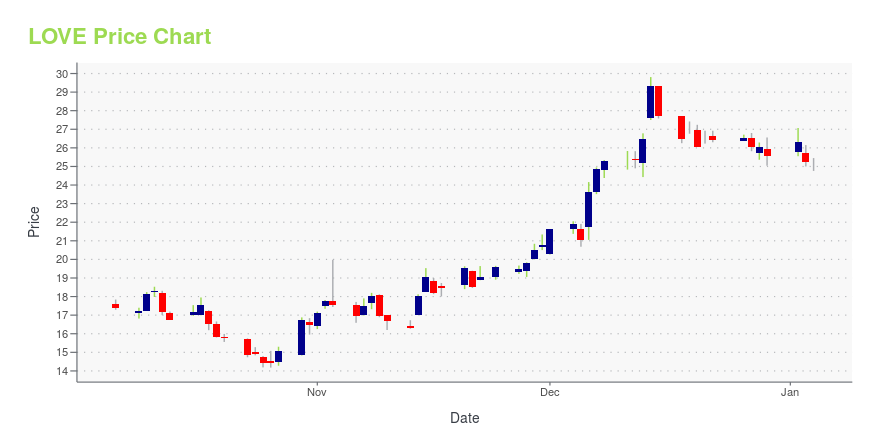

The Lovesac Company (LOVE): Price and Financial Metrics

LOVE Price/Volume Stats

| Current price | $27.72 | 52-week high | $30.39 |

| Prev. close | $27.57 | 52-week low | $14.18 |

| Day low | $26.63 | Volume | 238,700 |

| Day high | $28.30 | Avg. volume | 296,559 |

| 50-day MA | $25.79 | Dividend yield | N/A |

| 200-day MA | $22.95 | Market Cap | 431.07M |

LOVE Stock Price Chart Interactive Chart >

The Lovesac Company (LOVE) Company Bio

The Lovesac Company designs, manufactures, and sells foam filled furniture, sectional couches, and related accessories. It offers sactionals, such as seats and sides; sacs, including foam beanbag chairs; and accessories comprising drink holders, footsac blankets, decorative pillows, fitted seat tables, and ottomans. The company markets its products through its 66 showrooms at top tier malls and lifestyle centers in 29 states of the United States, as well as through online. The Lovesac Company was founded in 1998 and is based in Stamford, Connecticut.

Latest LOVE News From Around the Web

Below are the latest news stories about LOVESAC CO that investors may wish to consider to help them evaluate LOVE as an investment opportunity.

4 Magnificent Growth Stocks That Can Build Generational Wealth by 2040Life-altering gains could be a click of the buy button away with these innovation-driven companies. |

20 Most Luxurious and Expensive Woods for Furniture In The WorldIn this article, we will take a detailed look at the 20 Most Luxurious and Expensive Woods for Furniture In The World with insights into per-board foot price. For a quick overview of such expensive woods for furniture, read our article 5 Most Luxurious and Expensive Woods for Furniture In The World. The furniture market is flourishing due to […] |

4 Unstoppable Multibaggers to Buy in 2024 and Hold for the Next DecadeEven after posting solid results so far in 2023, these four stocks still offer long-term multibagger potential. |

The Lovesac Company Publishes 2023 ESG ReportSTAMFORD, Conn., Dec. 18, 2023 (GLOBE NEWSWIRE) -- The Lovesac Company (Nasdaq: LOVE) (“Lovesac” or the “Company”), the home furnishing brand best known for its Sactionals, The World's Most Adaptable Couch, has released its Environmental, Social & Governance (“ESG”) Report for the 2023 fiscal year ended January 29, 2023. The report highlights Lovesac’s priorities and initiatives on environmental stewardship, social commitments, corporate governance, and community service. Shawn Nelson, Chief Exe |

The Lovesac Company (NASDAQ:LOVE) Looks Just Right With A 50% Price JumpThe Lovesac Company ( NASDAQ:LOVE ) shareholders would be excited to see that the share price has had a great month... |

LOVE Price Returns

| 1-mo | 27.51% |

| 3-mo | 26.92% |

| 6-mo | 14.40% |

| 1-year | -3.72% |

| 3-year | -54.56% |

| 5-year | 27.21% |

| YTD | 8.49% |

| 2023 | 16.08% |

| 2022 | -66.78% |

| 2021 | 53.77% |

| 2020 | 168.47% |

| 2019 | -30.03% |

Continue Researching LOVE

Want to do more research on Lovesac Co's stock and its price? Try the links below:Lovesac Co (LOVE) Stock Price | Nasdaq

Lovesac Co (LOVE) Stock Quote, History and News - Yahoo Finance

Lovesac Co (LOVE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...