Lloyds Banking Group PLC ADR (LYG): Price and Financial Metrics

LYG Price/Volume Stats

| Current price | $3.09 | 52-week high | $3.11 |

| Prev. close | $3.06 | 52-week low | $1.88 |

| Day low | $3.03 | Volume | 11,208,413 |

| Day high | $3.11 | Avg. volume | 9,176,514 |

| 50-day MA | $2.85 | Dividend yield | 6.03% |

| 200-day MA | $2.44 | Market Cap | 48.29B |

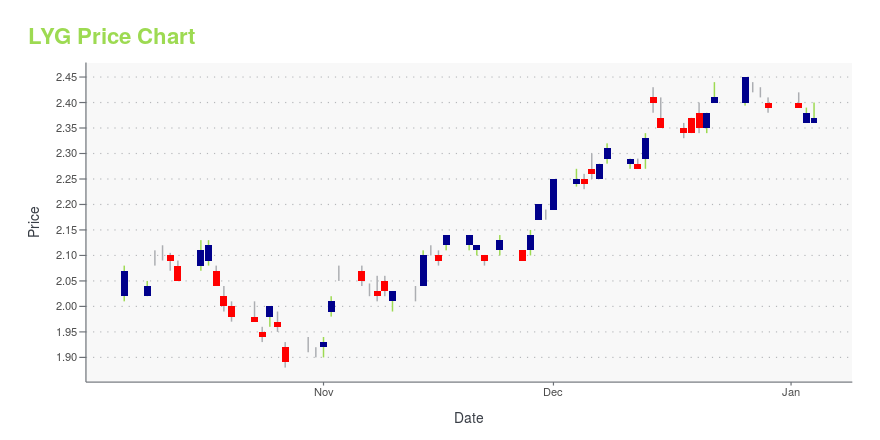

LYG Stock Price Chart Interactive Chart >

Lloyds Banking Group PLC ADR (LYG) Company Bio

Lloyds Banking Group is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. Lloyds Bank was founded in 1765 but the wider Group's heritage extends over 320 years, dating back to the founding of the Bank of Scotland by the Parliament of Scotland in 1695. (Source:Wikipedia)

Latest LYG News From Around the Web

Below are the latest news stories about LLOYDS BANKING GROUP PLC that investors may wish to consider to help them evaluate LYG as an investment opportunity.

FTSE top trending tickers of 2023Lloyds, BT, BP, Tesco and six other stocks that moved markets. |

Biggest scams to look out for: From concert and football tickets to holiday fake dealsOnline shopping remains a hotspot for fraudulent activities, says Lloyds Bank. |

Why won’t MBNA send me paper statements?It is pressing me to receive statements digitally, because of some unspecified ‘issues’ |

Barclay Family Repays Lloyds for £1.2 Billion Telegraph Loan(Bloomberg) -- Lloyds Banking Group Plc has received £1.2 billion ($1.5 billion) from the owners of the Telegraph newspaper, marking an end of the bank’s involvement in a saga that’s spawned government investigations and sparked a nationwide discussion on freedom of the press. Most Read from BloombergHow Suspects Laundered Billions in Singapore for YearsWall Street’s Furious Bull Run Gets Reality Check: Markets WrapBitcoin Surges Past $42,000 Even as Stocks and Bonds Take a HitHarvard Alumni Reb |

Barclay family repays £1.2bn debt to Lloyds amid potential sale of TelegraphThe Barclays had reached a deal with RedBird IMI, an Abu Dhabi-backed group, to help repay the debt. |

LYG Price Returns

| 1-mo | 11.15% |

| 3-mo | 18.39% |

| 6-mo | 50.98% |

| 1-year | 43.95% |

| 3-year | 41.67% |

| 5-year | 35.72% |

| YTD | 33.92% |

| 2023 | 14.57% |

| 2022 | -9.72% |

| 2021 | 33.82% |

| 2020 | -40.79% |

| 2019 | 36.71% |

LYG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LYG

Want to do more research on Lloyds Banking Group plc's stock and its price? Try the links below:Lloyds Banking Group plc (LYG) Stock Price | Nasdaq

Lloyds Banking Group plc (LYG) Stock Quote, History and News - Yahoo Finance

Lloyds Banking Group plc (LYG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...