Logitech International S.A. (LOGI): Price and Financial Metrics

LOGI Price/Volume Stats

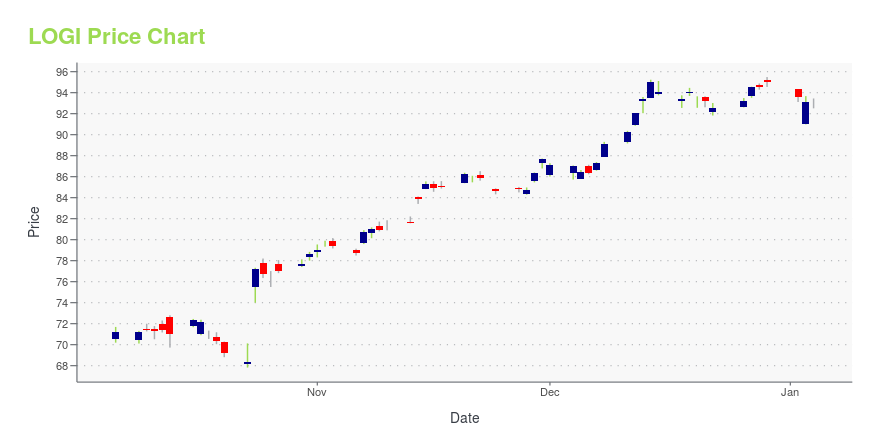

| Current price | $88.92 | 52-week high | $102.59 |

| Prev. close | $88.40 | 52-week low | $65.31 |

| Day low | $88.58 | Volume | 317,500 |

| Day high | $89.90 | Avg. volume | 473,310 |

| 50-day MA | $94.97 | Dividend yield | N/A |

| 200-day MA | $88.10 | Market Cap | 14.06B |

LOGI Stock Price Chart Interactive Chart >

Logitech International S.A. (LOGI) Company Bio

Logitech International S.A. (/ˈlɒdʒɪtɛk/ LOJ-i-tek; often shortened to Logi) is a Swiss-American multinational manufacturer of computer peripherals and software, with headquarters in Lausanne, Switzerland and Newark, California. The company has offices throughout Europe, Asia, Oceania, and the Americas, and is one of the world's leading manufacturers of input and interface devices for personal computers (PCs) and other digital products. It is a component of the flagship Swiss Market Index. (Source:Wikipedia)

Latest LOGI News From Around the Web

Below are the latest news stories about LOGITECH INTERNATIONAL SA that investors may wish to consider to help them evaluate LOGI as an investment opportunity.

Here's What Makes Logitech (LOGI) a Promising Portfolio PickWith healthy fundamentals and upward estimate revisions, Logitech (LOGI) appears to be an enticing investment option at the moment. |

Logitech Named to Dow Jones Sustainability Europe IndexRecognized for leadership for a fourth consecutive year LAUSANNE, SWITZERLAND and SAN JOSE, CA / ACCESSWIRE / December 20, 2023 /Logitech International (SIX:LOGN)(Nasdaq:LOGI) announced today that it has been included in the Dow Jones Sustainability ... |

Logitech (LOGI) AI Camera Certified for Teams and Zoom RoomsLogitech (LOGI) Sight AI Camera receives certification for compatibility with Microsoft Teams and Zoom Rooms. |

Logitech Sight AI Camera Now Certified for Microsoft Teams and Zoom RoomsLAUSANNE, Switzerland & SAN JOSE, Calif., December 18, 2023--Today, Logitech (SIX: LOGN) (NASDAQ: LOGI) announced that Logitech Sight, the AI-powered, sustainably-built tabletop companion camera with intelligent multi-participant framing, is the first intelligent camera to be certified by Microsoft Teams as a center-of-table camera that works in tandem with the front-of-room video bars and is the first Panoramic Camera to be certified for use with Zoom Rooms. |

Logitech and Product Carbon Impact LabelingCarbon Clarity: An Excerpt from Logitech's FY23 Impact ReportNORTHAMPTON, MA / ACCESSWIRE / December 5, 2023 / LogitechCarbon is the new calorie - everyone should know what they are consuming. By being open and transparent about impact, Logitech is ... |

LOGI Price Returns

| 1-mo | -7.68% |

| 3-mo | 12.19% |

| 6-mo | 5.93% |

| 1-year | 24.40% |

| 3-year | -15.03% |

| 5-year | 127.47% |

| YTD | -6.46% |

| 2023 | 52.71% |

| 2022 | -22.85% |

| 2021 | -14.29% |

| 2020 | 108.66% |

| 2019 | 53.41% |

Continue Researching LOGI

Here are a few links from around the web to help you further your research on Logitech International Sa's stock as an investment opportunity:Logitech International Sa (LOGI) Stock Price | Nasdaq

Logitech International Sa (LOGI) Stock Quote, History and News - Yahoo Finance

Logitech International Sa (LOGI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...