The Marygold Companies Inc., (MGLD): Price and Financial Metrics

MGLD Price/Volume Stats

| Current price | $1.14 | 52-week high | $1.92 |

| Prev. close | $1.13 | 52-week low | $0.78 |

| Day low | $1.10 | Volume | 3,500 |

| Day high | $1.15 | Avg. volume | 9,854 |

| 50-day MA | $1.26 | Dividend yield | N/A |

| 200-day MA | $1.15 | Market Cap | N/A |

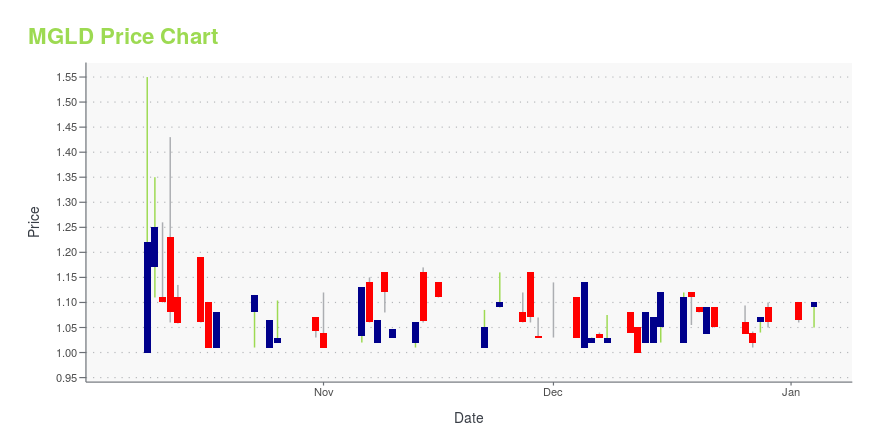

MGLD Stock Price Chart Interactive Chart >

The Marygold Companies Inc., (MGLD) Company Bio

The Marygold Companies Inc., through its subsidiaries, engages in investment fund management, beauty products, food products, and security alarm systems businesses in the United States, New Zealand, Australia, and Canada. It also operates as an investment advisor to exchange traded funds and exchange traded products organized as limited partnerships or investment trusts. In addition, the company manufactures and distributes meat pies and related bakery confections to groceries, gasoline convenience stores, and independent retailers, as well as prints specialty wrappers for the food industry; and sells and installs commercial and residential alarm monitoring systems under the Brigadier Security Systems and Elite Security names. Further, it engages in the formulation and wholesale distribution of hair and skin care products under the Original Sprout brand to salons, resorts, grocery stores, health food stores, e-tail sites, and online shopping carts. Additionally, the company engages in the development of a Fintech software application to provide an enhanced mobile banking experience. The company was formerly known as Concierge Technologies, Inc. and changed its name to The Marygold Companies Inc. in March 2022. The Marygold Companies Inc. was founded in 1996 and is headquartered in San Clemente, California.

Latest MGLD News From Around the Web

Below are the latest news stories about MARYGOLD COMPANIES INC that investors may wish to consider to help them evaluate MGLD as an investment opportunity.

The Marygold Companies Reports Financial Results for 2024 First Fiscal QuarterSAN CLEMENTE, Calif., November 13, 2023--The Marygold Companies, Inc. ("TMC," or the "Company") (NYSE American: MGLD), a diversified global holding firm, today reported financial results for the 2024 first fiscal quarter ended September 30, 2023. |

The Marygold Companies to Participate in Virtual Tech Sector Investor Conference, Hosted by Maxim Group’s M-Vest Platform October 11, 2023SAN CLEMENTE, Calif., October 09, 2023--The Marygold Companies, Inc. ("TMC," or the "Company") (NYSE American: MGLD), a diversified global holding firm, today announced that it will present at Exploring All Corners of the Technology Sector, a virtual investor conference hosted by Maxim Group’s M-Vest platform, on October 11. |

The Marygold Companies Reports Fiscal 2023/Q4 Financial ResultsSAN CLEMENTE, Calif., September 25, 2023--The Marygold Companies, Inc. ("TMC" or the "Company") (NYSE American: MGLD) (formerly Concierge Technologies, Inc.), a diversified global holding firm, today reported financial results for the fiscal year ended June 30, 2023. |

The Marygold Companies’ Subsidiary, Original Sprout, Launches New Coastal Collection as Sponsor of the World Surf League’s Rip Curl WSL Finals and The Original Sprout Malibu Longboard World Championships EventsSAN CLEMENTE, Calif., September 07, 2023--The Marygold Companies, Inc. ("TMC," or the "Company") (NYSE American: MGLD), a diversified global holding firm, today announced that its Original Sprout subsidiary will be the title sponsor of the World Surf League’s Longboard Championships in Malibu and an official sponsor of the Rip Curl WSL Finals to be held in San Clemente, California. |

7 High-Growth Stocks Under $5 for Aggressive InvestorsIf you don’t mind the sweaty palms effect of wild speculation, these high-growth stocks to buy under $5 could be attractive. |

MGLD Price Returns

| 1-mo | -0.87% |

| 3-mo | -10.24% |

| 6-mo | N/A |

| 1-year | 8.57% |

| 3-year | -38.38% |

| 5-year | N/A |

| YTD | 7.55% |

| 2023 | -29.33% |

| 2022 | -50.00% |

| 2021 | 138.10% |

| 2020 | N/A |

| 2019 | 0.00% |

Loading social stream, please wait...