LM Funding America, Inc. (LMFA): Price and Financial Metrics

LMFA Price/Volume Stats

| Current price | $3.87 | 52-week high | $6.11 |

| Prev. close | $3.73 | 52-week low | $1.63 |

| Day low | $3.74 | Volume | 44,700 |

| Day high | $3.96 | Avg. volume | 131,932 |

| 50-day MA | $4.16 | Dividend yield | N/A |

| 200-day MA | $3.13 | Market Cap | 9.65M |

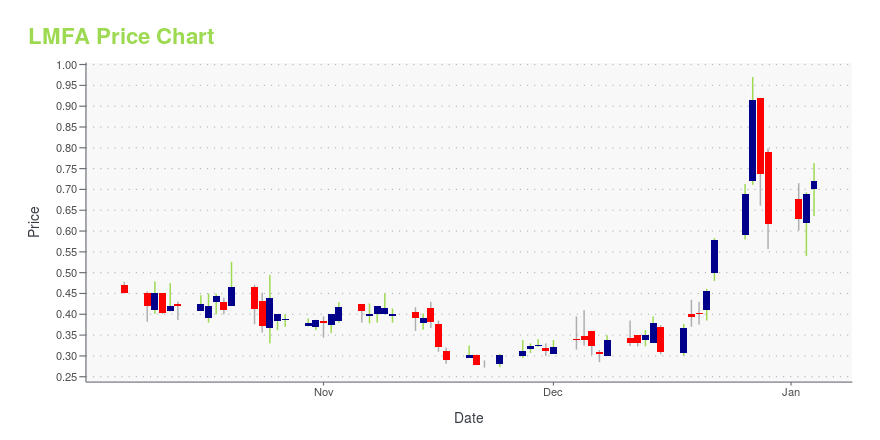

LMFA Stock Price Chart Interactive Chart >

LM Funding America, Inc. (LMFA) Company Bio

LM Funding America, Inc. operates as a finance company. The Company provides funding to non-profit community associations. LM Funding America serves customers throughout the United States.

Latest LMFA News From Around the Web

Below are the latest news stories about LM FUNDING AMERICA INC that investors may wish to consider to help them evaluate LMFA as an investment opportunity.

LM Funding America, Inc. Achieves Over 1,720% Year-Over-Year Revenue Growth to $3.4 MillionMined 117.1 Bitcoins in the Third Quarter of 2023 at an Average Market Revenue Value of Approximately $28,000 per Bitcoin Implementing 'Infrastructure Light' Approach to Bitcoin Mining Business; Focuses Capital Investment on Bitcoin and Bitcoin Mining Machines That Track the Value of Bitcoin Reports Working Capital of Approximately $4.5 Million and LM Funding Stockholders’ Equity of $35.9 Million ($2.45 per share) as of September 30, 2023 Conference Call to Be Held Today at 11:00 am ET TAMPA, Fl |

LM Funding America, Inc. Schedules Third Quarter 2023 Financial Results and Business Update Conference CallTAMPA, FL, Nov. 13, 2023 (GLOBE NEWSWIRE) -- LM Funding America, Inc. (NASDAQ: LMFA) ("LM Funding" or the "Company"), a cryptocurrency mining and technology-based specialty finance company, today announced that it will host a conference call on Wednesday, November 15, 2023, at 11:00 a.m. Eastern Time to discuss financial results for the quarter ended September 30, 2023, and provide a business update. The conference call will be available via telephone by dialing toll-free +1 888-506-0062 for U.S |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's time to start off the final trading day this week with a breakdown of the biggest pre-market stock movers on Friday! |

LM Funding America, Inc. Provides Quarterly Operational and Bitcoin Mining Update for Three Months Ended September 30, 2023Reports Increases in Bitcoin Mined, Bitcoin Sold and New Mining MachinesTAMPA, Oct. 18, 2023 (GLOBE NEWSWIRE) -- LM Funding America, Inc. (NASDAQ:LMFA) (“LM Funding” or the “Company”), a cryptocurrency mining and technology-based specialty finance company, today provided a preliminary, unaudited Bitcoin mining update for the nine months ended September 30, 2023. Metrics * Three Months March 31, 2023 Three Months June 30, 2023Three Months September 30, 2023Nine Months September 30, 2023Bitcoin Mi |

LM Funding America Chairman and CEO Bruce Rodgers Interviewed on “The Big Biz Show”TAMPA, FL, Sept. 19, 2023 (GLOBE NEWSWIRE) -- LM Funding America, Inc. (NASDAQ: LMFA) (“LM Funding” or the “Company”), a cryptocurrency mining and technology-based specialty finance company, today announced that Bruce M. Rodgers, Chairman and CEO of LM Funding America participated in an interview with “The Big Biz Show,” an Emmy Award-winning nationally syndicated TV and radio show. During the interview, Mr. Rodgers discussed the benefits of Bitcoin and blockchain technology, particularly the tr |

LMFA Price Returns

| 1-mo | -9.15% |

| 3-mo | 42.28% |

| 6-mo | 29.00% |

| 1-year | -3.73% |

| 3-year | -84.15% |

| 5-year | -88.68% |

| YTD | 4.62% |

| 2023 | 11.68% |

| 2022 | -88.64% |

| 2021 | 45.07% |

| 2020 | -13.56% |

| 2019 | -34.31% |

Continue Researching LMFA

Here are a few links from around the web to help you further your research on Lm Funding America Inc's stock as an investment opportunity:Lm Funding America Inc (LMFA) Stock Price | Nasdaq

Lm Funding America Inc (LMFA) Stock Quote, History and News - Yahoo Finance

Lm Funding America Inc (LMFA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...