23andMe Holding Co. Class A Common Stock (ME): Price and Financial Metrics

ME Price/Volume Stats

| Current price | $0.44 | 52-week high | $1.98 |

| Prev. close | $0.45 | 52-week low | $0.35 |

| Day low | $0.44 | Volume | 1,484,134 |

| Day high | $0.47 | Avg. volume | 5,908,597 |

| 50-day MA | $0.47 | Dividend yield | N/A |

| 200-day MA | $0.64 | Market Cap | 215.81M |

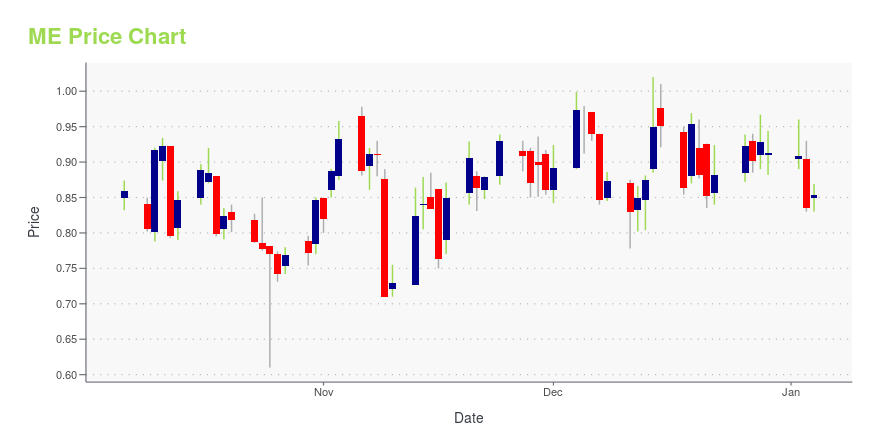

ME Stock Price Chart Interactive Chart >

23andMe Holding Co. Class A Common Stock (ME) Company Bio

23andMe, Inc., a consumer genetics and research company, engages in developing a genetic database to unlock insights leading to the rapid discovery of new targets for drug development. It offers a crowdsourced platform that helps people to access, understand, and benefit from the human genome; access direct-to-consumer genetic testing; and give consumers personalized information about their genetic health risks, ancestry, and traits. The company was incorporated in 2006 and is based in Sunnyvale, California with an additional office in Mountain View, California.

Latest ME News From Around the Web

Below are the latest news stories about 23ANDME HOLDING CO that investors may wish to consider to help them evaluate ME as an investment opportunity.

Retail investors account for 35% of 23andMe Holding Co.'s (NASDAQ:ME) ownership, while institutions account for 35%Key Insights The considerable ownership by retail investors in 23andMe Holding indicates that they collectively have a... |

23andMe announces further expansion of 23ME-00610 Phase 1/2a clinical trial in advanced neuroendocrine and ovarian cancer patient cohortsThirty additional patients with advanced neuroendocrine and advanced ovarian cancer will be enrolled in the study of 23ME-00610, an investigational antibody targeting CD200R1 A second potentially efficacious dose level to characterize safety and efficacy will be evaluated to identify the optimal dose in alignment with recently published regulatory guidance SOUTH SAN FRANCISCO, Calif., Dec. 19, 2023 (GLOBE NEWSWIRE) -- 23andMe Holding Co. (Nasdaq: ME) (23andMe), a leading human genetics and bioph |

The Danger in Genetic-Data Breaches: You Can’t Change Your DNA.A data breach at genetic-testing company 23andMe shows why the U.S. needs a comprehensive data-privacy law, Justin Sherman writes in a commentary essay. |

23andMe makes a controversial move that customers won't likeGenetic testing firm 23andMe appears to be scrambling to cover its bases after it was revealed that a hacker was able to access and leak the DNA data of roughly 6.9 million of its users, a large increase from the 14,000 it reported to the U.S. Securities and Exchange Commission in a court filing on Dec. 1. 23andMe recently sent an email to customers notifying them that the company updated its terms of service on Nov. 30 by revising its "Dispute Resolution and Arbitration" section. "Important updates were made to the Dispute Resolution and Arbitration section to include procedures that will encourage a prompt resolution of any disputes and to streamline arbitration proceedings where multiple similar claims are filed," the email states. |

Cyberattacks surge in 2023, as millions fall victim to ransomware: ReportCyberattacks, especially ransomware attacks, continue to increase across the world. |

ME Price Returns

| 1-mo | 9.45% |

| 3-mo | -5.19% |

| 6-mo | -41.18% |

| 1-year | -75.49% |

| 3-year | -94.69% |

| 5-year | N/A |

| YTD | -51.83% |

| 2023 | -57.71% |

| 2022 | -67.57% |

| 2021 | -41.73% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...