Middlefield Banc Corp. (MBCN): Price and Financial Metrics

MBCN Price/Volume Stats

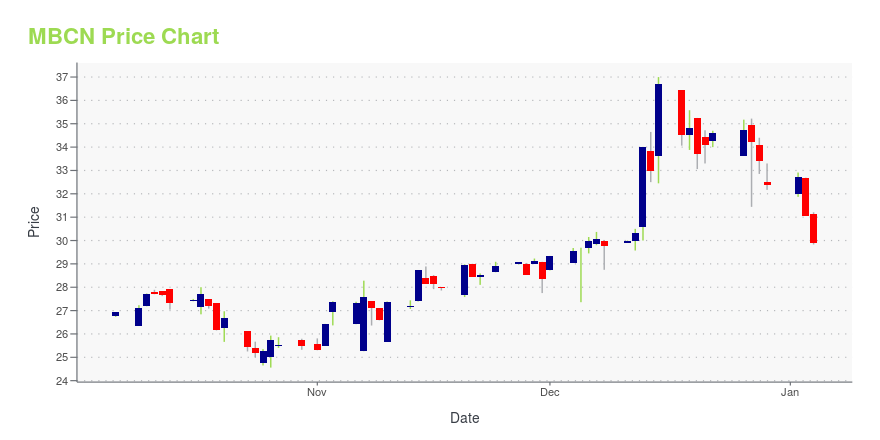

| Current price | $28.86 | 52-week high | $37.00 |

| Prev. close | $29.17 | 52-week low | $20.61 |

| Day low | $28.41 | Volume | 10,239 |

| Day high | $29.54 | Avg. volume | 10,325 |

| 50-day MA | $22.93 | Dividend yield | 2.98% |

| 200-day MA | $25.67 | Market Cap | 232.81M |

MBCN Stock Price Chart Interactive Chart >

Middlefield Banc Corp. (MBCN) Company Bio

Macatawa Bank Corporation provides commercial and personal banking services in western Michigan. The company was founded in 1997 and is based in Holland, Michigan.

Latest MBCN News From Around the Web

Below are the latest news stories about MIDDLEFIELD BANC CORP that investors may wish to consider to help them evaluate MBCN as an investment opportunity.

Why You Might Be Interested In Middlefield Banc Corp. (NASDAQ:MBCN) For Its Upcoming DividendMiddlefield Banc Corp. ( NASDAQ:MBCN ) stock is about to trade ex-dividend in three days. The ex-dividend date is one... |

Middlefield (MBCN) Stock Gains on Special Dividend AnnouncementThe announcement of a special dividend by Middlefield (MBCN) is likely to enhance shareholder value. This has led to bullish investor sentiments as the stock has risen 5.6%. |

Middlefield Banc Corp. Announces 2023 Fourth Quarter Cash Dividend Payment and Declares a $0.05 Special Cash Dividend PaymentTotal dividends declared of $0.85 per share for 2023 represents a 5% year-over-year increaseMIDDLEFIELD, Ohio, Nov. 14, 2023 (GLOBE NEWSWIRE) -- Middlefield Banc Corp. (NASDAQ: MBCN) today announced that its Board of Directors declared a special cash dividend of $0.05 per common share and a regular quarterly cash dividend of $0.20 per common share. Both dividends are payable on December 15, 2023, to shareholders of record as of December 1, 2023. James R. Heslop, II, Chief Executive Officer of Mi |

Middlefield Banc Corp. Announces Chief Executive Officer TransitionRonald L. Zimmerly, Jr. Ronald L. Zimmerly, Jr. Ronald L. Zimmerly, Jr. Appointed Chief Executive Officer on January 1, 2024James R. Heslop, II to Retire as Chief Executive Officer MIDDLEFIELD, Ohio, Nov. 14, 2023 (GLOBE NEWSWIRE) -- Middlefield Banc Corp. (NASDAQ: MBCN) today announced the Company has appointed Ronald L. Zimmerly, Jr. as Chief Executive Officer, succeeding James R. Heslop, II. Mr. Zimmerly, currently President and Director of Middlefield Banc Corp. (“Middlefield” or the “Compan |

Middlefield Banc Corp. Just Missed Earnings - But Analysts Have Updated Their ModelsIt's shaping up to be a tough period for Middlefield Banc Corp. ( NASDAQ:MBCN ), which a week ago released some... |

MBCN Price Returns

| 1-mo | 35.43% |

| 3-mo | 32.90% |

| 6-mo | -1.09% |

| 1-year | 2.58% |

| 3-year | 31.58% |

| 5-year | 62.39% |

| YTD | -9.25% |

| 2023 | 21.87% |

| 2022 | 13.90% |

| 2021 | 13.46% |

| 2020 | -11.17% |

| 2019 | 25.78% |

MBCN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MBCN

Want to see what other sources are saying about Middlefield Banc Corp's financials and stock price? Try the links below:Middlefield Banc Corp (MBCN) Stock Price | Nasdaq

Middlefield Banc Corp (MBCN) Stock Quote, History and News - Yahoo Finance

Middlefield Banc Corp (MBCN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...