Metropolitan Bank Holding Corp. (MCB): Price and Financial Metrics

MCB Price/Volume Stats

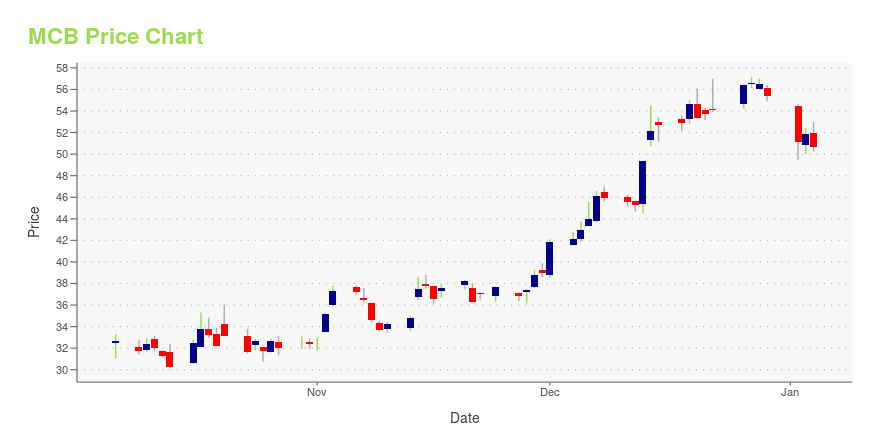

| Current price | $54.74 | 52-week high | $57.69 |

| Prev. close | $54.10 | 52-week low | $30.20 |

| Day low | $52.84 | Volume | 113,608 |

| Day high | $55.15 | Avg. volume | 100,485 |

| 50-day MA | $44.28 | Dividend yield | N/A |

| 200-day MA | $42.05 | Market Cap | 612.70M |

MCB Stock Price Chart Interactive Chart >

Metropolitan Bank Holding Corp. (MCB) Company Bio

Metropolitan Bank Holding Corp. operates as the bank holding company for Metropolitan Commercial Bank that provides a range of business, commercial, and retail banking products and services to small businesses, middle-market enterprises, public entities, and individuals in the New York metropolitan area. The company was founded in 1999 and is based in New York, New York.

Latest MCB News From Around the Web

Below are the latest news stories about METROPOLITAN BANK HOLDING CORP that investors may wish to consider to help them evaluate MCB as an investment opportunity.

Metropolitan Bank Holding Corp. (MCB) Surges 5.7%: Is This an Indication of Further Gains?Metropolitan Bank Holding Corp. (MCB) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road. |

ConnectOne (CNOB) Surges 7.7%: Is This an Indication of Further Gains?ConnectOne (CNOB) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Strength Seen in Equity Bancshares (EQBK): Can Its 5.8% Jump Turn into More Strength?Equity Bancshares (EQBK) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term. |

Do Options Traders Know Something About Metropolitan Bank (MCB) Stock We Don't?Investors need to pay close attention to Metropolitan Bank (MCB) stock based on the movements in the options market lately. |

Metropolitan Bank Holding's (NYSE:MCB) earnings have declined over year, contributing to shareholders 46% lossMetropolitan Bank Holding Corp. ( NYSE:MCB ) shareholders should be happy to see the share price up 12% in the last... |

MCB Price Returns

| 1-mo | 39.22% |

| 3-mo | 29.93% |

| 6-mo | 8.94% |

| 1-year | 24.07% |

| 3-year | -22.06% |

| 5-year | 24.41% |

| YTD | -1.16% |

| 2023 | -5.61% |

| 2022 | -44.93% |

| 2021 | 193.71% |

| 2020 | -24.80% |

| 2019 | 56.34% |

Continue Researching MCB

Want to see what other sources are saying about Metropolitan Bank Holding Corp's financials and stock price? Try the links below:Metropolitan Bank Holding Corp (MCB) Stock Price | Nasdaq

Metropolitan Bank Holding Corp (MCB) Stock Quote, History and News - Yahoo Finance

Metropolitan Bank Holding Corp (MCB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...