Moody's Corp. (MCO): Price and Financial Metrics

MCO Price/Volume Stats

| Current price | $448.75 | 52-week high | $458.24 |

| Prev. close | $437.21 | 52-week low | $298.86 |

| Day low | $439.69 | Volume | 884,400 |

| Day high | $452.62 | Avg. volume | 729,687 |

| 50-day MA | $422.32 | Dividend yield | 0.75% |

| 200-day MA | $384.80 | Market Cap | 81.94B |

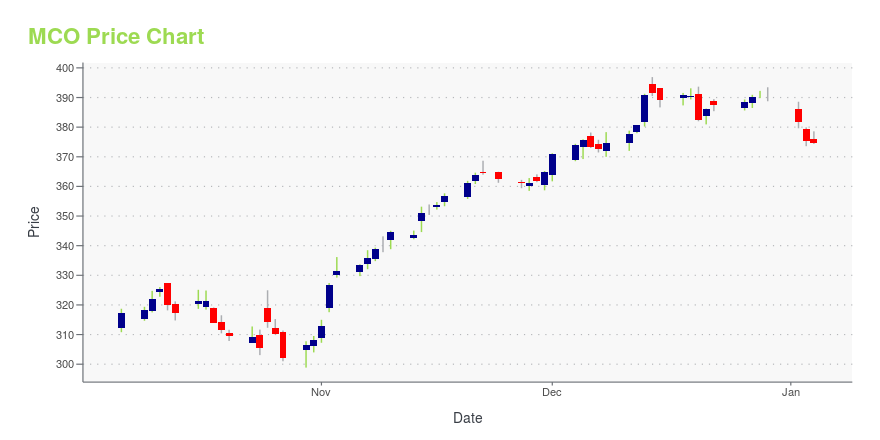

MCO Stock Price Chart Interactive Chart >

Moody's Corp. (MCO) Company Bio

Moody's Corporation, often referred to as Moody's, is an American business and financial services company. It is the holding company for Moody's Investors Service (MIS), an American credit rating agency, and Moody's Analytics (MA), an American provider of financial analysis software and services. (Source:Wikipedia)

Latest MCO News From Around the Web

Below are the latest news stories about MOODYS CORP that investors may wish to consider to help them evaluate MCO as an investment opportunity.

The Top 7 Stocks to Buy Before They Take Off Next YearThese seven blue-chip stocks to buy can form a robust core portfolio for the next leg higher in 2024 and beyond. |

Warren Buffett Has Gained Over $196 Billion From Only 4 StocksThe Oracle of Omaha's concentrated investment portfolio at Berkshire Hathaway has led to a veritable mountain of unrealized gains. |

BOJ Likely to Keep World’s Last Negative Rate in Upcoming Decision(Bloomberg) -- The Bank of Japan is widely expected to keep the world’s last negative interest rate intact on Tuesday, with investors set to scour comments for hints on if — and when — authorities might scrap the policy next year.Most Read from BloombergUS Frackers Return to Haunt OPEC’s Pricing StrategyBP to Pause All Tanker Transits Through the Red SeaChina’s Real Estate Meltdown Is Battering Middle Class WealthGulf Splits Hinder US Efforts to End Houthi Ship AttacksDimon’s Heir at JPMorgan St |

These 3 Stocks Have Made Warren Buffett the Most Money in 2023. Are They No-Brainer Buys for the New Year?A few stocks have soared more than these three so far in 2023. But none have made the Oracle of Omaha more money. |

Xi Disappoints Investors by Skipping Signal for Big Stimulus(Bloomberg) -- China’s top leaders including President Xi Jinping vowed to make industrial policy their top economic priority next year, a letdown for investors hoping to see more forceful stimulus to boost growth.Most Read from BloombergJPMorgan Is in a Fight Over Its Client’s Lost $50 Million FortuneTesla Recalls 2 Million Cars to Fix Autopilot Safety FlawsGoldman Trader Paid $100 Million Since 2020 Is Stepping DownArgentina’s Milei Devalues Peso by 54% in First Batch of Shock MeasuresCOP28 Na |

MCO Price Returns

| 1-mo | 7.00% |

| 3-mo | 19.56% |

| 6-mo | 15.19% |

| 1-year | 28.08% |

| 3-year | 22.04% |

| 5-year | 133.25% |

| YTD | 15.40% |

| 2023 | 41.52% |

| 2022 | -27.80% |

| 2021 | 35.57% |

| 2020 | 23.26% |

| 2019 | 71.26% |

MCO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MCO

Want to do more research on Moodys Corp's stock and its price? Try the links below:Moodys Corp (MCO) Stock Price | Nasdaq

Moodys Corp (MCO) Stock Quote, History and News - Yahoo Finance

Moodys Corp (MCO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...