Pulmonx Corp. (LUNG): Price and Financial Metrics

LUNG Price/Volume Stats

| Current price | $7.75 | 52-week high | $14.84 |

| Prev. close | $7.84 | 52-week low | $5.67 |

| Day low | $7.74 | Volume | 517,505 |

| Day high | $8.08 | Avg. volume | 457,587 |

| 50-day MA | $7.23 | Dividend yield | N/A |

| 200-day MA | $9.68 | Market Cap | 300.82M |

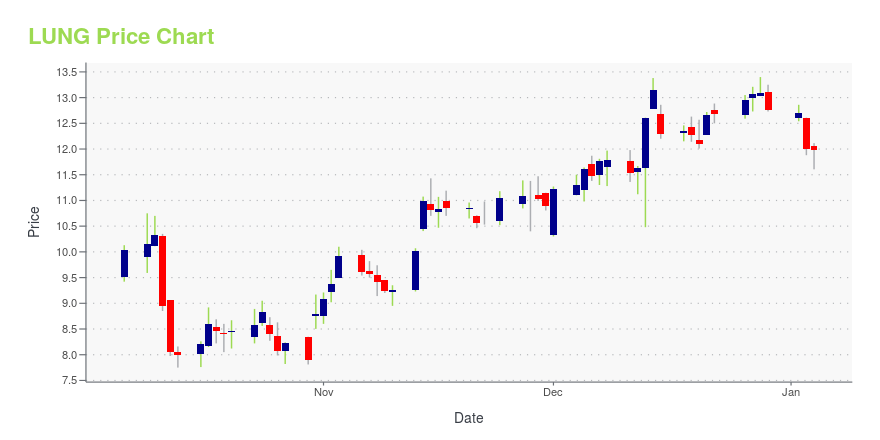

LUNG Stock Price Chart Interactive Chart >

Pulmonx Corp. (LUNG) Company Bio

Pulmonx Corp. provides interventional pulmonology, planning tools, and treatments for obstructive lung diseases. It carries out its operations in the following geographical locations: Europe, Middle East and Africa (EMEA), Asia Pacific, Other International, and United States. It offers the Zephyr Endobronchial Valve, an implantable device used to occlude all airways feeding the hyperinflated lobe of a lung that is most diseased with emphysema. It also offers StratX Lung Analysis, a platform designed to treat severe emphysema, and the Chartis Assessment System, a pulmonary assessment system. The company was founded by Rodney C. Perkins and is headquartered in Redwood City, CA.

Latest LUNG News From Around the Web

Below are the latest news stories about PULMONX CORP that investors may wish to consider to help them evaluate LUNG as an investment opportunity.

Insider Sell: President and CEO French Glendon E. III Sells 10,000 Shares of Pulmonx Corp (LUNG)Pulmonx Corp (NASDAQ:LUNG), a company specializing in medical devices for the treatment of pulmonary disorders, has reported an insider sell according to a recent SEC filing. |

The Honest Company Announces Appointment of Michael Barkley, Alissa Hsu Lynch, and Andrea Turner to the Board of DirectorsLOS ANGELES, Dec. 11, 2023 (GLOBE NEWSWIRE) -- The Honest Company (NASDAQ: HNST), a digitally-native consumer products company dedicated to creating clean- and sustainably-designed products spanning baby care, beauty, personal care, wellness and household care, today announced that Michael Barkley, Former Chief Executive Officer of Kind LLC, Alissa Hsu Lynch, Former Global Head of MedTech Strategy and Solutions for Google Cloud, and Andrea Turner, Former Senior Vice President, Global Customer Se |

Biotech Breakthroughs: 3 Revolutionary Stocks Redefining HealthcareThe article embarks on a transformative journey through the biopharmaceutical frontier, where the listed companies stand as titans reshaping healthcare norms. |

Pulmonx to Present at the Piper Sandler 35th Annual Healthcare ConferenceREDWOOD CITY, Calif., Nov. 15, 2023 (GLOBE NEWSWIRE) -- Pulmonx Corporation (Nasdaq: LUNG) (“Pulmonx”) a global leader in minimally invasive treatments for severe lung disease, today announced the company will be participating in a fireside chat at the Piper Sandler 35th Annual Healthcare Conference in New York on Wednesday, November 29, 2023, at 11:00 AM PT / 2:00 PM ET. A live and archived webcast of the presentation will be available on “Investors” section of the Pulmonx website at https://in |

Pulmonx to Participate at Upcoming Investor ConferencesREDWOOD CITY, Calif., Oct. 31, 2023 (GLOBE NEWSWIRE) -- Pulmonx Corporation (Nasdaq: LUNG) (“Pulmonx”) a global leader in minimally invasive treatments for severe lung disease, today announced the company will be participating in two upcoming investor conferences. Pulmonx management is scheduled to participate in a fireside chat at the Stifel 2023 Healthcare Conference in New York on Tuesday, November 14, 2023, at 11:25am PT / 2:25pm ET. Interested parties may access a live and archived webcast |

LUNG Price Returns

| 1-mo | 26.22% |

| 3-mo | 6.46% |

| 6-mo | -42.16% |

| 1-year | -40.06% |

| 3-year | -79.86% |

| 5-year | N/A |

| YTD | -39.22% |

| 2023 | 51.25% |

| 2022 | -73.71% |

| 2021 | -53.54% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...