Mizuho Financial Group, Inc. Sponosred ADR (Japan) (MFG): Price and Financial Metrics

MFG Price/Volume Stats

| Current price | $4.29 | 52-week high | $4.50 |

| Prev. close | $4.27 | 52-week low | $3.09 |

| Day low | $4.27 | Volume | 717,552 |

| Day high | $4.31 | Avg. volume | 909,463 |

| 50-day MA | $4.15 | Dividend yield | 2.44% |

| 200-day MA | $3.77 | Market Cap | 54.37B |

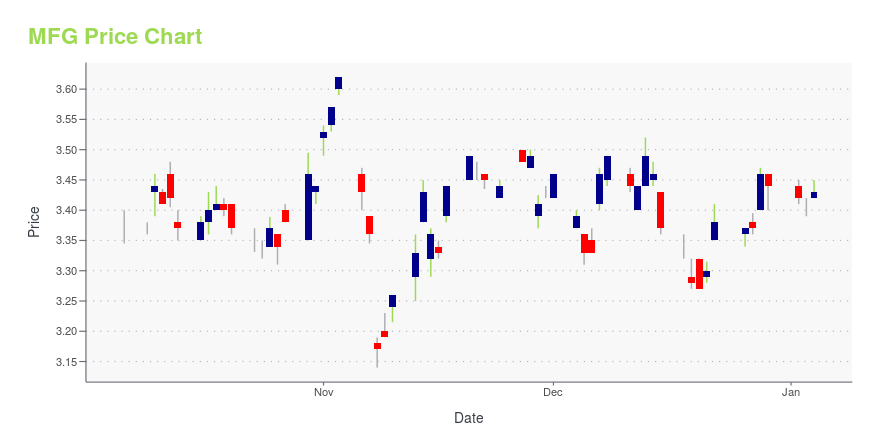

MFG Stock Price Chart Interactive Chart >

Mizuho Financial Group, Inc. Sponosred ADR (Japan) (MFG) Company Bio

Mizuho Financial Group engages in banking, trust banking, securities, and other businesses related to financial services in Japan, the Americas, Europe, and Asia/Oceania excluding Japan. The company was founded in 2003 and is based in Tokyo, Japan.

Latest MFG News From Around the Web

Below are the latest news stories about MIZUHO FINANCIAL GROUP INC that investors may wish to consider to help them evaluate MFG as an investment opportunity.

Japan’s Nikkei Ends Higher in Mixed TradingNEWSPLUS 0610 GMT — Japan shares closed higher in mixed trading, with conglomerates gaining. The Nikkei Stock Average finished the day 0.2% higher at 33305.85 after many stocks flitted in and out of positive territory throughout the session. |

Nikkei Ends 0.6% Lower on Profit Taking; Conglomerates WeighJapan’s Nikkei Stock Average closed 0.6% lower at 32758.98 as investors looked to book profit after the index’s rally in the past few sessions. |

Mizuho Expands its Global Private Capital Advisory PlatformNEW YORK, Dec. 13, 2023 (GLOBE NEWSWIRE) -- Mizuho Americas today announced it is integrating the primary capital advisory services of Capstone Partners and the secondary liquidity solutions business of Greenhill Private Capital Advisory under a newly created Mizuho Private Capital Advisory platform, serving general partners (GPs) and limited partners (LPs) with a comprehensive set of solutions. “GPs and LPs are looking for a wide range of solutions, and with the acquisition of Greenhill, we are |

3 Great Growth Opportunities Beyond the Magnificent 7 StocksInvestors looking to supercharge their portfolios should take a position in one of these stocks outperforming the market now. |

The 3 Best Blue-Chip Stocks to Buy in DecemberDon't miss out on the opportunity to buy these stocks as we head into a possible, strong, year-end Santa Claus rally. |

MFG Price Returns

| 1-mo | 5.41% |

| 3-mo | 11.43% |

| 6-mo | 21.49% |

| 1-year | 34.90% |

| 3-year | 67.32% |

| 5-year | 76.78% |

| YTD | 26.43% |

| 2023 | 24.81% |

| 2022 | 15.61% |

| 2021 | 3.56% |

| 2020 | -13.93% |

| 2019 | 6.55% |

MFG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MFG

Here are a few links from around the web to help you further your research on Mizuho Financial Group Inc's stock as an investment opportunity:Mizuho Financial Group Inc (MFG) Stock Price | Nasdaq

Mizuho Financial Group Inc (MFG) Stock Quote, History and News - Yahoo Finance

Mizuho Financial Group Inc (MFG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...