LightPath Technologies, Inc. - (LPTH): Price and Financial Metrics

LPTH Price/Volume Stats

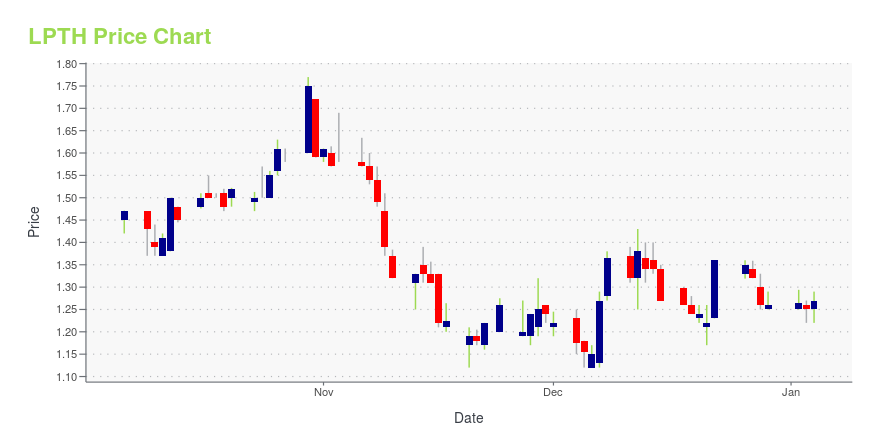

| Current price | $1.44 | 52-week high | $1.90 |

| Prev. close | $1.40 | 52-week low | $1.12 |

| Day low | $1.40 | Volume | 19,368 |

| Day high | $1.53 | Avg. volume | 54,336 |

| 50-day MA | $1.29 | Dividend yield | N/A |

| 200-day MA | $1.38 | Market Cap | 55.88M |

LPTH Stock Price Chart Interactive Chart >

LightPath Technologies, Inc. - (LPTH) Company Bio

LightPath Technologies, Inc. manufactures collimator assemblies and GRADIUM glass products. The Company also develops various optical switch products.

Latest LPTH News From Around the Web

Below are the latest news stories about LIGHTPATH TECHNOLOGIES INC that investors may wish to consider to help them evaluate LPTH as an investment opportunity.

LightPath Announces Initial $4.7m Order from Lockheed MartinORLANDO, FL / ACCESSWIRE / December 11, 2023 / LightPath Technologies, Inc. (NASDAQ:LPTH), ("LightPath" or the "Company"), a leading vertically integrated global manufacturer and integrator of proprietary optical and infrared technologies, announced ... |

LightPath Technologies Schedules Annual Meeting of StockholdersORLANDO, FL / ACCESSWIRE / December 4, 2023 / LightPath Technologies, Inc. (NASDAQ:LPTH) ("LightPath," the "Company," or "we"), a leading global, vertically integrated provider of thermal imaging cores, custom optical assemblies, photonics and infrared ... |

LightPath Technologies Postpones Annual Meeting of StockholdersORLANDO, FL / ACCESSWIRE / November 13, 2023 / LightPath Technologies, Inc. (NASDAQ:LPTH) ("LightPath," the "Company," or "we"), a leading global, vertically integrated provider of thermal imaging cores, custom optical assemblies, photonics and infrared ... |

LightPath Technologies, Inc. (NASDAQ:LPTH) Q1 2024 Earnings Call TranscriptLightPath Technologies, Inc. (NASDAQ:LPTH) Q1 2024 Earnings Call Transcript November 9, 2023 LightPath Technologies, Inc. misses on earnings expectations. Reported EPS is $-0.04 EPS, expectations were $-0.02. Operator: Good afternoon, everyone, and welcome to the LightPath Technologies Fiscal First Quarter 2024 Financial Results Conference Call. Please note that, today’s event is being recorded. And at […] |

Q1 2024 LightPath Technologies Inc Earnings CallQ1 2024 LightPath Technologies Inc Earnings Call |

LPTH Price Returns

| 1-mo | 18.03% |

| 3-mo | 2.86% |

| 6-mo | 3.60% |

| 1-year | -20.00% |

| 3-year | -35.14% |

| 5-year | 87.01% |

| YTD | 14.29% |

| 2023 | 3.28% |

| 2022 | -50.00% |

| 2021 | -37.76% |

| 2020 | 440.69% |

| 2019 | -51.34% |

Continue Researching LPTH

Here are a few links from around the web to help you further your research on Lightpath Technologies Inc's stock as an investment opportunity:Lightpath Technologies Inc (LPTH) Stock Price | Nasdaq

Lightpath Technologies Inc (LPTH) Stock Quote, History and News - Yahoo Finance

Lightpath Technologies Inc (LPTH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...