Luokung Technology Corp. (LKCO): Price and Financial Metrics

LKCO Price/Volume Stats

| Current price | $0.60 | 52-week high | $1.38 |

| Prev. close | $0.62 | 52-week low | $0.41 |

| Day low | $0.57 | Volume | 10,889 |

| Day high | $0.62 | Avg. volume | 81,499 |

| 50-day MA | $0.70 | Dividend yield | N/A |

| 200-day MA | $0.64 | Market Cap | 8.03M |

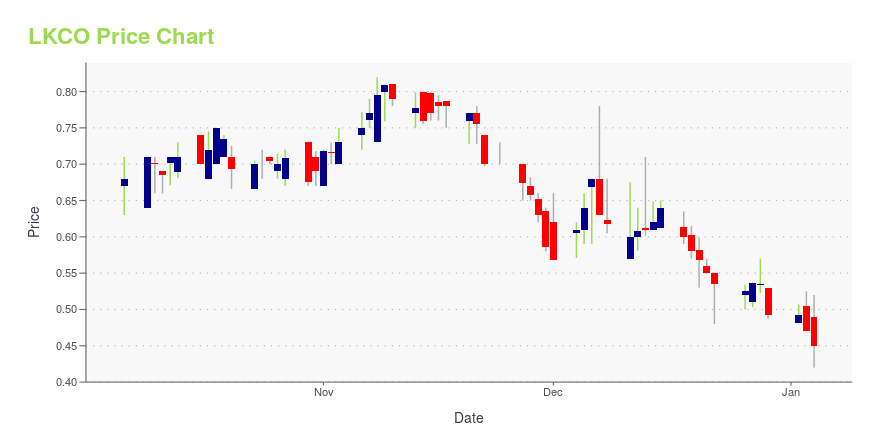

LKCO Stock Price Chart Interactive Chart >

Luokung Technology Corp. (LKCO) Company Bio

Luokung Technology Corp. operates as a big-data processing technology company. The Company offers spatial temporal big data PaaS, SaaS, and DaaS intelligent services based on technology which can be applied in mobile internet LBS, internet travel, intelligent transportation, automatic drive, smart city, and intelligent IoT.

Latest LKCO News From Around the Web

Below are the latest news stories about LUOKUNG TECHNOLOGY CORP that investors may wish to consider to help them evaluate LKCO as an investment opportunity.

Luokung Announces Receipt of Nasdaq Notification Regarding Minimum Bid Price DeficiencyBEIJING, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Luokung Technology Corp. (NASDAQ: LKCO) (“Luokung” or the “Company”), a leading spatial-temporal intelligent big data services company and provider of interactive location-based services (“LBS”) and high-definition maps (“HD Maps”) in China, today announced that it has received a notification letter from The Nasdaq Stock Market LLC ("Nasdaq") notifying the Company that it is not in compliance with the minimum bid price requirement set forth in Nasdaq Li |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start off the week with a breakdown of the biggest pre-market stock movers worth watching on Monday morning! |

Investors Aren't Entirely Convinced By Luokung Technology Corp.'s (NASDAQ:LKCO) RevenuesWith a price-to-sales (or "P/S") ratio of 0.2x Luokung Technology Corp. ( NASDAQ:LKCO ) may be sending bullish signals... |

Luokung Announces Issuing 5.5 Million Shares to Obtain $220 Million Strategic InvestmentLuokung Technology Corp. (NASDAQ: LKCO) ("Luokung," "we," "our" or the "Company"), a leading spatial-temporal intelligent big data services company and provider of interactive location-based services ("LBS") in China, today announced that it has signed a shares subscription agreement with a strategic investor CHINA ORIENT SMART ECOTECH INVESTMENT GROUP LIMITED ("COIG"), pursuant to which the Company agreed to issue a total of 5,469,019 restricted ordinary shares for an aggregate of USD220 millio |

Luokung Announces 30-to-1 Share CombinationLuokung Technology Corp. (NASDAQ: LKCO) ("Luokung," "we," "our" or the "Company"), a British Virgin Islands company, reported that it expects to implement a 30-to-1 share combination on its ordinary shares effective Tuesday, March 22, 2023, with trading to begin on a split-adjusted basis at the market open on that day. Trading in the ordinary shares will continue on the Nasdaq Capital Market under the symbol "LKCO". The new CUSIP number for the ordinary shares following the share combination is |

LKCO Price Returns

| 1-mo | -14.41% |

| 3-mo | 23.66% |

| 6-mo | 39.53% |

| 1-year | -54.83% |

| 3-year | -98.66% |

| 5-year | -99.78% |

| YTD | 21.63% |

| 2023 | -89.14% |

| 2022 | -74.98% |

| 2021 | -11.00% |

| 2020 | -58.28% |

| 2019 | N/A |

Loading social stream, please wait...