908 Devices Inc. (MASS): Price and Financial Metrics

MASS Price/Volume Stats

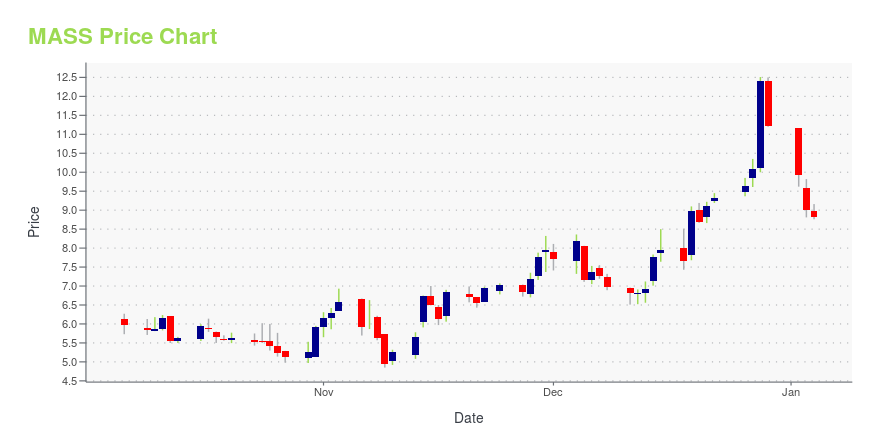

| Current price | $5.79 | 52-week high | $12.51 |

| Prev. close | $5.55 | 52-week low | $4.57 |

| Day low | $5.59 | Volume | 141,792 |

| Day high | $5.93 | Avg. volume | 201,083 |

| 50-day MA | $5.78 | Dividend yield | N/A |

| 200-day MA | $6.64 | Market Cap | 199.67M |

MASS Stock Price Chart Interactive Chart >

908 Devices Inc. (MASS) Company Bio

908 Devices, Inc. develops measurement devices for chemical and biochemical analysis. It develops its products using mass spectrometry technology, an analytical technique for measuring the mass of charged molecules that is used in chemical analysis laboratories for applications, such as safety and security, food science, biotechnology, clinical diagnostics, and controlling industrial processes. Its products include desktops and handhelds. The company was founded by Kevin J. Knopp, Miller Scott, Steve Araiza, Andrew Bartfay, Michael Jobin, Christopher D. Brown, and Christopher J. Petty in 2012 and is headquartered in Boston, MA.

Latest MASS News From Around the Web

Below are the latest news stories about 908 DEVICES INC that investors may wish to consider to help them evaluate MASS as an investment opportunity.

908 Devices Inc. (MASS) Upgraded to Buy: What Does It Mean for the Stock?908 Devices Inc. (MASS) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

Trending tickers: Bitcoin | Oil | Tesla | AppleCrypto stocks, Tesla and Apple were among gainers on Thursday, as we head towards the year's market close. |

2 Cathie Wood Stocks That Could Soar in 2024, According to Wall StreetWall Street is uber-bullish on these two Ark Invest holdings. |

Chief Product Officer Christopher Brown Sells 20,000 Shares of 908 Devices IncOn December 21, 2023, Christopher Brown, the Chief Product Officer of 908 Devices Inc (NASDAQ:MASS), sold 20,000 shares of the company's stock, according to a SEC Filing. |

How Much Upside is Left in 908 Devices Inc. (MASS)? Wall Street Analysts Think 100.39%The consensus price target hints at a 100.4% upside potential for 908 Devices Inc. (MASS). While empirical research shows that this sought-after metric is hardly effective, an upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term. |

MASS Price Returns

| 1-mo | 15.80% |

| 3-mo | 2.12% |

| 6-mo | -21.76% |

| 1-year | -12.01% |

| 3-year | -81.34% |

| 5-year | N/A |

| YTD | -48.40% |

| 2023 | 47.24% |

| 2022 | -70.55% |

| 2021 | -54.57% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...