Mesoblast Limited (MESO): Price and Financial Metrics

MESO Price/Volume Stats

| Current price | $7.40 | 52-week high | $8.66 |

| Prev. close | $7.42 | 52-week low | $1.61 |

| Day low | $7.30 | Volume | 89,200 |

| Day high | $7.59 | Avg. volume | 1,098,216 |

| 50-day MA | $7.39 | Dividend yield | N/A |

| 200-day MA | $4.19 | Market Cap | 844.92M |

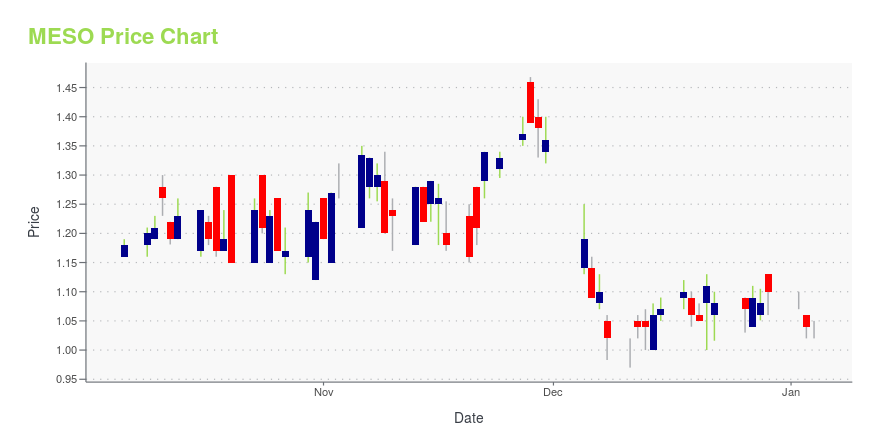

MESO Stock Price Chart Interactive Chart >

Mesoblast Limited (MESO) Company Bio

Mesoblast Ltd. has established a diverse portfolio of product candidates based on its proprietary allogeneic, off-the-shelf mesenchymal lineage cell-based technology, with multiple active Phase 3 clinical programs. Mesoblast's lead product candidates target major diseases with significant unmet medical needs despite existing therapies. These include chronic heart failure, chronic low back pain due to degenerative disc disease, and immune-mediated conditions such as acute graft versus host disease and biologic refractory rheumatoid arthritis. The company is based in Melbourne, Australia.

Latest MESO News From Around the Web

Below are the latest news stories about MESOBLAST LTD that investors may wish to consider to help them evaluate MESO as an investment opportunity.

5 Stocks to Ride the Santa Claus RallyMesoblast (MESO), Coinbase (COIN), Western Gas (WES), JAKKS Pacific (JAKK), and Brinker International (EAT) have the potential to outperform in the seven-day period. |

Mesoblast Files for Orphan Drug and Pediatric Rare Disease Designations for Rexlemestrocel-L as Treatment for Severe Congenital Heart DiseaseNEW YORK, Nov. 26, 2023 (GLOBE NEWSWIRE) -- Mesoblast Limited (Nasdaq:MESO; ASX:MSB), global leader in allogeneic cellular medicines for inflammatory diseases, today announced that it has filed for orphan drug designation (ODD) and rare pediatric disease designation (RPDD) with the United States Food and Drug Administration (FDA) for its allogeneic cell therapy Revascor® (rexlemestrocel-L) in the treatment of the congenital heart disease hypoplastic left heart syndrome (HLHS). The filings were b |

Mesoblast (MESO) Up on Deal With BMT CTN to Develop GVHD DrugMesoblast (MESO) partners with Blood and Marrow Transplant Clinical Trials Network to develop a pivotal study on its lead candidate, Ryoncil, for acute graft versus host disease. The stock rises 11%. |

Mesoblast Partners With Blood and Marrow Transplant Clinical Trials Network (BMT CTN) on Pivotal Trial in Adults With SR-aGVHDNEW YORK, Nov. 21, 2023 (GLOBE NEWSWIRE) -- Mesoblast Limited (Nasdaq:MESO; ASX:MSB), global leader in allogeneic cellular medicines for inflammatory diseases, today announced that the Blood and Marrow Transplant Clinical Trials Network (BMT CTN), a body including centers responsible for approximately 80% of all US allogeneic BMTs, has entered into an agreement to develop a pivotal trial of Mesoblast’s lead product candidate Ryoncil® (remestemcel-L) in the treatment of adults with steroid-refrac |

Most Shareholders Will Probably Find That The Compensation For Mesoblast Limited's (ASX:MSB) CEO Is ReasonableKey Insights Mesoblast's Annual General Meeting to take place on 28th of November Salary of US$672.7k is part of CEO... |

MESO Price Returns

| 1-mo | 11.45% |

| 3-mo | 18.59% |

| 6-mo | 304.37% |

| 1-year | -10.84% |

| 3-year | -47.44% |

| 5-year | -31.48% |

| YTD | 236.36% |

| 2023 | -62.20% |

| 2022 | -39.38% |

| 2021 | -43.46% |

| 2020 | 15.20% |

| 2019 | 78.88% |

Continue Researching MESO

Here are a few links from around the web to help you further your research on Mesoblast Ltd's stock as an investment opportunity:Mesoblast Ltd (MESO) Stock Price | Nasdaq

Mesoblast Ltd (MESO) Stock Quote, History and News - Yahoo Finance

Mesoblast Ltd (MESO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...