LyondellBasell Industries N.V. Cl A (LYB): Price and Financial Metrics

LYB Price/Volume Stats

| Current price | $97.26 | 52-week high | $107.02 |

| Prev. close | $96.60 | 52-week low | $88.46 |

| Day low | $96.35 | Volume | 1,113,500 |

| Day high | $97.55 | Avg. volume | 1,789,745 |

| 50-day MA | $96.38 | Dividend yield | 5.58% |

| 200-day MA | $96.70 | Market Cap | 31.67B |

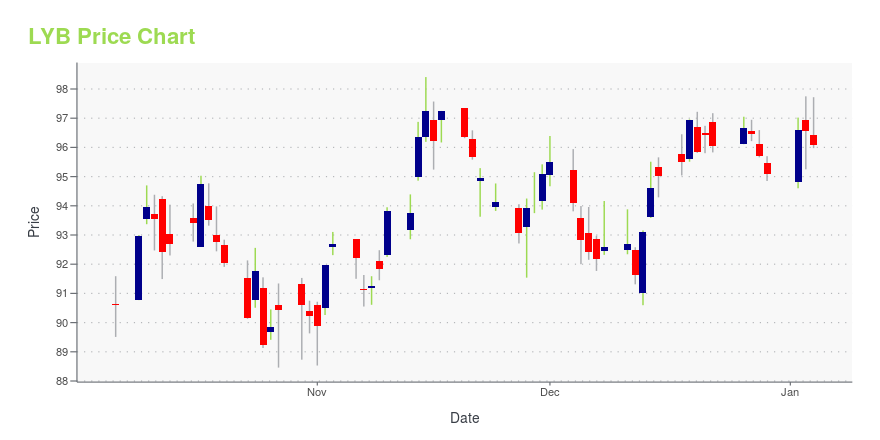

LYB Stock Price Chart Interactive Chart >

LyondellBasell Industries N.V. Cl A (LYB) Company Bio

LyondellBasell Industries N.V. (NYSE: LYB) is a multinational chemical company incorporated in the Netherlands with U.S. operations headquartered in Houston, Texas, and offices in London, UK. The company is the largest licensor of polyethylene and polypropylene technologies. It also produces ethylene, propylene, polyolefins, and oxyfuels. (Source:Wikipedia)

Latest LYB News From Around the Web

Below are the latest news stories about LYONDELLBASELL INDUSTRIES NV that investors may wish to consider to help them evaluate LYB as an investment opportunity.

LyondellBasell (LYB) & Pigeon to Advance Baby Nursing BottlesLyondellBasell's (LYB) CirculenRenew polymers are manufactured using renewable feedstocks obtained from bio-based wastes and residual oils such as used cooking oils. |

Prediction: You Won't Regret Buying These 3 No-Brainer High-Yield Dividend StocksThese dividend stocks seem like sure things right now. |

12 Best Foreign Stocks With DividendsIn this article, we will take a detailed look at the 12 Best Foreign Stocks With Dividends. For a quick overview of such stocks, read our article 5 Best Foreign Stocks With Dividends. While markets are roaring amid the Fed’s indication that it’s ready to begin interest rate cuts next year, some analysts still advise caution and […] |

TotalEnergies (TTE) Signs Two Solar CPPA With LyondellBasellTotalEnergies (TTE) continues to supply clean electricity generated in the United States to its industrial customers through a Corporate Power Purchase Agreement and assist in cutting emissions. |

LyondellBasell (LYB) Inches Closer to 2030 Renewable Energy GoalLyondellBasell (LYB) signs a long-term power purchase agreement for 125 MW of renewable energy from TotalEnergies' Brazoria Solar project in Texas. |

LYB Price Returns

| 1-mo | 1.49% |

| 3-mo | -3.47% |

| 6-mo | 4.79% |

| 1-year | 4.18% |

| 3-year | 19.76% |

| 5-year | 56.29% |

| YTD | 5.00% |

| 2023 | 20.70% |

| 2022 | -0.98% |

| 2021 | 5.07% |

| 2020 | 2.64% |

| 2019 | 19.41% |

LYB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LYB

Want to do more research on LyondellBasell Industries NV's stock and its price? Try the links below:LyondellBasell Industries NV (LYB) Stock Price | Nasdaq

LyondellBasell Industries NV (LYB) Stock Quote, History and News - Yahoo Finance

LyondellBasell Industries NV (LYB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...