MBIA Inc. (MBI): Price and Financial Metrics

MBI Price/Volume Stats

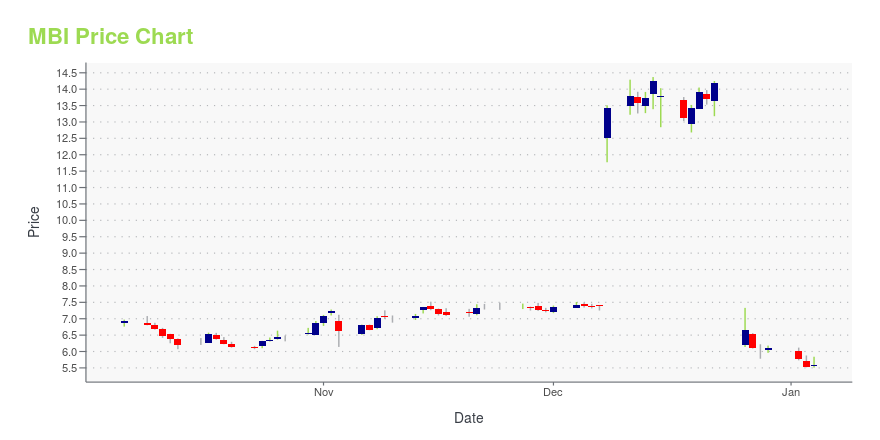

| Current price | $4.77 | 52-week high | $14.37 |

| Prev. close | $4.41 | 52-week low | $4.40 |

| Day low | $4.46 | Volume | 839,400 |

| Day high | $4.82 | Avg. volume | 494,669 |

| 50-day MA | $5.37 | Dividend yield | N/A |

| 200-day MA | $6.62 | Market Cap | 244.59M |

MBI Stock Price Chart Interactive Chart >

MBIA Inc. (MBI) Company Bio

MBIA Inc. provides financial guarantee insurance services to public finance markets in the United States and internationally. The company operates through U.S. Public Finance Insurance, and International and Structured Finance Insurance segments. It issues financial guarantees for municipal bonds, including tax-exempt and taxable indebtedness, as well as utility districts, airports, health care institutions, higher educational facilities, student loan issuers, housing authorities, and other similar agencies and obligations issued by private entities. The company was founded in 1973 and is based in Purchase, New York.

Latest MBI News From Around the Web

Below are the latest news stories about MBIA INC that investors may wish to consider to help them evaluate MBI as an investment opportunity.

Dow Up Triple Digits As Oil Prices PlummetThe S&P 500 Index and Nasdaq Composite are also higher, as investors await tomorrow's interest rate decision. |

6 big dividends & buybacks this week: Mastercard hikes by 15.8%, Broadcom by 14.1%The dividend will be payable on December 29, 2023, to stockholders of record on December 20, 2023, with an ex-dividend date of December 19, 2023. |

Bitfarms, MBIA, Applied Digital among financials gainersMore on Financial: |

CANO, VIEW and CDT among mid-day movers

|

Why Is Avid Bioservices (CDMO) Stock Down 18% Today?Avid Bioservices stock is falling hard on Friday as investors in CDMO react to a lackluster earnings report and a guidance cut. |

MBI Price Returns

| 1-mo | -11.50% |

| 3-mo | -30.06% |

| 6-mo | -25.59% |

| 1-year | -46.28% |

| 3-year | -62.85% |

| 5-year | -49.84% |

| YTD | -22.06% |

| 2023 | -52.37% |

| 2022 | -18.62% |

| 2021 | 139.97% |

| 2020 | -29.25% |

| 2019 | 4.26% |

Continue Researching MBI

Want to see what other sources are saying about Mbia Inc's financials and stock price? Try the links below:Mbia Inc (MBI) Stock Price | Nasdaq

Mbia Inc (MBI) Stock Quote, History and News - Yahoo Finance

Mbia Inc (MBI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...