Mayville Engineering Company, Inc. (MEC): Price and Financial Metrics

MEC Price/Volume Stats

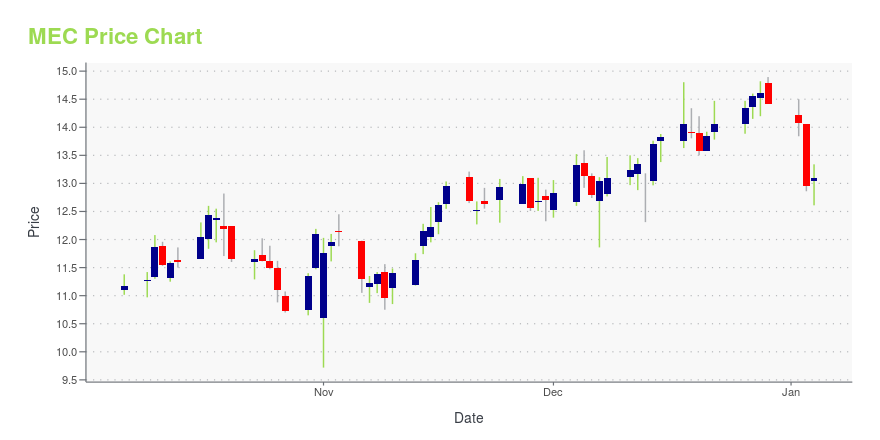

| Current price | $16.13 | 52-week high | $23.02 |

| Prev. close | $16.18 | 52-week low | $11.72 |

| Day low | $15.93 | Volume | 98,500 |

| Day high | $16.55 | Avg. volume | 105,981 |

| 50-day MA | $15.39 | Dividend yield | N/A |

| 200-day MA | $16.04 | Market Cap | 330.04M |

MEC Stock Price Chart Interactive Chart >

Mayville Engineering Company, Inc. (MEC) Company Bio

Mayville Engineering Co., Inc. engages in the production of metal components. It offers a broad range of prototyping and tooling, production fabrication, coating, assembly, and aftermarket components. Its customers operate in diverse end markets, including heavy- and medium-duty commercial vehicles, construction, powersports, agriculture, military, and other end markets. The company was founded by Leo Bachhuber and Ted Bachhuber in 1945 and is headquartered in Mayville, WI.

MEC Price Returns

| 1-mo | 10.56% |

| 3-mo | 30.08% |

| 6-mo | 2.94% |

| 1-year | -11.76% |

| 3-year | 136.86% |

| 5-year | 106.53% |

| YTD | 2.61% |

| 2024 | 9.02% |

| 2023 | 13.90% |

| 2022 | -15.09% |

| 2021 | 11.10% |

| 2020 | 43.07% |

Loading social stream, please wait...