. (NASDAQ: LIQT), a clean technology company that manufactures and markets highly specialized filtration products and systems, will report financial results for its third quarter 2023 for the period ended September 30, 2023, on Thursday, November 9, 2023, before the market opens. The Company has scheduled a conference call that same day, November 9, 2023, at 10:00 a.m. ET, to review the results. |

LiqTech Enters Distribution Agreement with Waterco Across Australia and Asia Pacific for Swimming Pool Water Filtration System MarketLiqTech International, Inc. (NASDAQ: LIQT), a clean technology company that manufactures and markets highly specialized filtration products and systems, today announced it has entered into an exclusive distribution agreement with Waterco for the distribution of LiqTech's Aqua Solution® swimming pool water filtration systems covering Australia, New Zealand, Papua New Guinea, and the Pacific Islands. Waterco is a well-established player in the swimming pool market and has worked with LiqTech succe |

LiqTech Expands its Geographic Reach in Swimming Pool Water Filtration System MarketLiqTech International, Inc. (NASDAQ: LIQT), a clean technology company that manufactures and markets highly specialized filtration products and systems, today announced it has entered a new agreement for the distribution of LiqTech's Aqua Solution® swimming pool water filtration systems covering the Middle East. The agreement helps to expand LiqTech's fast-growing swimming pool systems market in this key geographic market. |

LIQT Price Returns

| 1-mo | -10.33% |

| 3-mo | -17.49% |

| 6-mo | -35.80% |

| 1-year | -40.55% |

| 3-year | -95.76% |

| 5-year | -96.94% |

| YTD | -36.36% |

| 2023 | 12.17% |

| 2022 | -93.36% |

| 2021 | -28.50% |

| 2020 | 36.75% |

| 2019 | 6.75% |

Continue Researching LIQT

Want to see what other sources are saying about Liqtech International Inc's financials and stock price? Try the links below:Liqtech International Inc (LIQT) Stock Price | Nasdaq

Liqtech International Inc (LIQT) Stock Quote, History and News - Yahoo Finance

Liqtech International Inc (LIQT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...