LumiraDx Limited (LMDX): Price and Financial Metrics

LMDX Price/Volume Stats

| Current price | $0.02 | 52-week high | $1.33 |

| Prev. close | $0.03 | 52-week low | $0.02 |

| Day low | $0.02 | Volume | 132,236,800 |

| Day high | $0.03 | Avg. volume | 56,745,219 |

| 50-day MA | $0.10 | Dividend yield | N/A |

| 200-day MA | $0.34 | Market Cap | 5.10M |

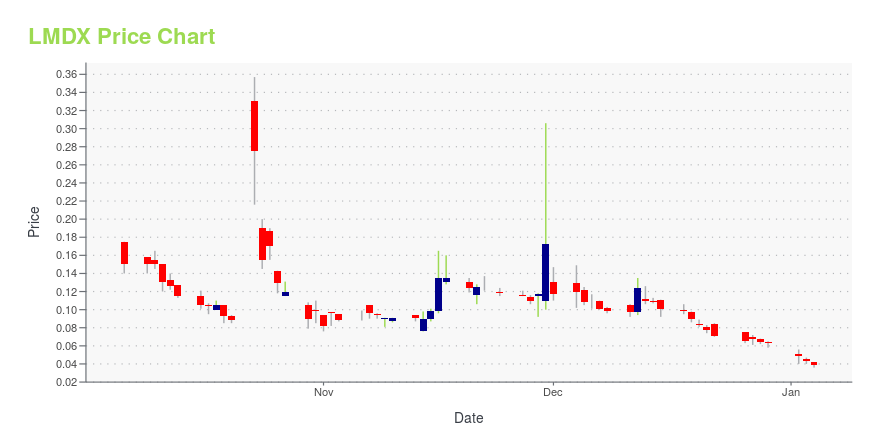

LMDX Stock Price Chart Interactive Chart >

LumiraDx Limited (LMDX) Company Bio

LumiraDx Limited operates as a point of care diagnostic company. It focuses on transforming community-based healthcare by providing critical diagnostic information to healthcare providers. The company was formerly known as Point of Care Testing Limited and changed its name to LumiraDx Ltd in January 2018. LumiraDx Limited was incorporated in 2002 and is based in London, the United Kingdom.

Latest LMDX News From Around the Web

Below are the latest news stories about LUMIRADX LTD that investors may wish to consider to help them evaluate LMDX as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's the final day of trading this week and we're starting it with a breakdown of the biggest pre-market stock movers on Friday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayPre-market stock movers are a hot topic on Thursday and we're checking out all of the biggest ones worth watching this morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time for another busy day of trading as we go over the biggest pre-market stock movers worth watching on Tuesday morning! |

LumiraDx Announces Receipt of NASDAQ Delisting Determination; Plans to AppealLONDON, Oct. 27, 2023 (GLOBE NEWSWIRE) -- On October 24, 2023, LumiraDx Limited (Nasdaq: LMDX)(the “Company”) received a notice (“Notice”) from the Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) stating that on April 21, 2023, the Staff had notified the Company that the bid price of its listed securities had closed at less than $US1.00 per share over the previous 30 consecutive business days, and, as a result, did not comply with Listing Rule 5450(a)(1) |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic on Wednesday and we're offering all the details that investors need to know about this morning. |

LMDX Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -94.59% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -68.20% |

| 2023 | -93.01% |

| 2022 | -89.90% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...