LG Display Co. Ltd. ADR (LPL): Price and Financial Metrics

LPL Price/Volume Stats

| Current price | $4.12 | 52-week high | $5.66 |

| Prev. close | $4.36 | 52-week low | $3.45 |

| Day low | $4.12 | Volume | 167,400 |

| Day high | $4.29 | Avg. volume | 402,327 |

| 50-day MA | $4.03 | Dividend yield | N/A |

| 200-day MA | $4.38 | Market Cap | 4.12B |

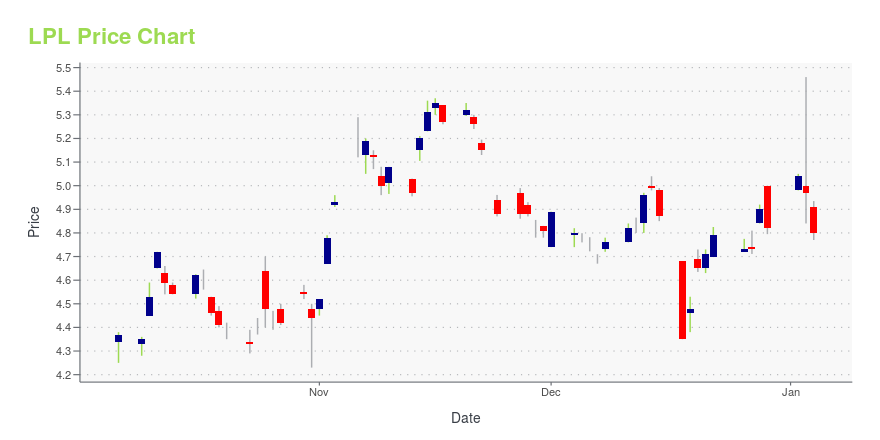

LPL Stock Price Chart Interactive Chart >

LG Display Co. Ltd. ADR (LPL) Company Bio

LG Display Co Ltd. manufactures and sells thin film transistor liquid crystal display panels in the Republic of Korea, the United States, Europe, and Asia. The company was founded in 1985 and is based in Seoul, the Republic of Korea.

Latest LPL News From Around the Web

Below are the latest news stories about LG DISPLAY CO LTD that investors may wish to consider to help them evaluate LPL as an investment opportunity.

Zacks Industry Outlook Highlights Logitech, LG Display and TransAct TechnologiesLogitech, LG Display and TransAct Technologies have been highlighted in this Industry Outlook article. |

3 Stocks to Buy From a Prospering Computer Peripheral IndustryThe Zacks Computer-Peripheral Equipment industry participants like LOGI, LPL and TACT are likely to benefit from the growing demand for professional gaming accessories, touchscreen devices, smart glasses, 3D printed health equipment and RFID solutions. |

Despite Fast-paced Momentum, LG Display (LPL) Is Still a Bargain StockLG Display (LPL) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen. |

LG DIsplay will make OLED iPad Pro screens from FebruaryApple supply chain partner LG Display will start producing OLED panels for the iPad Pro from February, earlier than expected for launch early in 2024, and costing Apple three times compared to the iPhone equivalents. |

William Sauers joins Cetera Advisor NetworksCetera Financial Group (Cetera), the premier financial advisor Wealth Hub, announced that William Sauers** has joined Cetera Advisor Networks via Cetera Wealth Management Group. Within Cetera Wealth Management Group, Sauers joins Evershore Financial Group's Boca Raton firm location under the leadership of managing partners Robert D. Barboni, CFP®** and Daniel C. Zagata, CLU, ChFC, CFP®, AIF®** as well as Senior Vice President Steven Zborowski.** Sauers was previously affiliated with LPL Financia |

LPL Price Returns

| 1-mo | 1.98% |

| 3-mo | 4.30% |

| 6-mo | -10.04% |

| 1-year | -20.77% |

| 3-year | -56.72% |

| 5-year | -37.58% |

| YTD | -14.52% |

| 2023 | -2.82% |

| 2022 | -50.89% |

| 2021 | 19.67% |

| 2020 | 21.61% |

| 2019 | -15.26% |

Continue Researching LPL

Want to do more research on LG Display Co Ltd's stock and its price? Try the links below:LG Display Co Ltd (LPL) Stock Price | Nasdaq

LG Display Co Ltd (LPL) Stock Quote, History and News - Yahoo Finance

LG Display Co Ltd (LPL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...