Lipocine Inc. (LPCN): Price and Financial Metrics

LPCN Price/Volume Stats

| Current price | $5.51 | 52-week high | $11.79 |

| Prev. close | $5.82 | 52-week low | $2.31 |

| Day low | $5.51 | Volume | 14,973 |

| Day high | $6.00 | Avg. volume | 55,215 |

| 50-day MA | $7.21 | Dividend yield | N/A |

| 200-day MA | $4.55 | Market Cap | 29.47M |

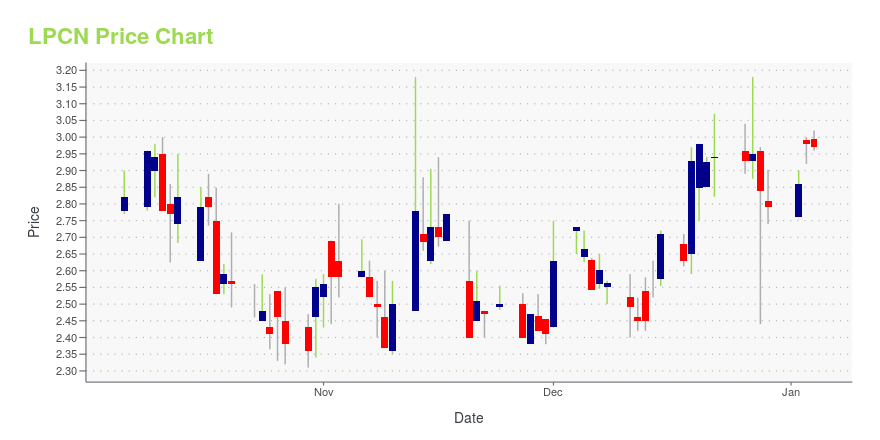

LPCN Stock Price Chart Interactive Chart >

Lipocine Inc. (LPCN) Company Bio

Lipocine develops pharmaceutical products using its oral drug delivery technology in the areas of mens and womens health, with a current focus being testosterone replacement. The company was founded in 1997 and is based in Salt Lake City, Utah.

Latest LPCN News From Around the Web

Below are the latest news stories about LIPOCINE INC that investors may wish to consider to help them evaluate LPCN as an investment opportunity.

Lipocine Releases Late Breaking Presentation on LPCN 1148 Phase 2 Results at The Liver Meeting® 2023Lipocine Inc. (NASDAQ: LPCN), a biopharmaceutical company focused on treating Central Nervous System (CNS) disorders, today announced that results of its Phase 2 study evaluating LPCN 1148 are being presented at The American Association for the Study of Liver Diseases (AASLD) – The Liver Meeting® 2023, taking place in Boston MA. The results are featured in a late-breaking oral presentation and e-poster by Dr. Arun Sanyal, MD, Director, Stravitz-Sanyal Institute for Liver Disease and Metabolic He |

Lipocine Announces Financial Results for the Third Quarter Ended September 30, 2023Lipocine Inc. (NASDAQ: LPCN), a biopharmaceutical company focused on treating Central Nervous System (CNS) disorders by leveraging its proprietary platform to develop differentiated products, today announced financial results for the third quarter and nine months ended September 30, 2023, and provided a corporate update. |

Lipocine to Present Clinical Data on LPCN 1148 at The Liver Meeting® 2023Lipocine Inc. (NASDAQ: LPCN), a biopharmaceutical company focused on treating Central Nervous System (CNS) disorders, today announced that an abstract on LPCN 1148 has been selected for a late breaking oral presentation at The American Association for the Study of Liver Diseases (AASLD) – The Liver Meeting® 2023, to take place in Boston MA, November 10 to 14, 2023. |

Lipocine Completes Successful Meeting with FDA on LPCN 1154 in Postpartum DepressionLipocine Inc. (NASDAQ: LPCN), a biopharmaceutical company focused on treating Central Nervous System (CNS) disorders by leveraging its proprietary platform, today announced the completion of a meeting with the FDA and guidance for the appropriate acceptance criteria for the upcoming LPCN 1154 pivotal study. |

Lipocine to Present at the H.C. Wainwright Annual NASH Investor ConferenceLipocine Inc. (NASDAQ: LPCN), a biopharmaceutical company focused on treating Central Nervous System (CNS) disorders, today announced that it will present and meet with investors at the H.C. Wainwright 7th Annual NASH Investor Conference, taking place virtually October 24, 2023. |

LPCN Price Returns

| 1-mo | -29.81% |

| 3-mo | 14.85% |

| 6-mo | 41.65% |

| 1-year | 8.04% |

| 3-year | -75.45% |

| 5-year | -82.48% |

| YTD | 97.49% |

| 2023 | -58.74% |

| 2022 | -59.86% |

| 2021 | -27.13% |

| 2020 | 253.34% |

| 2019 | -70.39% |

Loading social stream, please wait...