Live Oak Bancshares, Inc. (LOB): Price and Financial Metrics

LOB Price/Volume Stats

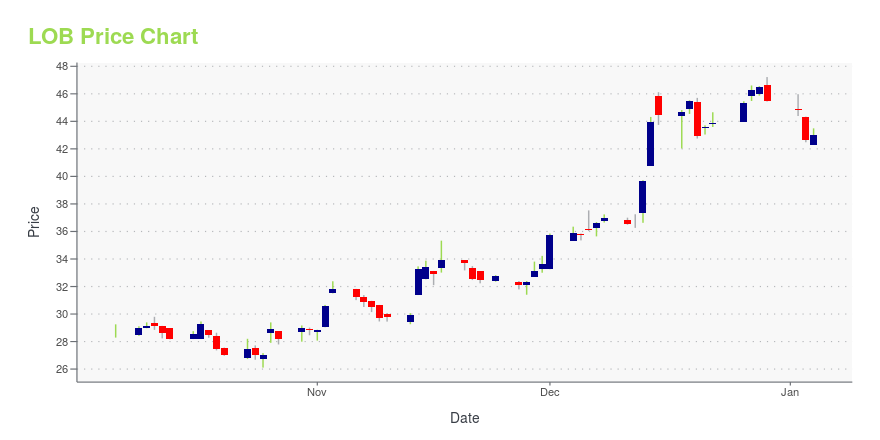

| Current price | $45.66 | 52-week high | $47.22 |

| Prev. close | $44.50 | 52-week low | $26.11 |

| Day low | $44.95 | Volume | 300,791 |

| Day high | $46.13 | Avg. volume | 180,247 |

| 50-day MA | $35.72 | Dividend yield | 0.28% |

| 200-day MA | $36.71 | Market Cap | 2.05B |

LOB Stock Price Chart Interactive Chart >

Live Oak Bancshares, Inc. (LOB) Company Bio

Live Oak Bancshares provides various commercial banking products and services in North Carolina. The company was founded in 2008 and is based in Wilmington, North Carolina.

Latest LOB News From Around the Web

Below are the latest news stories about LIVE OAK BANCSHARES INC that investors may wish to consider to help them evaluate LOB as an investment opportunity.

Live Oak Bancshares (LOB) Moves 10.9% Higher: Will This Strength Last?Live Oak Bancshares (LOB) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Live Oak Bank Tops SBA’s 100 Most Active 7(a) LendersWILMINGTON, N.C., Nov. 20, 2023 (GLOBE NEWSWIRE) -- Live Oak Bank has been named the most active SBA 7(a) lender by dollar amount by the U.S. Small Business Administration for the sixth year in a row. The results were posted to the SBA website and display the country’s top SBA 7(a) lenders by dollar amount and loan volume for the administration’s 2023 fiscal year, which ended September 30. “The SBA 7(a) program has been the cornerstone in delivering capital to American small business owners for |

Live Oak Bancshares Announces Executive Appointments, Including Walter J. Phifer Named as Chief Financial OfficerWILMINGTON, N.C., Nov. 14, 2023 (GLOBE NEWSWIRE) -- Live Oak Bancshares announced today that its Board of Directors has made several organizational appointments including naming a new Chief Financial Officer and President of Live Oak Bancshares. In a natural evolution of his position as general partner and co-founder of Canapi Ventures, Neil L. Underwood has announced that he is stepping down as President of Live Oak Bancshares. William C. (BJ) Losch III, who has been serving as both President o |

Live Oak Bancshares (LOB) Upgraded to Buy: What Does It Mean for the Stock?Live Oak Bancshares (LOB) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

Live Oak Bancshares, Inc. Reports Third Quarter 2023 ResultsWILMINGTON, N.C., Oct. 25, 2023 (GLOBE NEWSWIRE) -- Live Oak Bancshares, Inc. (NYSE: LOB) (“Live Oak” or “the Company”) today reported third quarter of 2023 net income of $39.8 million, or $0.88 per diluted share. “The success of our quarter shows that Live Oak Bank remains on a path of sustainable and sound growth to fulfill our mission to be America’s small business bank,” said Live Oak Chairman and CEO James S. (Chip) Mahan III. “Our products continue to be delivered with a focus on high-touc |

LOB Price Returns

| 1-mo | 35.81% |

| 3-mo | 37.73% |

| 6-mo | 15.12% |

| 1-year | 26.16% |

| 3-year | -24.81% |

| 5-year | 128.65% |

| YTD | 0.52% |

| 2023 | 51.27% |

| 2022 | -65.30% |

| 2021 | 84.27% |

| 2020 | 151.15% |

| 2019 | 29.26% |

LOB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LOB

Here are a few links from around the web to help you further your research on Live Oak Bancshares Inc's stock as an investment opportunity:Live Oak Bancshares Inc (LOB) Stock Price | Nasdaq

Live Oak Bancshares Inc (LOB) Stock Quote, History and News - Yahoo Finance

Live Oak Bancshares Inc (LOB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...