Marathon Digital Holdings Inc. (MARA): Price and Financial Metrics

MARA Price/Volume Stats

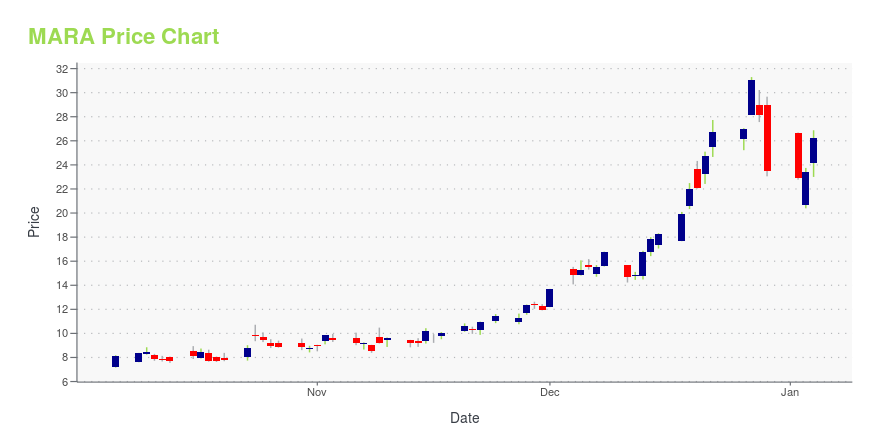

| Current price | $21.57 | 52-week high | $34.09 |

| Prev. close | $20.28 | 52-week low | $7.16 |

| Day low | $20.83 | Volume | 43,750,404 |

| Day high | $22.14 | Avg. volume | 61,833,879 |

| 50-day MA | $20.79 | Dividend yield | N/A |

| 200-day MA | $18.47 | Market Cap | 6.10B |

MARA Stock Price Chart Interactive Chart >

Marathon Digital Holdings Inc. (MARA) Company Bio

Marathon Digital Holdings, Inc. is a digital asset technology company, which mines cryptocurrencies, with a focus on the blockchain ecosystem and the generation of digital assets. It operates one mining facility in Quebec. The company was founded on February 23, 2010 and is headquartered in Las Vegas, NV.

Latest MARA News From Around the Web

Below are the latest news stories about MARATHON DIGITAL HOLDINGS INC that investors may wish to consider to help them evaluate MARA as an investment opportunity.

3 Stocks That Are Better Bets Than Cryptos In 2024Cryptocurrency made a major comeback in 2023. The strong year-to-date rally in the most popular cryptocurrencies testifies to the crypto boom. However, given the volatility of this market, here is a look at stocks that may be better and safer bets. |

The 500 Top Stocks to Buy for 2024, Ranked by AIThese are the very best stocks to buy for 2024 for any investor, according to Tom Yeung's MarketMasterAI system. |

Crypto-EquitiesIt’s more likely that BTC ease back over the coming months before making another thrust higher. |

7 Undervalued Stocks for Long-Term StabilityLooking at the fundamentals and earnings projections can help investors identify the best undervalued long-term stocks to buy today. |

MARA Stock Is Sputtering After A Jaw-Dropping Move. Why The Window To Lock In Gains Is Closing Fast.A frenzy has led to eye-popping returns this month. But the window to lock in gains for MARA stock is closing. Here's why. |

MARA Price Returns

| 1-mo | 11.36% |

| 3-mo | 11.01% |

| 6-mo | 20.84% |

| 1-year | 35.07% |

| 3-year | -20.17% |

| 5-year | 917.45% |

| YTD | -8.17% |

| 2023 | 586.84% |

| 2022 | -89.59% |

| 2021 | 214.75% |

| 2020 | 1,084.48% |

| 2019 | -38.79% |

Continue Researching MARA

Want to do more research on Marathon Patent Group Inc's stock and its price? Try the links below:Marathon Patent Group Inc (MARA) Stock Price | Nasdaq

Marathon Patent Group Inc (MARA) Stock Quote, History and News - Yahoo Finance

Marathon Patent Group Inc (MARA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...