Missfresh Ltd (MF): Price and Financial Metrics

MF Price/Volume Stats

| Current price | $1.00 | 52-week high | $3.28 |

| Prev. close | $0.95 | 52-week low | $0.41 |

| Day low | $0.89 | Volume | 130,300 |

| Day high | $1.04 | Avg. volume | 1,131,228 |

| 50-day MA | $0.85 | Dividend yield | N/A |

| 200-day MA | $0.99 | Market Cap | 7.18M |

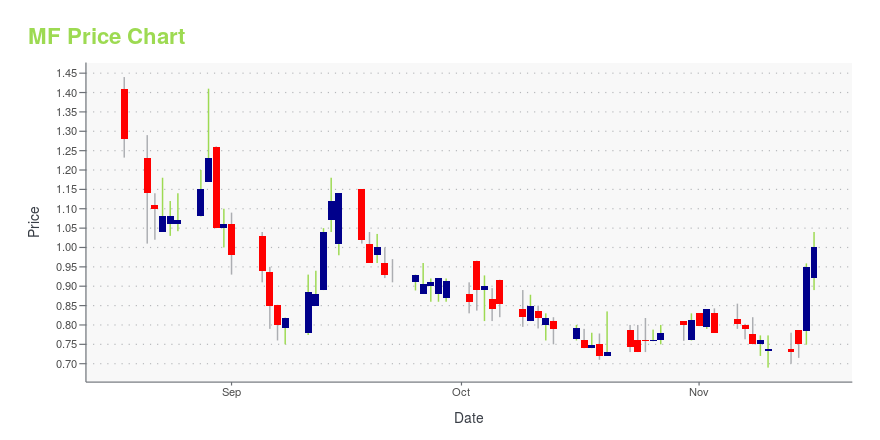

MF Stock Price Chart Interactive Chart >

Missfresh Ltd (MF) Company Bio

Missfresh Limited operates as an online-and-offline integrated on-demand retail company in China. It. It operates a community retail digital platform that offers fresh produce, such as fruits, vegetables, meat, eggs, aquatic products, and dairy products; and fast-moving consumer goods, including snack foods, light food, cereals, oil, wine, drink, fast food, light food through online e-commerce platform and distributed mini warehouse networks. The company also sells its products through vending machines. The company was founded in 2014 and is based in Beijing, the People's Republic of China.

Latest MF News From Around the Web

Below are the latest news stories about MISSFRESH LTD that investors may wish to consider to help them evaluate MF as an investment opportunity.

Missfresh Limited Announces Results of Annual General MeetingBEIJING, Sept. 15, 2023 (GLOBE NEWSWIRE) -- Missfresh Limited (“Missfresh” or the “Company”) (NASDAQ: MF) is pleased to announce that at its annual general meeting of shareholders held virtually today, shareholders of the Company approved each of the four proposed resolutions set out in the notice of annual general meeting (the “Meeting Notice”), namely, an ordinary resolution to increase the Company’s authorized share capital, a special resolution to amend the Company’s memorandum and articles |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayWe're starting off Tuesday with a breakdown of the biggest pre-market stock movers investors will want to keep an eye on! |

Missfresh Limited to Hold Annual General Meeting on September 15, 2023BEIJING, China, Aug. 18, 2023 (GLOBE NEWSWIRE) -- Missfresh Limited (“Missfresh” or the “Company”) (NASDAQ: MF), today announced that it will hold an annual general meeting of shareholders (the “AGM”) virtually held at https://meeting.tencent.com/dw/9lPeKAxZAu6p on September 15, 2023 at 9:00 A.M. (Beijing time), for the purposes of considering and, if thought fit, passing each of the proposed resolutions set forth in the notice of the AGM (the “AGM Notice”). The AGM Notice, which contains detail |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start off the week with a breakdown of the biggest pre-market stock movers worth reading about on Monday morning! |

FIRST ANNUAL PAYNE STEWART INVITATIONAL BENEFITING THE PAYNE STEWART KIDS GOLF FOUNDATION PRODUCED BY MF ENTERTAINMENTMF Entertainment (MFE), a full-service lifestyle and entertainment company specializing in creating world-class events and experiences, today announced the inception of the 2023 Payne Stewart Invitational, the primary fundraiser for the Payne Stewart Kids Golf Foundation. Taking place December 3-4, 2023 at the Floridian National Golf Club in Palm City, Florida, this new tournament will combine competition and charity in honor of 3-time major winner, 11-time PGA Tour winner, and philanthropist Pa |

MF Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 99.80% |

| 3-year | -99.42% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -98.82% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...