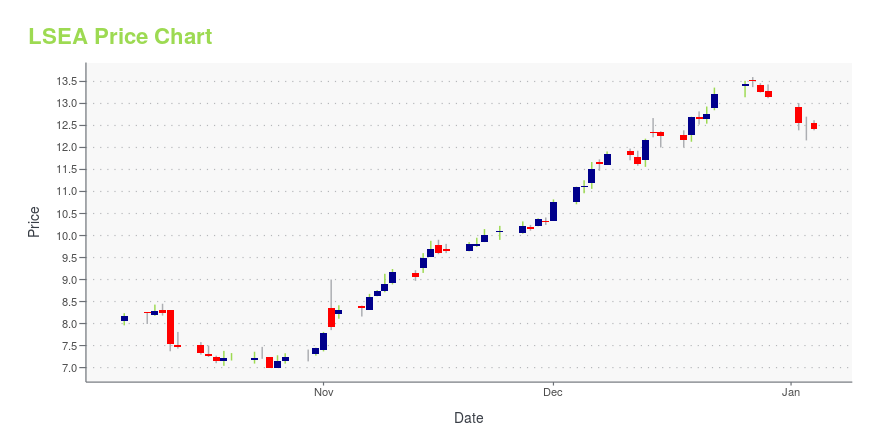

Landsea Homes Corporation (LSEA): Price and Financial Metrics

LSEA Price/Volume Stats

| Current price | $12.21 | 52-week high | $14.91 |

| Prev. close | $11.78 | 52-week low | $7.00 |

| Day low | $11.96 | Volume | 157,472 |

| Day high | $12.52 | Avg. volume | 203,941 |

| 50-day MA | $9.96 | Dividend yield | N/A |

| 200-day MA | $10.95 | Market Cap | 441.75M |

LSEA Stock Price Chart Interactive Chart >

Landsea Homes Corporation (LSEA) Company Bio

Landsea Homes Corporation provides construction services. The Company designs and builds communities and homes. Landsea Homes serves customers in the United States.

Latest LSEA News From Around the Web

Below are the latest news stories about LANDSEA HOMES CORP that investors may wish to consider to help them evaluate LSEA as an investment opportunity.

LANDSEA HOMES LAUNCHES FIRST ENVIRONMENTAL, SOCIAL AND GOVERNANCE REPORTLandsea Homes Corporation (Nasdaq: LSEA) ("Landsea Homes" or the "Company"), a publicly traded residential homebuilder, today published its first environmental, social and governance (ESG) report, which details the Company's ongoing environmental and sustainability initiatives as well as diversity, equity, and inclusion efforts. |

Insider Sell Alert: Director Elias Farhat Sells 35,177 Shares of Landsea Homes Corp (LSEA)Landsea Homes Corp (NASDAQ:LSEA) has recently witnessed a significant insider sell by Director Elias Farhat, who offloaded 35,177 shares of the company on December 12, 2023. |

3 Stocks in Focus on New Analyst CoverageThe recent surge in analyst coverage for stocks such as OFG, Lamar (LAMR) and Landsea (LSEA) indicates the potential for significant price appreciation in the near term. |

What Does Landsea Homes Corporation's (NASDAQ:LSEA) Share Price Indicate?Landsea Homes Corporation ( NASDAQ:LSEA ), is not the largest company out there, but it saw a significant share price... |

November Marks Best Month Since 2022: 4 Best Sectors & Stock PicksNovember marked an exceptional month for stocks. Interest rate-sensitive sectors and stocks like Udemy (UDMY), Oscar Health (OSCR), Rocky Brands (RCKY) and Landsea Homes (LSEA) outperformed in the month. |

LSEA Price Returns

| 1-mo | 35.22% |

| 3-mo | 8.44% |

| 6-mo | -1.13% |

| 1-year | 28.26% |

| 3-year | 50.55% |

| 5-year | N/A |

| YTD | -7.08% |

| 2023 | 152.21% |

| 2022 | -28.83% |

| 2021 | -31.07% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...