Lucid Diagnostics Inc. (LUCD): Price and Financial Metrics

LUCD Price/Volume Stats

| Current price | $0.86 | 52-week high | $1.72 |

| Prev. close | $0.85 | 52-week low | $0.63 |

| Day low | $0.83 | Volume | 212,600 |

| Day high | $0.88 | Avg. volume | 159,566 |

| 50-day MA | $0.83 | Dividend yield | N/A |

| 200-day MA | $1.12 | Market Cap | 45.08M |

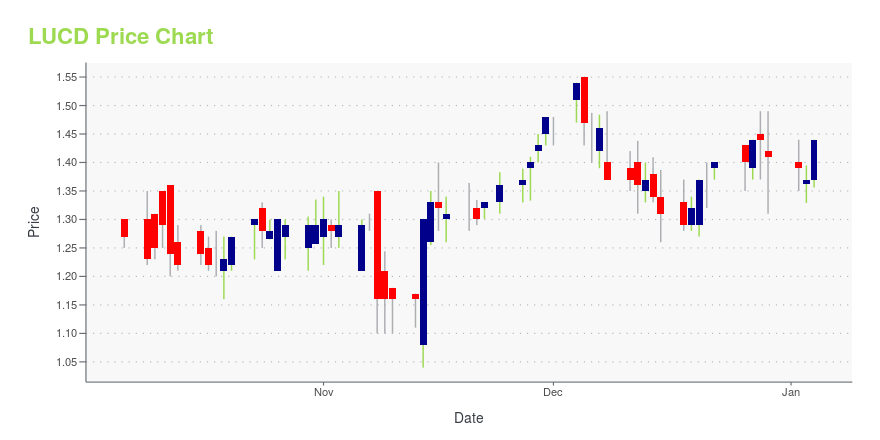

LUCD Stock Price Chart Interactive Chart >

Lucid Diagnostics Inc. (LUCD) Company Bio

Lucid Diagnostics Inc. operates as a commercial-stage medical diagnostics technology company. It focuses on patients with gastroesophageal reflux disease, also known as chronic heartburn, acid reflux or simply reflux, who are at risk of developing esophageal precancer and cancer, specifically highly lethal esophageal adenocarcinoma. The company's lead products include EsoGuard, a laboratory developed esophageal DNA test that examines individuals DNA molecules for the presence or absence of cytosine methylation; and EsoCheck, a cell collection device that collects cells of targeted region of the esophagus. Lucid Diagnostics Inc. was incorporated in 2018 and is based in New York, New York. Lucid Diagnostics Inc. is a subsidiary of PAVmed Inc.

Latest LUCD News From Around the Web

Below are the latest news stories about LUCID DIAGNOSTICS INC that investors may wish to consider to help them evaluate LUCD as an investment opportunity.

The 3 Most Undervalued Penny Stocks to Buy in DecemberWe cannot end the year without adding a few penny stocks to our portfolio to take advantage of the opportunities coming up in the next cycle. Of course, we must rely on our investment thesis and our own analysis, but here I am to tell you a little about these undervalued penny stocks that are worth analyzing and evaluating to add to our portfolio. Let’s take a brief look. PAVmed (PAVM) Source: venusvi / Shutterstock.com PAVmed (NASDAQ:PAVM) is making waves as one of the undervalued penny stocks |

Lucid Diagnostics Announces Peer-Reviewed Publication of Positive Results from Three Clinical Utility StudiesLucid Diagnostics Inc. (Nasdaq: LUCD) ("Lucid" or the "Company") a commercial-stage, cancer prevention medical diagnostics company, and majority-owned subsidiary of PAVmed Inc. (Nasdaq: PAVM, PAVMZ) ( "PAVmed"), today announced that three manuscripts providing interim results from the Prospective REView of Esophageal Precancer DetectioN in AT-Risk Patients (PREVENT) Registry, the CLinical Utility of EsoGuard (CLUE) study, and full data from the San Antonio Firefighter study, have been published— |

PAVmed Provides Additional Details for Upcoming Stock Dividend to ShareholdersPAVmed Inc. (Nasdaq: PAVM, PAVMZ) ("PAVmed" or the "Company"), a diversified commercial-stage medical technology company, operating in the medical device, diagnostics, and digital health sectors today provided additional details on the previously announced dividend of common stock of its majority-owned subsidiary, Lucid Diagnostics Inc. (Nasdaq: LUCD) for PAVmed shareholders. |

PAVmed Announces Dividend of Lucid Diagnostics Common Stock and Reverse Stock SplitPAVmed Inc. (Nasdaq: PAVM, PAVMZ) ("PAVmed" or the "Company"), a diversified commercial-stage medical technology company, operating in the medical device, diagnostics, and digital health sectors today announced a dividend of approximately 3.3 million shares of common stock of its majority-owned subsidiary, Lucid Diagnostics Inc. (Nasdaq: LUCD), which equals the number of shares PAVmed will receive in the contemporaneous partial settlement of outstanding intercompany debt owed to PAVmed by Lucid. |

PAVmed Inc. (NASDAQ:PAVM) Q3 2023 Earnings Call TranscriptPAVmed Inc. (NASDAQ:PAVM) Q3 2023 Earnings Call Transcript November 15, 2023 Operator: Good day, and welcome to the PAVmed Third Quarter 2023 Business Update Conference Call. All participants will be in a listen-only mode. [Operator Instructions] After today’s remarks, there will be an opportunity to ask questions. [Operator Instructions] Please also note that today’s event […] |

LUCD Price Returns

| 1-mo | 2.28% |

| 3-mo | 25.90% |

| 6-mo | -39.86% |

| 1-year | -37.45% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -39.01% |

| 2023 | 3.68% |

| 2022 | -74.67% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...