MacroGenics, Inc. (MGNX): Price and Financial Metrics

MGNX Price/Volume Stats

| Current price | $5.55 | 52-week high | $21.88 |

| Prev. close | $5.50 | 52-week low | $3.14 |

| Day low | $5.46 | Volume | 631,300 |

| Day high | $5.77 | Avg. volume | 1,848,222 |

| 50-day MA | $4.59 | Dividend yield | N/A |

| 200-day MA | $10.17 | Market Cap | 347.61M |

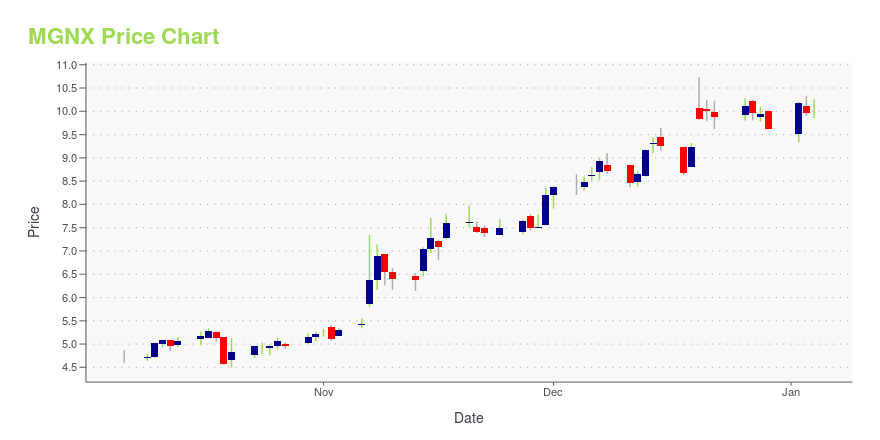

MGNX Stock Price Chart Interactive Chart >

MacroGenics, Inc. (MGNX) Company Bio

Macrogenics is a clinical-stage biopharmaceutical company focused on discovering and developing innovative monoclonal antibody-based therapeutics for the treatment of cancer, as well as autoimmune disorders and infectious diseases. The company was founded in 2000 and is based in Rockville, Maryland.

Latest MGNX News From Around the Web

Below are the latest news stories about MACROGENICS INC that investors may wish to consider to help them evaluate MGNX as an investment opportunity.

7 Undervalued Biotech Stocks That are Flying Under the Clinical RadarWith so many innovative firms skyrocketing this year, astute investors seeking compelling discounts may want to turn their attention to undervalued biotech picks. |

Shareholders in MacroGenics (NASDAQ:MGNX) are in the red if they invested three years agoIt is a pleasure to report that the MacroGenics, Inc. ( NASDAQ:MGNX ) is up 74% in the last quarter. But that doesn't... |

Q3 2023 MacroGenics Inc Earnings CallQ3 2023 MacroGenics Inc Earnings Call |

MacroGenics, Inc. (NASDAQ:MGNX) Q3 2023 Earnings Call TranscriptMacroGenics, Inc. (NASDAQ:MGNX) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Good afternoon. We will begin the MacroGenics 2023 Third Quarter Corporate Progress and Financial Results Conference Call in just a moment. [Operator Instructions] At this point, I will turn the call over to Jim Karrels, Senior Vice President and Chief Financial Officer of […] |

MacroGenics (MGNX) Q3 2023 Earnings Call TranscriptAt this point, I will turn the call over to Jim Karrels, senior vice president and chief financial officer of MacroGenics. Good afternoon and welcome to MacroGenics conference call to discuss our third quarter 2023 financial and operational results. |

MGNX Price Returns

| 1-mo | 36.36% |

| 3-mo | -61.88% |

| 6-mo | -58.02% |

| 1-year | 23.88% |

| 3-year | -77.90% |

| 5-year | -61.00% |

| YTD | -42.31% |

| 2023 | 43.37% |

| 2022 | -58.19% |

| 2021 | -29.79% |

| 2020 | 110.11% |

| 2019 | -14.33% |

Continue Researching MGNX

Want to do more research on Macrogenics Inc's stock and its price? Try the links below:Macrogenics Inc (MGNX) Stock Price | Nasdaq

Macrogenics Inc (MGNX) Stock Quote, History and News - Yahoo Finance

Macrogenics Inc (MGNX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...