MacroGenics, Inc. (MGNX): Price and Financial Metrics

MGNX Price/Volume Stats

| Current price | $1.39 | 52-week high | $16.59 |

| Prev. close | $1.26 | 52-week low | $0.99 |

| Day low | $1.20 | Volume | 785,700 |

| Day high | $1.47 | Avg. volume | 739,616 |

| 50-day MA | $1.98 | Dividend yield | N/A |

| 200-day MA | $3.23 | Market Cap | 87.70M |

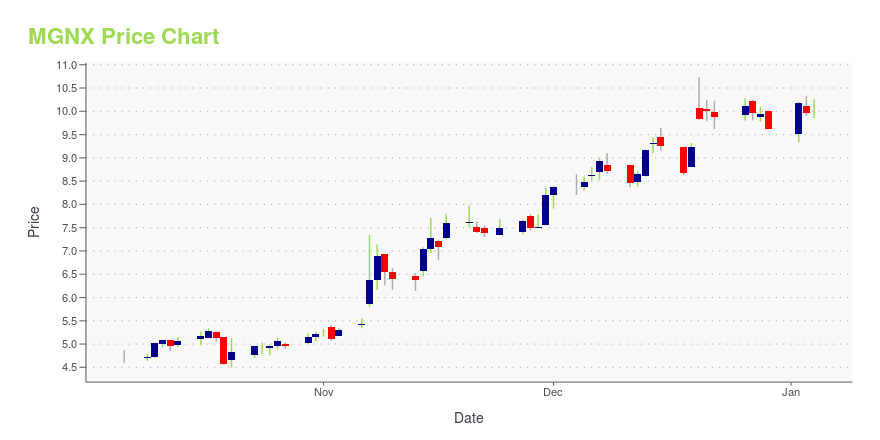

MGNX Stock Price Chart Interactive Chart >

MacroGenics, Inc. (MGNX) Company Bio

Macrogenics is a clinical-stage biopharmaceutical company focused on discovering and developing innovative monoclonal antibody-based therapeutics for the treatment of cancer, as well as autoimmune disorders and infectious diseases. The company was founded in 2000 and is based in Rockville, Maryland.

MGNX Price Returns

| 1-mo | -30.33% |

| 3-mo | -54.87% |

| 6-mo | -61.39% |

| 1-year | -90.98% |

| 3-year | -82.20% |

| 5-year | -80.67% |

| YTD | -57.23% |

| 2024 | -66.22% |

| 2023 | 43.37% |

| 2022 | -58.19% |

| 2021 | -29.79% |

| 2020 | 110.11% |

Continue Researching MGNX

Want to do more research on Macrogenics Inc's stock and its price? Try the links below:Macrogenics Inc (MGNX) Stock Price | Nasdaq

Macrogenics Inc (MGNX) Stock Quote, History and News - Yahoo Finance

Macrogenics Inc (MGNX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...