Medalist Diversified REIT, Inc. (MDRR): Price and Financial Metrics

MDRR Price/Volume Stats

| Current price | $12.13 | 52-week high | $14.94 |

| Prev. close | $12.01 | 52-week low | $2.06 |

| Day low | $12.05 | Volume | 1,305 |

| Day high | $12.13 | Avg. volume | 15,164 |

| 50-day MA | $6.04 | Dividend yield | 1.3% |

| 200-day MA | $3.52 | Market Cap | 13.56M |

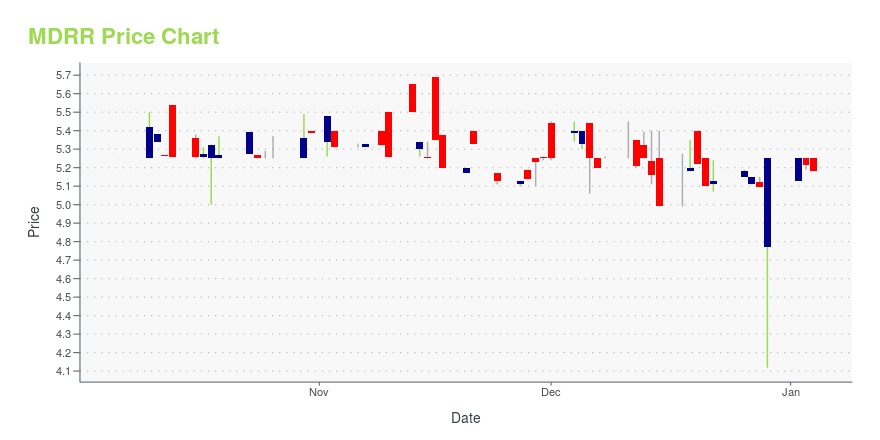

MDRR Stock Price Chart Interactive Chart >

Medalist Diversified REIT, Inc. (MDRR) Company Bio

Medalist Diversified REIT, Inc. is focused on acquiring, renovating, leasing and managing income-producing properties, with a primary focus on commercial properties, including flex-industrial, and retail properties, and multi-family residential properties. The Company invests primarily in properties across secondary and tertiary markets in the southeastern part of the United States, with a concentration in Virginia, North Carolina, South Carolina, Georgia, Florida and Alabama. The Company has three investments, such as the Shops at Franklin Square, a 134,299 square foot retail property located in Gastonia, North Carolina; the Greensboro Airport Hampton Inn located in Greensboro, North Carolina, and the Shops at Hanover Square North, consisting of two parcels of land containing a 73,440 square foot retail center located in Mechanicsville, Virginia. Medalist Diversified Holdings, L.P. is the Company's subsidiary.

Latest MDRR News From Around the Web

Below are the latest news stories about MEDALIST DIVERSIFIED REIT INC that investors may wish to consider to help them evaluate MDRR as an investment opportunity.

Director Emanuel Neuman Buys 4,142 Shares of Medalist Diversified REIT Inc (MDRR)On September 13, 2023, Emanuel Neuman, a director at Medalist Diversified REIT Inc (NASDAQ:MDRR), purchased 4,142 shares of the company. |

Medalist Diversified REIT, Inc. Releases Update From Interim CEO and PresidentRICHMOND, Va., August 23, 2023--Medalist Diversified REIT, Inc. (NASDAQ: MDRR) (the "Company" or "Medalist"), a Virginia-based real estate investment trust that specializes in acquiring, owning and managing commercial real estate in the Southeast region of the U.S., released today a letter from Francis P. Kavanaugh, the Company’s interim CEO and President, providing an update on the Company’s activities during the first 30 days of his tenure. |

Medalist Diversified REIT, Inc. Grants Waiver to Shareholder Francis P. Kavanaugh to Increase Common Share OwnershipRICHMOND, Va., August 09, 2023--Medalist Diversified REIT, Inc. (NASDAQ: MDRR) (the "Company" or "Medalist"), a Virginia-based real estate investment trust that specializes in acquiring, owning and managing commercial real estate in the Southeast region of the U.S., announced today that the Company’s Board of Directors (the "Board") has granted a waiver of the ownership limitations in Article VI of the Company’s Articles of Incorporation as amended (the "Charter") to permit Francis P. Kavanaugh |

Medalist Diversified REIT, Inc. Shifts to Long-Term Value Creation Amid Current Market ConditionsRICHMOND, Va., August 07, 2023--Medalist Diversified REIT, Inc. (NASDAQ: MDRR) (the "Company" or "Medalist"), a Virginia-based real estate investment trust that specializes in acquiring, owning and managing commercial real estate in the Southeast region of the U.S., announced today that it has paused its previously announced plan to sell certain assets and has shifted its strategy to focus on continuing to optimize long-term asset value. The move responds to evolving market conditions and aligns |

Medalist Diversified REIT, Inc. Announces Transition to Internalized Management and Leadership ChangesRICHMOND, Va., July 18, 2023--Medalist Diversified REIT, Inc. (NASDAQ: MDRR) (the "Company" or "Medalist"), a Virginia-based real estate investment trust that specializes in acquiring, owning and managing commercial real estate in the Southeast region of the U.S., announced today that the Company has completed its process to internalize management, and resultant changes to the Company’s leadership and to the Company’s Board of Directors (the "Board"). |

MDRR Price Returns

| 1-mo | 318.20% |

| 3-mo | N/A |

| 6-mo | 389.73% |

| 1-year | 349.29% |

| 3-year | 232.55% |

| 5-year | -6.12% |

| YTD | 366.41% |

| 2023 | 6.36% |

| 2022 | -37.26% |

| 2021 | -43.15% |

| 2020 | -35.08% |

| 2019 | N/A |

MDRR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MDRR

Want to see what other sources are saying about Medalist Diversified REIT Inc's financials and stock price? Try the links below:Medalist Diversified REIT Inc (MDRR) Stock Price | Nasdaq

Medalist Diversified REIT Inc (MDRR) Stock Quote, History and News - Yahoo Finance

Medalist Diversified REIT Inc (MDRR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...